Photo: Shutterstock

Photo: ShutterstockAetna's Suit Alleging Medical Group Inflated Bills Cleared to Proceed

Insurance giant Aetna's lawsuit against a medical group over allegations that it inflated bills for neonatal care can proceed, a federal judge has ruled.

October 23, 2018 at 04:40 PM

3 minute read

Insurance giant Aetna's lawsuit against a medical group over allegations that it inflated bills for neonatal care can proceed, a federal judge has ruled.

U.S. District Judge Wendy Beetlestone of the Eastern District of Pennsylvania denied defendant Mednax's motion to dismiss Aetna's claims. Beetlestone held that Aetna's claims were not barred by the statute of limitations and presented issues of fact to be determined by a jury.

Aetna accused Mednax of “upcoding,” or making infant patients out to be sicker than they were so that the bill for services could be increased, according to Beetlestone's opinion.

“As alleged by Aetna, this 'upcoding' scheme permeated Mednax's operations. Mednax trained and required physicians to engage in 'upcoding,' and encouraged physicians to perform unnecessary services to support higher billing rates. Further, Mednax would sometimes inflate the codes itself, above the level indicated by physicians, before submitting the forms to Aetna,” Beetlestone said.

Mednax argued that Aetna's claims fell outside of the two-year statute of limitations, but Aetna countered that its claims are timely under the continuing violations doctrine and the discovery rule.

“As alleged, the 'upcoding' scheme began in 2009 and continued through at least September 2016. This suit was initiated in November 2017—accordingly, any wrongful acts that took place in 2016 fall within the two-year limitations period. Nevertheless, because Aetna has alleged an ongoing scheme that persisted into the limitations period, it is not appropriate to resolve at the pleadings stage whether the continuing violations doctrine allows Aetna to maintain suit for actions that occurred prior to the limitations period. Further, because Mednax allegedly concealed the falsity of its claims, it is possible that the discovery rule applies as well. In short, it is not 'apparent on the face of the complaint' that the statute of limitations bars Aetna's claims,” Beetlestone said.

The judge also said Aetna made sufficient fraud claims to proceed, contrary to Mednax's argument. “Though the 'hypothesis' of fraudulent activity put forward by Aetna 'could be challenged'—and, indeed, ultimately shown to be unfounded—the allegations setting forth the tortious practices 'certainly suffice[] to give [the defendant] notice of the charges against it.'”

Additionally, Aetna plausibly alleged that it justifiably relied on the upcoded forms when paying reimbursements.

“It may be shown, as Mednax asserts, that Aetna had access to certain documents regarding Mednax's claims, and that Aetna often investigates claims or denies coverage in such a way as to render its reliance on Mednax's forms unjustifiable,” Beetlestone said. “But that question turns on issues of fact—such as Aetna's access to documentation underlying each claim—and is not appropriately resolved on a motion to dismiss.”

Aenta's counsel, Frederick P. Santarelli of Elliott Greenleaf, and Mednax's counsel, Luke Nikas of Goldman of Quinn Emanuel Urquhart & Sullivan, did not respond to requests for comment.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

GC Pleads Guilty to Embezzling $7.4 Million From 3 Banks

Plaintiffs Seek Redo of First Trial Over Medical Device Plant's Emissions

4 minute read

Remembering Am Law 100 Firm Founder and 'Force of Nature' Stephen Cozen

5 minute readTrending Stories

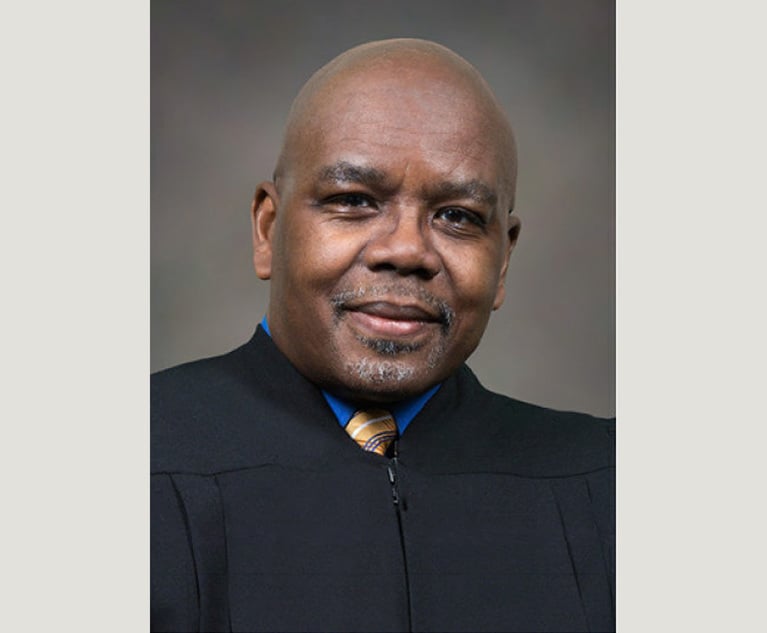

- 1Trailblazing Broward Judge Retires; Legacy Includes Bush v. Gore

- 2Federal Judge Named in Lawsuit Over Underage Drinking Party at His California Home

- 3'Almost an Arms Race': California Law Firms Scooped Up Lateral Talent by the Handful in 2024

- 4Pittsburgh Judge Rules Loan Company's Online Arbitration Agreement Unenforceable

- 5As a New Year Dawns, the Value of Florida’s Revised Mediation Laws Comes Into Greater Focus

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250