Capitalizing on Texas Niche, Jackson Walker Sets Record Revenue in 2019

Despite the challenges stemming from the new coronavirus, managing partner Wade Cooper said practices including labor and employment, health care, real estate and finance remain busy.

March 31, 2020 at 11:01 AM

6 minute read

C. Wade Cooper, managing partner of Texas firm Jackson Walker. (Courtesy photo)

C. Wade Cooper, managing partner of Texas firm Jackson Walker. (Courtesy photo)

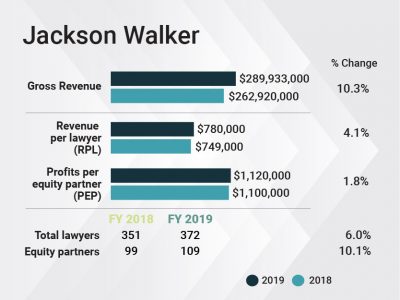

Revenue grew by 10.3% at Texas firm Jackson Walker in 2019, largely thanks to some significant real estate and finance transactions, in a departure from previous years when big litigation matters drove revenue growth.

Managing partner Wade Cooper said the shift was due in part to the firm's lateral hiring in real estate and finance, as well as some very active clients. Although he added that litigation continued as one of the firm's strongest practices in 2019. And in an effort to add a market-leading practice, the firm is also growing its wealth planning practice and building a roster of wealthy business-owner clients, he said.

Cooper said a number of financial factors also contributed to the firm's increased revenue in 2019, including a "standard" rate increase, 6% head count growth and improved realization.

Gross revenue at Jackson Walker hit $289.9 million in 2019, up from $262.9 million in 2018. Revenue per lawyer improved by 4.1% to $780,000, up from $749,000 in 2018, even as the firm grew by 6%, reaching 372 lawyers on a full-time equivalent basis.

Profits per equity partner came in at $1.12 million, up 1.8% from $1.1 million the year before, and the firm had 109 equity partners—10 more than it had in 2018. Net income was $122.1 million, up 12.3% from $108.7 million the prior year.

Cooper said finance was the busiest area of the firm in 2019, followed by real estate and litigation. But the wealth practice has grown in recent years, and the firm now has one of the largest practices in Texas representing wealthy families and entrepreneurs. In one major matter, Jackson Walker represented Whataburger, the iconic burger chain based in San Antonio, when it sold a majority interest to BDT Capital Partners of Chicago last year.

Cooper said finance was the busiest area of the firm in 2019, followed by real estate and litigation. But the wealth practice has grown in recent years, and the firm now has one of the largest practices in Texas representing wealthy families and entrepreneurs. In one major matter, Jackson Walker represented Whataburger, the iconic burger chain based in San Antonio, when it sold a majority interest to BDT Capital Partners of Chicago last year.

"That's a sweet spot for us," Cooper said of the practice area.

In the wealth planning area, the firm hired partner Kal Grant, who was a managing director at Tolleson Wealth Management, in 2019. Other lateral hires included former Houston appeals court justice Jennifer Caughey; Dallas ERISA partner Greta Cowart from Winstead; condemnation partners Joe Regan and Adam Plumbley from K&L Gates in Fort Worth; Houston employment partner Scott Fiddler who had his own firm; Dallas environmental partner Jon Bull from Foley Gardere; Austin-based energy and regulatory partner Kirk Rasmussen from Enoch Kever; Houston energy partner Kirk Tucker from Mayer Brown; and former in-house lawyer Lindsey Berwick in San Antonio.

Cooper said real estate deals kept many lawyers busy in 2019. That work included representing KDC Real Estate Development and Investment in the sale of the Pioneer Natural Resources headquarters in Irving. The firm also represented American Airlines in the development and construction of its new world headquarters at DFW International Airport and in the sale of a former headquarters building.

Jackson Walker is the largest Texas-only firm, and Cooper said that's an advantage, pointing to referrals and local counsel work that comes in from national firms. For instance, he said Kirkland & Ellis has brought in Jackson Walker's bankruptcy group when it encounters conflicts on Texas matters, he said.

"As a Texas-only firm, we are not a threat to a lot of people. … Part of our success is our ability to develop relationships with national firms," he said.

Other areas in that model include Texas regulatory work, he said. "We know a lot about the local politics, the local regulatory [and] tax environment. We do real estate projects with other capital markets firms around the country," he said.

Jackson Walker has offices in Dallas, Houston, Austin, San Antonio, Fort Worth, San Angelo and Texarkana. It is not currently considering opening any new locations, Cooper said.

Despite last year's lateral hiring, Cooper said last year's growth in the equity partner tier was partly due to a longer term succession strategy to add "NexGens" to the equity partnership.

This year, he said, the firm is addressing diversity in management. Currently, on the management committee, three of eight members are women and one is diverse, and on the compensation committee, seven of 16 members are women and two are diverse.

For the first two months of 2020, revenue was ahead of 2019′s pace, Cooper said, because the firm had grown and demand was high. But in recent weeks, the outlook has changed.

"Now, we are in a whole different ballgame," he said, referring to the effect of the stay-home orders instituted in an attempt too slow the spread of the coronavirus, and the economic effects of the virus hitting the U.S.

He said it's too early to make any decisions about what steps the firm might take if the uncertainly continues for a long period. "We have to be patient and let this play out a little bit," he said.

But, Cooper noted, during the 2008 recession, Jackson Walker did not implement any reduction-in-force, unlike many other Am Law 200 firms. "We made the decision to keep our whole team together and we did. Culturally, that's important to us," he said.

He said the firm is well-positioned because of its low overhead, lack of significant debt and a "lean and mean" staff.

Despite the economic uncertainty, Cooper said some practices are currently "super busy" including labor and employment, health care—the firm has a niche practice in telemedicine—finance and real estate. Litigators are busy, even as they encounter rescheduled hearings and trial dates, he said, and wealth planning and bankruptcy are seeing continued strong demand.

Having joined the firm in 1981, Cooper said he's worked through other downturns. "We will get to the other side of it," he said.

Read More

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Jones Day Names New Practice Leaders for Antitrust, Business and Tort Litigation and Latin America

Haynes and Boone Expands in New York With 7-Lawyer Seward & Kissel Fund Finance, Securitization Team

3 minute read

'None of Us Like It': How Expedited Summer Associate Recruiting Affects Law Students and the Firms Hiring Them

Law Firms Mentioned

Trending Stories

- 1States Accuse Trump of Thwarting Court's Funding Restoration Order

- 2Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 3Coral Gables Attorney Busted for Stalking Lawyer

- 4Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

- 5Securities Report Says That 2024 Settlements Passed a Total of $5.2B

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250