Financial Abuse in Divorce Cases: What It Is and Why It Matters

One type of abuse often begets another in a vicious cycle ultimately resulting in the survivor feeling powerless and trapped in the relationship.

December 23, 2019 at 02:41 PM

6 minute read

Kevin Segler, an Associate at KoonsFuller in Plano, Texas. (Courtesy photo.)

Kevin Segler, an Associate at KoonsFuller in Plano, Texas. (Courtesy photo.)

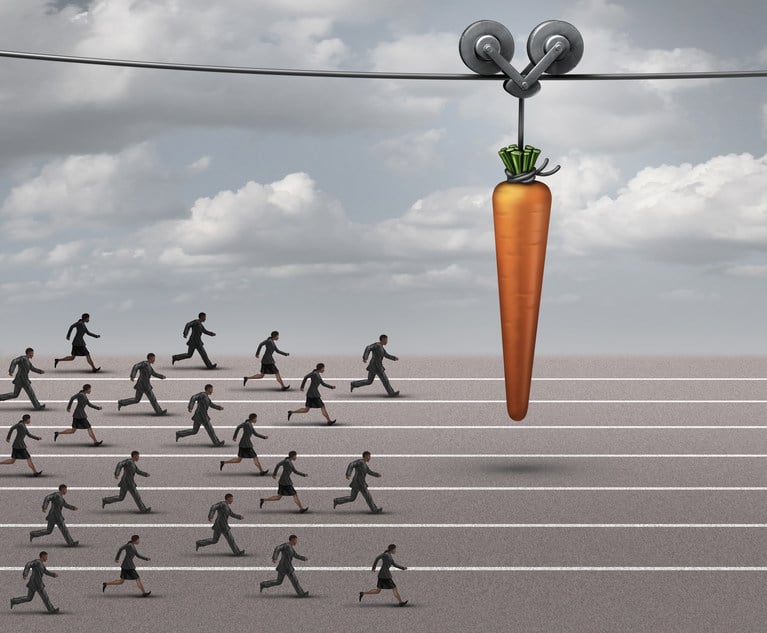

Family violence is rarely just physical abuse. It almost always involves a combination of other types of abuse (verbal, emotional, sexual), resulting in a dynamic of coercive control. Coercive control is a pattern of behavior in which the abuser seeks to maintain power and control in the relationship through various forms of manipulation, intimidation and punishment. One type of abuse often begets another in a vicious cycle ultimately resulting in the survivor feeling powerless and trapped in the relationship.

What Is Financial Abuse?

Each type of abuse plays its own role in shifting the power and control to the abuser. Physical abuse can be used to show noncompliance with an abuser's authority will result in physical pain, which also carries the implied threat that noncompliance in the future will have similar repercussions. Verbal abuse is often used to convey the threat of physical violence, exploit the survivor's insecurities, or threaten financial or social ruin. Emotional or psychological abuse often involves diminishing the survivor's self-esteem, self-confidence, and/or making the survivor feel as they are somehow responsible for (and possibly deserving of) the abuse they receive.

Financial abuse is behavior seeking control of a person's ability to acquire, use, or maintain economic resources, and threatens their self-sufficiency and financial autonomy. (See Adams, A.E., Beeble, M.L. (2018). "Intimate Partner Violence and Psychological Well-Being: Examining the effect of economic abuse on women's quality of life." Psychology of Violence.)

Often the abuser conceals financial information and limits access to finances so that, even if the survivor wanted to leave the abusive relationship, they are trapped in the relationship because they are financially unable to survive outside of the relationship. Some studies have found that approximately 75% of abuse survivors stay with their abusers for economic reasons.

What Does Financial Abuse Look Like?

Financial abuse can take many forms. Some methods of financial abuse are quite subtle and, perhaps in a non-abusive situation, may appear to be part of a normal arrangement for how couples handle their finances. Other methods of financial abuse are much more obvious. As with other forms of abuse, during a relationship it is common for the abuser's behaviors to become more manipulative and escalate with time. Some of the methods of financial abuse include:

- Demanding the survivor not work.

- Demanding the survivor not obtain or finish their education or other types of professional training.

- Taking actions to prohibit or inhibit the survivor from obtaining employment or maintaining employment (many survivors miss work and/or ultimately lose their jobs due to physical or sexual abuse).

- Not allowing the survivor to have their own bank account.

- Not allowing the survivor access to any financial information.

- Taking the survivor's paycheck and depositing it in their account and denying the survivor access to it.

- Requiring the survivor to ask for specific amounts of money whenever it is needed and an explanation of what it will be used for and/or requiring receipts to be produced to support the amount expended.

- Taking out credit in the survivor's name only and racking up debt in the survivor's name only (often with the survivor being unaware it exists).

- Racking up debt on joint credit cards.

- Refusing (or threatening to refuse) to pay for necessities for the survivor and/or the children.

- Not paying bills in the survivor's name or taking other actions to decrease the survivor's credit score (while usually keeping their credit score pristine).

- Convincing the survivor to allow them to manage any property or inheritance the survivor receives.

- Refusing to allow the survivor to pay any of the household bills.

- Hiding assets.

- Threatening that if the survivor ever files for divorce they will get nothing and be broke and living on the street (or something to that effect).

- Falsely accusing the survivor of overspending when the expenditures are either minor or necessary family expenses.

- Monitoring the survivor's spending online and scrutinizing any charge at any location.

How Does Financial Abuse Impact a Divorce Case?

First, in any divorce case involving a survivor of abuse, it is imperative to be empathetic and attempt to understand (a) all they have survived and endured up to that point; (b) how much they have had to overcome to simply get to the point of taking any step to get out of the relationship; and (c) how skewed or altered their version of the future could look based on their history.

Second, once the survivor is at the point of filing for divorce, it might be the first or 10th time they have taken steps to try to leave the relationship and it may be the furthest they have ever made it in any attempt to escape. It is not uncommon for the fear of financial ramifications (or perceived ramifications) of a divorce or the divorce process to cause the survivor to reconcile with their abuser prior to the divorce being finalized. The power/control dynamic between the abuser and survivor is incredibly powerful and, in times of high stress, even a highly motivated survivor may revert to old patterns and return to their abuser.

Third, financial abuse can be impeded or perpetuated during the course of the divorce process. It is important the survivor obtain appropriate relief on a temporary orders basis that fosters financial independence. Obtaining orders that give a financially abused spouse independent access to funds to live on, access to funds to pay a lawyer, and the ability to acquire financial information is really giving the abused spouse a fair trial and the opportunity to get a just and right result.

Finally, a survivor should also have the assistance of an independent counselor and the ability to consult with a financial adviser. The divorce process for someone who has been controlled by finances, can be especially anxiety-provoking and having a professional support system is crucial to their recovery. These resources can aid the survivor in coping with their feelings, reestablishing self-confidence and building their financial knowledge for the future.

Kevin Segler is board-certified family law attorney with KoonsFuller. He can be reached at [email protected].

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Are 'Struggling' With Partner Pay Segmentation, as Top Rainmakers Bring In More Revenue

5 minute read

Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

5 minute readTrending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250