Government Shutdown, Energy Slowdown Made for a Flat 2019 at Haynes and Boone

Demand at the Texas firm increased substantially during the second half of the year, but couldn't fully make up for a slow start.

March 09, 2020 at 06:20 PM

5 minute read

Haynes and Boone office sign (Photo: Rick Kopstein/ALM)

Haynes and Boone office sign (Photo: Rick Kopstein/ALM)

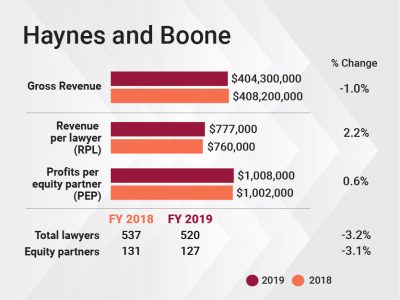

Following a slow start to 2019, Haynes and Boone could only do so much to catch up in the second half. The firm saw gross revenue decline by 1%, while revenue per lawyer increased 2.2% on slimmer head count.

"The first half ended up being very, very slow. You had a government shutdown … at the same time you saw the slowdown on the energy side," managing partner Timothy Powers said. But, he added, demand improved significantly during the second half of the year.

"The second half really ramped up in the M&A area," he said. Also in the latter half, the firm saw energy restructuring activity continue, a pickup in litigation, and strong activity in the appellate and financial services practices.

The uptick in restructuring work and litigation was a boon to 2019 results, but it didn't totally compensate for the early year slowdown, Powers said, because the firm is about 73% business and 27% controversy.

"No matter how busy our controversy side gets, if your business cycle is slow, it doesn't make up [for that]," he said.

Haynes and Boone, which is celebrating its 50th anniversary this year, posted revenue of $404.3 million in 2019, compared with $408.2 million in 2018. RPL came in at $777,000, up from $760,000 the year before, as total head count declined by 3.2% to 520. The firm increased billing rates by less than 3%.

Haynes and Boone, which is celebrating its 50th anniversary this year, posted revenue of $404.3 million in 2019, compared with $408.2 million in 2018. RPL came in at $777,000, up from $760,000 the year before, as total head count declined by 3.2% to 520. The firm increased billing rates by less than 3%.

Profits per equity partner inched upward $6,000, or 0.6%, compared with the year before. Net income was $127.6 million, down 3% from $131.5 million in 2018.

The 2019 financials contrast to 2018, when the firm surpassed significant multiple milestone—revenue moved over the $400 million mark, PEP topped $1 million, and RPL shot past $750,000. The firm stayed above all three of those marks in 2019, but didn't significantly improve them.

Haynes and Boone spent a good part of 2019 working on implementing its "2025 Plan" by investing significantly in technology, launching wellness programs—the firm signed the American Bar Association's Well-Being Pledge—enhancing its alumni program, and continuing to focus on diversity and inclusion, Powers said.

He said head count declined in part because of aggressive moves by out-of-state firms moving into the Texas market.

"We are constantly dealing with free agency, firms coming into town," he said, noting that Haynes and Boone has grown outside of Texas, such as in Charlotte, North Carolina, where it opened an office last year for banking work. Clients there include Bank of America and Wells Fargo.

The firm also grew in New York on the financial services side, and added insurance coverage litigators in Washington, D.C., Powers noted.

He expects the firm to direct attention to the West Coast this year to support its national practice. The firm has an office in Costa Mesa, California, but is eyeing San Francisco and Los Angeles, he said.

During 2019 in Texas, the firm represented Landry's and owner Tilman Fertitta in the acquisition of the Del Frisco's Double Eagle Steakhouses and Frisco's Grilles; advised Callon Petroleum Co. in the sale of certain noncore assets in the Midland Basin; represented Blucora in its acquisition of 1st Global, a tax-focused wealth management company in Dallas, and Stream Energy in the sale of its retail electricity and natural gas business to NRG Energy.

Lawyers also won a defense verdict in an intellectual property trial in U.S. District Court for the Eastern District of Texas for client HiCon, a Korean company sued by Plastronics Socket Partners, and successfully represented the board of trustees of the Dallas Police and Fire Pension System in litigation over the constitutionality of public pension reforms.

Unlike 2019, the firm had a strong start to 2020, Powers said, with January and February coming in as the best first two months of a year in the firm's history.

"All that said, we've hit that headwind of the new coronavirus. You've seen what that's done to the market," he said, wondering out loud what it will do to CEO confidence. Because of COVID-19, lawyers in the firm's office in Shanghai are working remotely, Powers added.

He also expects a "brutal election season" to have some impact on the market, but noted that the countercyclical practices of litigation and restructuring should be very busy this year.

Powers, who has been managing partner for six years, will turn 65 this year and is planning to step down from his position at the end of 2020. He said a committee will appoint his successor, who will likely be a partner already in a leadership role.

"There will be a very smooth transition of power," he said.

The 2019 financial figures reported in this report are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

Read More

Haynes and Boone Posts Record-Setting 2018 on Modest Gains

Haynes and Boone Opens Charlotte Office, Adding Partner from King & Spalding

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Foley Partner Wrapping Up Long Legal Career, 29 Years of Chairing MLK Jr. Oratory Competition in Houston

3 minute read

Sunbelt Law Firms Experienced More Moderate Growth Last Year, Alongside Some Job Cuts and Less Merger Interest

4 minute readLaw Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250