Amid Energy Investment Slowdown, Thompson & Knight Feels Revenue, Profit Pinch in 2019

Bankruptcy is one practice that started slow at Texas firm Thompson & Knight in 2019, then picked up as the year went on.

March 17, 2020 at 03:51 PM

4 minute read

Mark Sloan of Thompson & Knight. Courtesy photo

Mark Sloan of Thompson & Knight. Courtesy photo

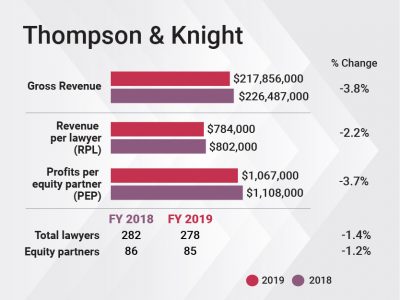

Coming off a record 2018, Thompson & Knight saw revenue slip 3.8% in 2019 thanks to a slow start in intellectual property and bankruptcy, and a midyear decline in capital investment in the energy sector.

Revenue per lawyer at the Dallas-based firm was $784,000 in 2019, down 2.2% when compared with $802,000 the year before, as lawyer head count dropped by 1.4%. Gross revenue totaled $217.9 million, compared with $226.5 million in 2018.

Profits per equity partner came in at $1.07 million, down 3.7% from $1.11 million in 2018. Net income was $90.6 million, a decline of 4.9% from $95.3 million the prior year.

Mark Sloan, managing partner of Thompson & Knight, said 2019 was a "little bit of a back-off" from last year, when gross revenue grew by 6.8% and PEP improved by a hefty 15.9%.

He said most of the firm's practices stayed busy during the first quarter, but intellectual property work was slow because a large lawsuit settled in January. Bankruptcy also took off slowly, although it picked up considerably by the third quarter, he said.

By May and June, the firm's transactional side started seeing the effects of the lack of capital investment in the energy market. On the plus side, Sloan said the trial group and real estate were busy all year, along with health care and tax controversy.

Significant transactions in 2019 included representing EnCap Investments in the sale of its foreign investments in Sierra Oil & Gas to a subsidiary of DEA AG; representing Haggar Clothing Co. and Yue Yuen Industrial as Haggar was acquired by Randa Accessories; representing Frog Scooters in launching its global operations; and representing US Bank National Association in three note offerings totaling $1.85 billion.

Collections also slowed in 2019, Sloan said, which was related in part to the energy industry. But because of that, the firm started the year sitting on "pretty high" inventory and accounts receivable, and he said collections improved a bit after the first of the year.

Collections also slowed in 2019, Sloan said, which was related in part to the energy industry. But because of that, the firm started the year sitting on "pretty high" inventory and accounts receivable, and he said collections improved a bit after the first of the year.

The firm raised billing rates at the beginning of 2019 as part of a normal annual review to fit the market. "We aren't the highest-cost provider. We aren't the lowest-cost provider," Sloan said.

Hiring during 2019 was largely focused in Houston, but Sloan said the firm also added some lawyers in Dallas. Laterals included project finance partner George Humphrey and tax partner Louis Jenull in Houston.

This year, the firm is open to "good opportunities" in Dallas and Houston, and also looking to expand in New York, a location "not as large as we want it to be," Sloan said. Like other Texas firms, Thompson & Knight is aiming to hire more bankruptcy and restructuring lawyers, he said, particularly as energy companies feel the effects of a downturn in oil prices.

"The energy industry is not in favor right now by investors and I think obviously what's happening with energy prices right now, there will be some shakeout," he said.

Head count in 2019 was 278, down slightly from 282 in 2018, but the firm's nonequity partner count dipped to 50 from 60 the year before while the firm had 85 equity partners, only one less than the prior year.

Sloan said the drop in nonequity partners is due to some retirements and departures, but the firm is nevertheless focused on increasing its leverage by adding associates.

"Long term, it makes sense to have fewer income partners and more associates in terms of our leverage model. It's happening naturally," he said.

The firm closed its 7-year-old Los Angeles office in 2019. "Frankly, it wasn't strategic," Sloan said. He said the firm is not seriously considering any new locations this year.

2020 started out a bit above budget, Sloan said, noting that uncertainty in energy markets led the firm to budget conservatively for the year. Real estate continues to be busy, and IP, bankruptcy and technology are also showing strength, he said. But much remains to be seen in the coming months.

"This coronavirus thing is the big unknown. Nobody knows how long it's going to impact things," Sloan said.

Read More

Thompson & Knight Posts Big Profit Gains in 2018

Thompson & Knight's Mexico Presence Helped Lure Houston Project Finance Lawyer

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute read

Holland & Knight Hires Former Davis Wright Tremaine Managing Partner in Seattle

3 minute read

Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

5 minute read

Trending Stories

- 1E-Discovery Provider Casepoint Merges With Government Software Company OPEXUS

- 2How I Made Partner: 'Focus on Being the Best Advocate for Clients,' Says Lauren Reichardt of Cooley

- 3People in the News—Jan. 27, 2025—Barley Snyder

- 4UK Firm Womble Bond to Roll Out AI Tool Across Whole Firm

- 5Starbucks Hands New CLO Hefty Raise, Says He Fosters 'Environment of Courage and Joy'

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250