Ballard Spahr Sees Big Revenue Gain, Slight Profit Dip After Midwest Merger

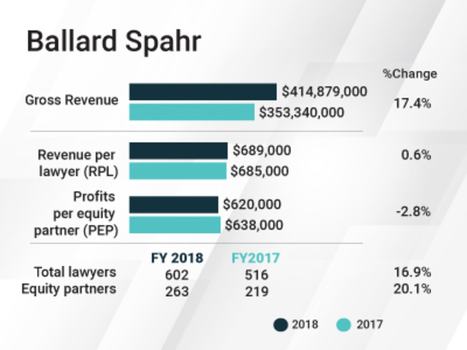

Gross revenue was up 17.4 percent while profits per equity partner dipped 2.8 percent from 2017 to 2018, as the firm completed a major merger.

March 01, 2019 at 05:21 PM

4 minute read

Photo: Diego M. Radzinschi/ALM

Photo: Diego M. Radzinschi/ALM

Ballard Spahr saw significant gross revenue growth in the year following the biggest merger in its history, while profits per equity partner (PEP) took a slight hit in the midst of integration.

The Philadelphia-based firm saw gross revenue increase by 17.4 percent, to $414.88 million in 2018, up from $353.34 million in 2017. Revenue per lawyer was roughly flat, increasing by 0.6 percent, to $689,000.

PEP was down 2.8 percent from 2017 to 2018, dipping to $620,000. But net income was up 16.7 percent, to $162.98 million.

PEP was down 2.8 percent from 2017 to 2018, dipping to $620,000. But net income was up 16.7 percent, to $162.98 million.

Ballard Spahr chairman Mark Stewart said the 2018 PEP was still the second best the firm has seen. “This is part of the process,” he said, of “trying to create a foundation to compete.”

The firm made its merger with Minneapolis-based Lindquist & Vennum official at the start of 2018. Just a couple months before, in the fall of 2017, it had acquired media law boutique Levine Sullivan Koch & Schulz.

Integrating all those lawyers was “the biggest thing we've ever undertaken,” Stewart said.

The firm's total head count, on a full-time equivalent basis, went from 516 in 2017 to 602 last year. Its equity partnership grew by 20.1 percent, to 263 partners. Ballard Spahr doesn't have a nonequity tier.

Among strong practices in 2018 were intellectual property litigation, the firm's Chancery practice in Delaware, and finance practices including public finance, transactional finance and real estate finance, Stewart said.

Bankruptcy continued to be weaker, he said, and litigation “felt a little slowdown” as some big matters resolved.

Courting the Midmarket

The entrance into Minneapolis was aimed at strengthening the corporate practice and increasing contact with midmarket clients, Stewart said. Those clients, he noted, “are more reliant on their lawyers,” because they don't have large in-house legal departments.

“It's a lucrative place for us,” and one in which Ballard Spahr's rate structure fits well, he said.

Ballard Spahr did raise rates by an average of 3 percent across the firm, he said. And the Lindquist & Vennum lawyers' rate structures have been adjusted gradually over time to be more in-line with the rest of the firm's business, he said.

But Stewart said the firm has been aiming to increase its revenue without constant rate increases, looking to improved project management as way to achieve that. “That's working,” he said, noting increases in the firm's realization rate over recent years.

About 17 percent of the firm's work is handled under alternative fee arrangements, he said. And the firm's chief client value officer, Melissa Prince, whose role was made official at the beginning of last year, has become increasingly involved in customizing those arrangements.

Prince's office used to be a fairly quiet place, Stewart said, but “now it's Grand Central Station” as lawyers within the firm increasingly seek Prince's help in customizing aspects of their client relationships.

In addition to the merger, Ballard Spahr added several lateral hires, including fintech and payment systems lawyer Chris Ford and IP and startup partner John Zurawski.

The firm started this year with several other lateral acquisitions as well. Ballard Spahr took a federal lobbying group from Nossaman in Washington, D.C., after long seeking to add federal lobbying capabilities. And it brought on commercial and intellectual property litigator Aliza Karetnick from Duane Morris as a partner in Philadelphia.

The firm also saw cybercrime prosecutor Edward McAndrew leave for DLA Piper last month. And earlier this year, project finance co-leader Tom Hoffman left for Foley & Lardner, while labor and employment partner Daniel Johns headed to Cozen O'Connor.

In 2019, the firm will look to rebuild its cyber practice, which is in progress, Stewart said.

It will also continue to focus efforts on improving project management, and may eventually seek to grow in the Florida and Texas legal markets, he said.

Asked whether any more mergers might be on the table, Stewart said, “if it's in the best interests of the firm.”

However, he added, “If you ask our partners, they'd say let's focus on making what we've got a 100 percent success.”

Read More

One Year After Lindquist Merger, Ballard Spahr Still Focused on Midwest

'Client Value' Roles Take Off as Partners Place Trust in Professionals

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute read

Trending Stories

- 1Some Thoughts on What It Takes to Connect With Millennial Jurors

- 2Artificial Wisdom or Automated Folly? Practical Considerations for Arbitration Practitioners to Address the AI Conundrum

- 3The New Global M&A Kings All Have Something in Common

- 4Big Law Aims to Make DEI Less Divisive in Trump's Second Term

- 5Public Notices/Calendars

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250