Owner of Legal Benefits Company Charged in $30M Loan Fraud

Federal prosecutors on Friday announced charges against the owner of a legal benefits company for allegedly defrauding multiple lenders out of $30 million.

March 16, 2018 at 03:46 PM

3 minute read

Federal prosecutors on Friday announced charges against the owner of a legal benefits company for allegedly defrauding multiple lenders out of $30 million.

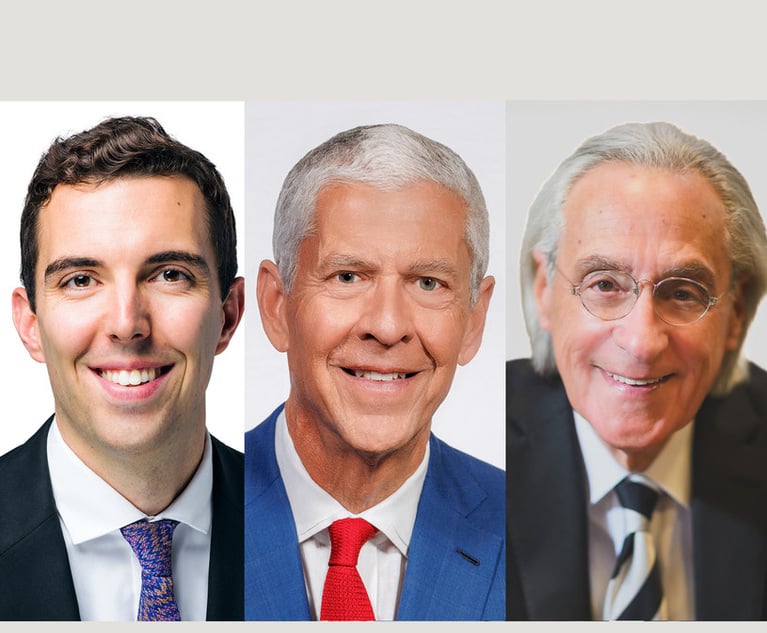

Gary Alan Frank, 47, of Philadelphia, was charged by criminal complaint with one count of wire fraud by the U.S. Attorney's Office for the Eastern District of Pennsylvania.

Frank allegedly defrauded several prospective lenders through his business, the Legal Coverage Group Ltd., which contracts with employers that offer their employees a legal plan as part of their employee benefits plans, prosecutors said in a statement Friday.

“In late 2014 Frank secured a $30 million loan from two lenders, Prudential

Insurance Co. of America and Prudential Retirement Insurance and Annuity

Co. (collectively, 'Prudential'), by making various false representations regarding the size and revenue of the Legal Coverage Group's business. After obtaining these funds, Frank and the Legal Coverage Group continued to deceive Prudential and other lenders, including various individuals,” prosecutors said.

“When the relationship between Prudential and the Legal Coverage Group soured in

2017, Prudential sued the Legal Coverage Group and Frank in New York state court,” prosecutors said, “Soon after Prudential brought this suit, Frank caused counsel for the Legal Coverage Group to provide fraudulent bank documents to Prudential. For example, on or about Oct. 11, 2017, Frank caused the Legal Coverage Group's counsel to email a false September 2017 bank account summary to Prudential's attorney. The false account summary for the Legal Coverage Group reflected an ending balance of $1,526,322.12, even though the actual ending balance for this period was approximately $13,114.24.”

While the New York litigation was ongoing, prosecutors said, Frank allegedly had an attorney with Legal Coverage Group deliver three additional false Bank of America account summaries to a lawyer for Prudential.

Additionally, on Jan. 26 of this year, Frank allegedly filed a false Chapter 11 bankruptcy petition for Legal Coverage Group in Philadelphia federal court, according to prosecutors. Prosecutors alleged that during the time of the bankruptcy proceedings, Frank “made and caused others to make additional material misrepresentations regarding the Legal Coverage Group, until at least March 1, 2018, when the government executed a court-authorized search of the company's premises.”

If Frank is convicted on this count, he faces up to 20 years in prison, three years of supervised release, and a $250,000 fine.

Frank's attorney, Robert Welsh of Welsh & Recker, said on Friday “he's cooperating with the authorities by returning assets and participating in interviews.” He added that the cooperation was part of the conditions for Frank's release and that there was no plea deal on the table.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Lawsuit Against Major Food Brands Could Be Sign of Emerging Litigation Over Processed Foods

3 minute read

Kline & Specter and Bosworth Resolve Post-Settlement Fighting Ahead of Courtroom Showdown

6 minute read

'Discordant Dots': Why Phila. Zantac Judge Rejected Bid for His Recusal

3 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250