Dechert Cracks $1B in Revenue in Big Hiring Year

As the firm settles into the $1 billion club, CEO Henry Nassau said it had a "milestone" year with high expectations for 2019.

February 28, 2019 at 10:12 AM

5 minute read

(Photo: Diego M. Radzinschi/ALM)

(Photo: Diego M. Radzinschi/ALM)

In what firm CEO Henry Nassau called a “milestone year,” Dechert passed the $1 billion revenue marker in the midst of a lateral hiring spree.

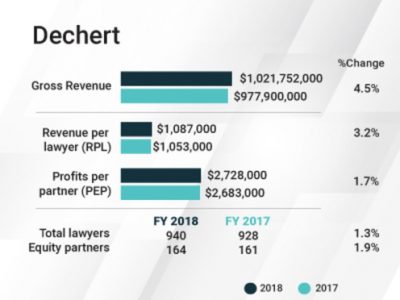

Gross revenue grew by 4.5 percent, to $1.02 billion in 2018, up from $977.9 million in 2017. Revenue per lawyer increased by 3.2 percent, to $1.09 million.

Profits grew at a slightly slower clip. Net income increased by 3.5 percent, to $447.67 million in 2018, compared with $432.5 million in 2017.

Profits per equity partner, at $2.73 million in 2018, increased by 1.7 percent from the year before.

Nassau said the firm's hours were up 6 percent in 2018, while rates increased in line with industry averages. Geographically, he said, it was a particularly good year for Dechert's Philadelphia, New York and London offices.

In terms of practice areas, litigation was the most robust, Nassau said, but corporate practices, especially those affected by activity in capital markets or mergers and acquisitions, also had a good year.

In terms of practice areas, litigation was the most robust, Nassau said, but corporate practices, especially those affected by activity in capital markets or mergers and acquisitions, also had a good year.

He highlighted “sophisticated” matters handled in 2018, such as Dechert's representation of CVS Health Corp. as it faced scrutiny over its merger with Aetna, and its work for longtime client SK hynix Inc., which acquired a unit of Toshiba's business for $18 billion.

Nassau said the 2018 revenue growth can be attributed in part to the firm's lateral hiring strategy but noted those additions would have had a greater effect on the numbers if not for the delay in collections typical in a lateral move.

“There's always a lag when you bring someone in,” he said. With that in mind, looking ahead to the rest of 2019, “we think it's going to be a shoot-the-lights-out year,” he said.

While the firm has aimed to remain “efficient,” he said, it has not sought out cost-cutting measures. And, in 2019, it was among the firms that matched market-leading associate salary increases—which Nassau called a “delightful” expense, noting the importance of associates to the firm.

Looking for Teams

Dechert added 26 lateral partners in 2018, making it “a very substantial growth year,” Nassau said.

The most significant was the addition of 21 products liability lawyers from Quinn Emanuel Urquhart & Sullivan, beginning with Sheila Birnbaum and Mark Cheffo, who had been co-chairs of Quinn Emanuel's products liability group, joining Dechert in May.

The firm also brought on several life sciences and IP lawyers from other large law firms, though it also saw a couple of life sciences groups depart in Europe.

And throughout the year, Dechert added several senior-level hires in Washington, D.C. Those included the former chair of Hughes Hubbard & Reed's international trade practice, F. Amanda DeBusk, who brought partner Melissa Duffy with her.

Other hires included international private equity lawyer Timothy Clark, who rejoined Dechert in New York as a partner after a decade at two other firms, and Steven Rabitz, a former in-house lawyer for The Goldman Sachs Group Inc. and Lehman Brothers Holdings Inc., who brought his employee benefits practice from Stroock & Stroock & Lavan to Dechert in June.

Outside the U.S., former New York federal prosecutor Roger Burlingame joined the firm's London office from Kobre & Kim. And the firm brought on its first real estate attorneys in Dubai over the summer, hiring a pair of lawyers from King & Spalding.

As for growth in the coming year, Nassau said Dechert will continue to seek opportunities to hire in key locations and practices, including internal investigations, capital markets, private equity and life sciences. Diversity also is a major factor in assessing the firm's talent pool, he noted.

The firm's lateral recruiting strategy has become more focused on teams of lawyers, he said, looking at “fewer ones and twos.” To that end, acquiring a firm of 20 to 40 lawyers might be of interest, but a merger of equals is much less likely, he said.

“We are open to anything that is consistent with our strategy and growth. We're a global firm,” Nassau said. “We have been approached by many firms. … We haven't seen anything we would say is accretive.”

Because of the firm's global footprint, Nassau said, he is watching developments like Brexit and nationalist movements around the globe with concern. But, “at least through today, everything seems to be going on robustly,” he said.

“We haven't seen any cracks in client demand yet,” Nassau said.

Read More

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Lackawanna County Lawyer Fails to Shake Legal Mal Claims Over Sex With Client

3 minute read

Conversation Catalyst: Transforming Professional Advancement Through Strategic Dialogue

5 minute readTrending Stories

- 1Thursday Newspaper

- 2Public Notices/Calendars

- 3Judicial Ethics Opinion 24-117

- 4Rejuvenation of a Sharp Employer Non-Compete Tool: Delaware Supreme Court Reinvigorates the Employee Choice Doctrine

- 5Mastering Litigation in New York’s Commercial Division Part V, Leave It to the Experts: Expert Discovery in the New York Commercial Division

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250