Saul Ewing Increases 2017 Revenue 43 Percent After Big Merger

Managing partner Barry Levin said the year was a "roaring success," despite the "dilutive effect" of the merger on revenue per lawyer and profits per partner.

April 03, 2018 at 01:38 PM

5 minute read

Saul Ewing Arnstein & Lehr, which started out in 2017 simply as Saul Ewing, saw revenue increase by more than $66 million from 2016 to 2017, thanks to the largest merger in its history.

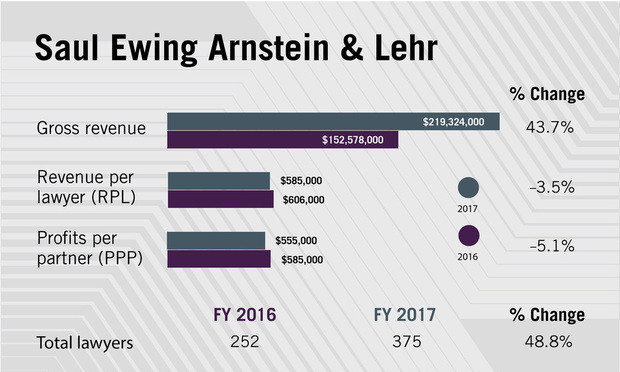

The firm's gross revenue grew by 43.7 percent, to $219.3 million. Revenue per lawyer decreased by 3.5 percent to $585,000, as head count grew dramatically. It was a similar story for profits per equity partner, which dropped by 5.1 percent to $555,000.

Saul Ewing announced in September that it had merged with Arnstein & Lehr, a midsize firm based in Chicago that also had offices in Florida. The combined firm had 375 lawyers, including 117 equity partners and 90 nonequity partners, in 2017.

Managing partner Barry Levin said the year was a “roaring success,” despite the “dilutive effect” of the merger on RPL and PPP.

“We got both added strength on strength, as well as a few new practice areas,” Levin said.

Levin said the merged firm beat its budget by 7 percent, based on a combination of the two firms' budgets pre-merger. That would have been 11 percent, he said, had the firm not prepaid some 2018 expenses.

The firm's profit margin was steady from 2016 to 2017, at 30 percent.

Levin said he expects the firm's RPL and PPP to return to pre-merger levels and continue growing in coming months. The decline was a product of the two firms having RPL in different places, he said, and will be remedied as the firms continue to integrate, implement operational best practices and take advantage of opportunities to collaborate. He said Saul Ewing and Arnstein & Lehr had modestly different rate structures before the merger.

Levin said he expects the firm's RPL and PPP to return to pre-merger levels and continue growing in coming months. The decline was a product of the two firms having RPL in different places, he said, and will be remedied as the firms continue to integrate, implement operational best practices and take advantage of opportunities to collaborate. He said Saul Ewing and Arnstein & Lehr had modestly different rate structures before the merger.

As a whole, the firm raised rates by close to 3 percent, Levin said. And its historically strong practices continued to be strong. He highlighted the higher education practice, in which the firm now represents more than 350 schools, and the litigation practice.

Merging Two Firms

Integrating 140-lawyer Arnstein & Lehr into Saul Ewing was a major focus of 2017, Levin said, beginning long before the deal was formalized and announced in September. The two firms initiated talks in June 2016, and an integration committee of seven lawyers and four other professionals met monthly throughout 2017. They also had a retreat six weeks before the merger became effective, he said.

The firms did not have to cut staff positions after combining, Levin said, and only one lawyer left as a result of the merger. There was no overlap in geography between the two firms, with Arnstein & Lehr adding a presence in Chicago and Florida. Still, Levin said he would describe the firm now as super-regional rather than national.

The combination has already started to pay off with new work, Levin said. Based on data collected through the integration, the combined firm has taken on 125 new matters that it wouldn't have been able to work on were it not for the merger, and one of those has 34 sub-matters, he said.

“We can do larger and more complicated matters,” Levin said, as well as projects in Chicago that Arnstein & Lehr may not have been able to take on before.

In bringing on Arnstein & Lehr's practices, Saul Ewing gained capabilities in products liability work and in EB-5 investment work, which is especially active in Florida.

Levin said integrating the firm's people was the highest priority, but they have also worked on adopting the operational best practices of each firm. They have already combined their financial systems, he noted.

In the coming year, Levin said, the firm will aim to expand on its existing practice areas. He noted cybersecurity and data privacy as an area of growth in the recent past and future. That practice got some extra attention last year when the firm's then-chair, April Doss, was tapped to serve as special counsel to the U.S. Senate Intelligence Committee in its investigation of Russia's involvement in the 2016 presidential election.

Levin said he's gotten numerous inquiries about other potential combinations since completing the merger with Arnstein & Lehr. A lot of them were from the West Coast, but none of those has led to further merger talks yet, he said.

However, he did acknowledge that Saul Ewing, like other Philadelphia-based law firms, has had to look outside its home city to grow.

“It's a mature marketplace for legal,” he said, referring to Philadelphia. “We wanted to be in growing geographic areas.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'The World Didn't End This Morning': Phila. Firm Leaders Respond to Election Results

4 minute read

Settlement With Kleinbard in Diversity Contracting Tiff Allows Pa. Lawyer to Avoid Sanctions

3 minute readTrending Stories

- 1Bribery Case Against Former Lt. Gov. Brian Benjamin Is Dropped

- 2‘Extremely Disturbing’: AI Firms Face Class Action by ‘Taskers’ Exposed to Traumatic Content

- 3State Appeals Court Revives BraunHagey Lawsuit Alleging $4.2M Unlawful Wire to China

- 4Invoking Trump, AG Bonta Reminds Lawyers of Duties to Noncitizens in Plea Dealing

- 522-Count Indictment Is Just the Start of SCOTUSBlog Atty's Legal Problems, Experts Say

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250