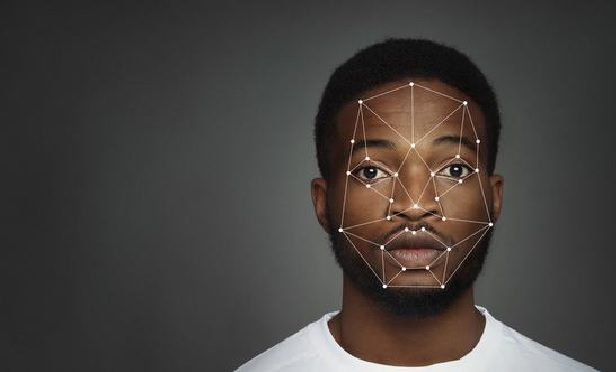

Well before the devastating collapse of the Champlain Towers, it had become near impossible for oceanfront commercial properties and those located in coastal regions to obtain coverage from Florida licensed carriers. (Credit: Fernando Medina/Shutterstock)

Well before the devastating collapse of the Champlain Towers, it had become near impossible for oceanfront commercial properties and those located in coastal regions to obtain coverage from Florida licensed carriers. (Credit: Fernando Medina/Shutterstock) How Surfside collapse could influence state-regulated insurance

Growing legal fees Fla. insurers face from past hurricanes and reduced faith in building inspections could drive a decline in available coverage.

August 04, 2021 at 12:00 AM

6 minute read

The original version of this story was published on Law.com

The business of insurance relies upon predictive indicators of risk exposure. So how will a seemingly (and hopefully) rare event like the Surfside condo collapse impact the way that condominium association-owned buildings model? Does the fact that a board of laypeople is tasked with decisions affecting the structural integrity of condo buildings influence the insurability of those buildings? If so, Florida residents will likely see a continued decline in the availability of property insurance coverage from Florida licensed insurers.

Florida's property and casualty insurance industry has been struggling to withstand a period of extreme turbulence during the past four years. Not only was the state hit with multiple major hurricanes from 2017-2019, but Florida's legal landscape foreseeably contributed to the storms' litigious aftermath. In fact, at least one study found that Florida insurers are paying out more in legal costs than actual indemnity payments owed to insureds. Although the legislature has taken some remedial action to retroactively address a few common causes, such as the 2019 AOB reforms and more recently with SB 76, Florida carriers were already issuing non-renewals in an effort to reel in their risk exposure.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

All my 'excess' live in Texas: Texas Supreme Court holding on additional insured status

6 minute read

Insurer must defend insured for Biometric Information Privacy Act violations

6 minute read

Law Firms Mentioned

Trending Stories

- 1Silk Road Founder Ross Ulbricht Has New York Sentence Pardoned by Trump

- 2Settlement Allows Spouses of U.S. Citizens to Reopen Removal Proceedings

- 3CFPB Resolves Flurry of Enforcement Actions in Biden's Final Week

- 4Judge Orders SoCal Edison to Preserve Evidence Relating to Los Angeles Wildfires

- 5Legal Community Luminaries Honored at New York State Bar Association’s Annual Meeting

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250