Revenue Dips at Locke Lord, RPL Up Slightly, as Head Count Declines

The Dallas-based firm posted another year of declining head count, losing 4.6% of its lawyers in 2019.

February 11, 2020 at 03:47 PM

5 minute read

Locke Lord offices in Washington, D.C. Sept. 14, 2016. (Photo: Diego M. Radzinschi/ALM)

Locke Lord offices in Washington, D.C. Sept. 14, 2016. (Photo: Diego M. Radzinschi/ALM)

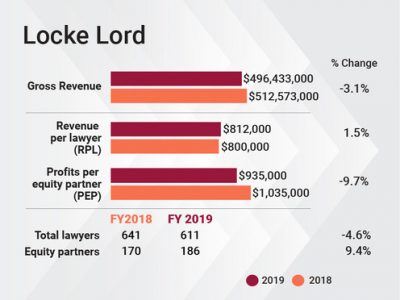

As it continued to shed lawyers for the fifth year in a row, Locke Lord saw gross revenue slip by 3.1% in 2019, while revenue per lawyer increased slightly.

Chair David Taylor said the small decrease in revenue is largely due to shrinkage in the total lawyer count—including the loss of a number of lawyers in the firm's Hong Kong office—and the fact that a contingency fee factored into 2018 financial results.

Taylor, who just completed his second year as chair of the Dallas-based firm, said he is focused on improving revenue per lawyer, which came in at $812,000 in 2019 and is up 1.5% from $800,000 in 2018. He called that increase a "good sign of healthy growth."

The firm reported to ALM Intelligence that it raised rates by more than 3% in 2019.

The firm posted gross revenue of $496.4 million in 2019, compared with $512.6 million the year before. Net income was $173.5 million in 2019, down 1.1% from $175.5 million in 2018.

But profits per equity partner (PEP) took a hit in 2019, slipping to $935,000, down 9.7% from $1.035 million in 2018. That follows a substantial increase in PEP a year ago. The swing can be attributed to a 9.4% increase in equity partners at Locke Lord in 2019—the equity tier grew to 186 partners from 170 in 2018.

But profits per equity partner (PEP) took a hit in 2019, slipping to $935,000, down 9.7% from $1.035 million in 2018. That follows a substantial increase in PEP a year ago. The swing can be attributed to a 9.4% increase in equity partners at Locke Lord in 2019—the equity tier grew to 186 partners from 170 in 2018.

"With the addition of equity partners, we knew our PEP would go down," Taylor said. He said the number of equity partners at Locke Lord increased in 2019 because some strong "next-generation" partners made more money, so according to Am Law 200 definitions those lawyers are now considered equity partners.

The nonequity partner count declined to 96, down 22.6%.

More broadly, Taylor said Locke Lord's revenue was attributable to a lower firmwide lawyer head count, which dipped to 611 on a full-time equivalent basis in 2019. The firm is 4.6% smaller than in 2018, a decline caused in part by the departure of lawyers in Hong Kong, including nine lawyers and paralegals that moved last fall to Holman Fenwick Willan.

With partner Gregory Burch remaining in charge of the Hong Kong office, Taylor said the firm maintains its license and its practice there, but is now "just managing it a little differently." He said Burch is assisted by lawyers from Houston, Chicago and Atlanta who also spend some time in Hong Kong.

"We are just trying to be strategic," he said.

While many Big Law firms are sizing up, Locke Lord's lawyer census has been on a downward trajectory since 2015, when it merged with Edwards Wildman Palmer, creating a 1,014-lawyer firm with 23 offices.

It is not unusual for firms to shed lawyers following a merger, but Locke Lord's lawyer count declined to 847 on a full-time equivalent basis in 2015, to 749 in 2016, and 664 in 2017. The shrinkage has slowed some, as head count dropped to 641 in 2018 and 611 in 2019.

Taylor said some of the decline was "normal attrition," but some was strategic as the firm concentrates on its strengths. Locke Lord opened an office in Brussels in 2019, but in recent years shuttered locations in Istanbul, Tokyo and Sacramento, he said.

"There may be areas geographically, from a practice standpoint, which may not work in the long run," he said.

The firm's lateral partner hires in 2019 include Eric Strain, an aviation litigator in New York; Steven Trybus, a pharmaceutical intellectual property lawyer in Chicago; corporate lawyer Robert Evans III in New York; and Eric Johnson, the Dallas mayor who joined as a public finance lawyer.

Overall, Taylor said, the firm's partners were happy with its 2019 performance.

Transactional practices were busy, he said. Energy lawyers worked on deals valued at more than $1 billion for clients including NextEra Energy Partners, Comstock Resources and Momentum Midstream. Private equity lawyers represented clients including Hastings Equity Partners, Tailwater Capital and the WildFire Energy management team.

Insurance was another robust area, he said, and the firm represented WellCare in its $17.3 billion merger with Centene. Public finance work was also robust, particularly in the Northeast, and commercial, financial services and intellectual property litigators were busy, he said.

Another growth area in 2019, Taylor said, was the privacy and cybersecurity practice in Los Angeles and San Francisco. He said the firm is advising clients on the California Consumer Privacy Act of 2019, which created new regulations related to how businesses deal with customer information.

Locke Lord has offices in 21 locations.

Taylor is excited about the start to 2020, noting that the firm just finished its strongest January ever. However, Locke Lord has lost some practice leaders to other firms already this year. The co-chairs of its global capital markets practice joined Winston & Strawn in Houston, and a co-chair of the construction law practice moved to Mayer Brown in Houston.

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

Read More

Locke Lord Loses Another Practice Head as Partner Joins Mayer Brown

Winston & Strawn Makes Houston Power Grab for Locke Lord Capital Markets Co-Chairs

Texas Firm Locke Lord's Entire Hong Kong Team Hired by Holman Fenwick

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

O'Melveny, White & Case, Skadden Beef Up in Texas With Energy, Real Estate Lateral Partner Hires

5 minute read

Chamberlain Hrdlicka Taps a New Leader as Firm Follows Succession Planning Path

3 minute read

Law Firms Are 'Struggling' With Partner Pay Segmentation, as Top Rainmakers Bring In More Revenue

5 minute read

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250