Baker Botts Posts Revenue Turnaround After 2-Year Slide

Every department at the firm exceeded revenue targets for 2019, managing partner John Martin said. But profitability declines continued.

February 24, 2020 at 12:51 PM

6 minute read

(Photo: Jason Doiy/ALM)

(Photo: Jason Doiy/ALM)

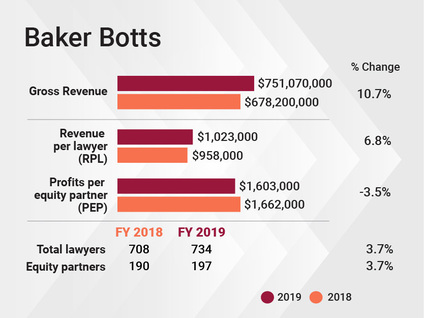

After two years of revenue declines, Baker Botts turned things around in 2019 with a 10.7% increase in revenue and 6.8% growth in revenue per lawyer.

But profitability took another hit at the Am Law 100 firm, with profits per equity partner dropping by 3.5% and net income remaining flat.

Despite that slip in profitability for a third straight year, John Martin, managing partner since last April, characterized the firm's performance for the year as "very strong," and a "validation" of its strategy.

Business was good in 2019, Martin said, with broad-based activity across practice areas, and the firm exceeded revenue targets at all five of its departments.

"2019 really was a turning point," he said, noting that revenue for the year is the highest since 2016, when the firm recorded $846.5 million due to significant income from contingency fees.

The $751.1 million in revenue for 2019 compares with $678.2 million in 2018. RPL moved across the seven-figure mark in 2019, coming in at $1.023 million, compared with $958,000 the year before.

The $751.1 million in revenue for 2019 compares with $678.2 million in 2018. RPL moved across the seven-figure mark in 2019, coming in at $1.023 million, compared with $958,000 the year before.

Net income was flat at $315.6 million, down 0.1% when compared with $315.9 million last year. PEP was $1.603 million, compared with $1.662 million the prior year.

While the firm's head count inched up 3.7% to 734 in 2019, the firm's revenue grew by a larger percentage.

Martin said the 6.8% improvement in RPL is the most reliable marker of the firm's performance, because it reflects increased client demand. The firm, he said, was focused on top-line revenue growth and RPL in 2019.

Baker Botts raised rates by more than 3% during 2019. Martin said two things played into that—the strength of the U.S. economy, and the fact that clients appreciate the firm's "value proposition" and expertise.

"They are eager to hire us," he said.

The firm, founded in Houston in 1840, worked on strategic planning throughout much of 2019, Martin said, involving a broad base of partners. The plan calls for the firm to focus on growth in five sectors—energy, intellectual property, targeted disputes (which includes a number of litigation specialties), corporate technology/media/telecommunications and private equity—to sharpen the firm's focus and differentiate it, Martin said.

Following that strategy, Baker Botts made 24 lateral partner hires in 2019, Martin said. During two months in the fall, the firm added five partners to its offices in Northern California. Hiring also included three partners in London. The largest group of laterals was a nine-partner environmental team of former Katten Muchin Rosenman lawyers in Houston, Austin, San Francisco and Washington, D.C.

"That's a perfect example of taking a strength of ours and adding strength to strength, to really deepen and widen our presence there," Martin said of the environmental team.

He noted that only 20% of the firm's lateral partner hires were in Texas, showing the focus of the firm's expansion.

The firm did lose some partners in 2019, including energy transactions lawyers Ned Crady and David Peterman, who moved to Paul Hastings in Houston; and at the end of the year, Van Beckwith, chair of Baker Botts' litigation department, left to become senior vice president and general counsel at Houston's Halliburton Co.

In significant litigation matters, Baker Botts lawyers secured a dismissal of a lawsuit filed against Kinder Morgan that had delayed construction of a $2 billion pipeline, and, among other matters, won a patent infringement suit for Lyft against RideApp.

On the deals side, Baker Botts represented Carrizo Oil & Gas Co. in its $3.2 billion acquisition by Callon Petroleum Co.; represented Sunnova in its $168 million initial public offering, which was the first solar IPO for a Texas company; represented NASCAR in its $2 billion acquisition of International Speedway Corp.; and also represents BP in the U.K. energy company's pending $5.6 billion sale of its Alaska operations and assets to Hilcorp Alaska.

Baker Botts did not change its lineup of offices during 2019, and Martin said the strategic plan does not include entering any new markets. Outside of Texas, the firm's U.S. offices are in New York, Washington, D.C., and Northern California. International offices for the firm are in Beijing, Brussels, Dubai, Hong Kong, London, Moscow and Riyadh, Saudi Arabia.

Martin, a corporate technology lawyer who had been head of the Palo Alto, California, office, moved into the managing partner role last April, succeeding Houston corporate partner Andrew Baker, who faced mandatory retirement at the end of 2019.

Just days after Martin took on the reins of the firm, he appointed some new, "next generation" partners-in-charge: Rebeca Huddle in Houston, Brian Lee in Palo Alto and Renee Wilm in New York. Saying diversity in leadership is one of his goals, Martin pointed out that the firm was recognized in 2019 by Diversity Lab as Mansfield Certified Plus, which recognizes the firm's efforts to have at least 30% women and diverse lawyers in key areas including leadership.

Looking ahead, Martin said the firm has been "strong out of the gate" in 2020, and he has high expectations for the year, especially as the lateral partners hired last year gain traction. He said the firm will do more partner hiring this year.

Read More:

Texas-Based Baker Botts Adds 5 New Partners in 2 Months to its Bay Area Offices

For Baker Botts, Ex-Katten Group Adds Crisis Response, White-Collar Heft in Environmental Practice

Baker Botts Picks Up Houston Tax Partner, Loses Restructuring Partner

Under New Firmwide MP, Baker Botts Promotes Younger Office Leaders

Baker Botts Again Posts Weaker Revenue, Profits, on Fewer Contingency Fees

With Texas Legacy, New West Coast MP, What Does Baker Botts' Future Hold?

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Conspiracy Suits Against Quinn Emanuel, Roc Nation Moved to Federal District Court

JCPenney Seeks Return of More Than $1.1M From Jackson Walker For Bankruptcy Work

3 minute read

Ex-Appellate Court Judges Launch Boutique Focused on Plaintiffs Appeals

2 minute read

O'Melveny, White & Case, Skadden Beef Up in Texas With Energy, Real Estate Lateral Partner Hires

5 minute readLaw Firms Mentioned

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250