Interest rates have been at historic lows for so long they have become the “new normal.” This includes the Applicable Federal Rate published each month by the Internal Revenue Service for use in computing assigned interest charges. Since the AFR also happens to be integral to many complex estate planning techniques, low rates can spell big estate planning returns.

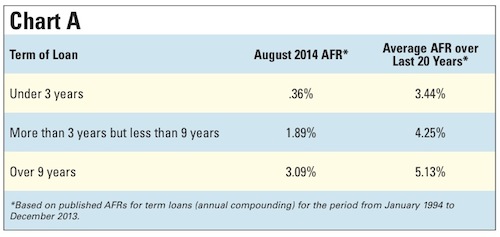

Chart A illustrates the difference between the prevailing AFRs for term loans originated in August 2014 and a benchmark comparison to the comparable, average rate over the last 20 years.

Chart A illustrates the difference between the prevailing AFRs for term loans originated in August 2014 and a benchmark comparison to the comparable, average rate over the last 20 years.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]