Climate Change and the Boardroom—Have Board Responsibilities Changed?

Climate change continues to develop as an issue that could wreak havoc on corporations and their insurers.

March 27, 2019 at 03:55 PM

8 minute read

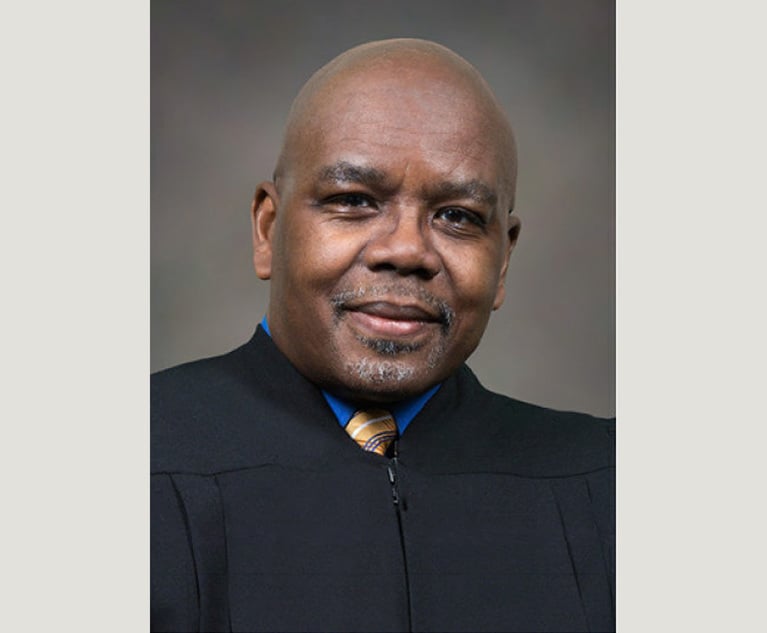

Key Coleman, Marcum LLP

Key Coleman, Marcum LLP

Climate change continues to develop as an issue that could wreak havoc on corporations and their insurers. While there is little disagreement that the CO2 and other greenhouse gases (GHGs) emitted from the burning of fossil fuels lead to climate change, there is very little clarity as to how to prove damages or who will bear the burden of future losses. Carbon extractors and heavy users of fossil fuels continue to draw reproach due to their contribution to the problem. However, it is not just heavy industry that is shouldering all the blame. As a result, risk managers in all industries are paying closer attention to developments related to climate change and making certain that they remain proactive in assessing risk.

At the highest level of an organization, corporate governance initiatives must now address the risks associated with climate change. Directors and officers of these entities need to understand the changing landscape, gather the best available information and take action on the most critical issues facing their organization. In order to continue to recruit and retain qualified directors and officers, however, the organization needs to provide the proper protection to its board, enabling members to defend themselves individually and shield their personal assets from climate change lawsuits.

The Changing Litigation Landscape

In the past couple of years we have witnessed an expansion in the type of climate change lawsuits filed. If the Trump administration has caused the federal government to let up to any degree on prosecution of climate issues, the state attorneys general, and even local governments, have taken the opposite approach. Moreover, the causes of action and pool of plaintiffs have expanded significantly.

This diversity of new lawsuits can be seen in just a small sampling of state and federal courts:

The People of the State of New York v. Exxon Mobil—In October 2018, the New York attorney general filed a securities fraud case against Exxon Mobil Corp., not for causing climate change, but for “providing misleading assurances that it is effectively managing the economic risks posed to its business by the increasingly stringent policies and regulations that it expects governments to adopt to address climate change.”[1] This lawsuit followed a three-year-long investigation which Exxon Mobil described as “tainted” and “meritless,” see “People of the State of New York,” by Barbara D. Underwood, Attorney General of the state of New York v. Exxon Mobil, Supreme Court of the State of New York, County of New York, Index No. 452044/2018, Received NYSCEF: Oct. 24, 2018.

Rhode Island v. Chevron—In July 2018, the state of Rhode Island sued multiple fossil fuel companies in state court over the effects of climate change. This lawsuit (unlike the New York suit against Exxon) does, in fact, allege that defendants actually caused climate change and goes on to claim damages from the rise in sea level, coastal erosion and salt water intrusion resulting from storms that were more destructive than those in the past, see “New York Sues Exxon Mobil, Saying it Deceived Shareholders on Climate Change,” New York Times, Oct. 24, 2018. In addition, the cities of New York and Baltimore both filed lawsuits in 2018 against fossil fuel companies alleging damages as a result of climate change, see Rhode Island v. Chevron, Case Number: PC-2018-4716, filed in Providence/Bristol County Superior Court, July 2, 2018.

Juliana v. United States—This lawsuit, directed by Our Children's Trust, was actually filed by children through their legal guardians in 2015, citing the government's admission of “'an obligation to current and future generations to 'take action' on climate change.” The complaint alleges that the federal government subsidizes the fossil fuel industry and has allowed CO2 pollution levels to reach reckless levels, see Juliana v. United States, USDC, District of Oregon— Eugene Division, Case No.: 6:15-cv-01517-TC, Filed 9/10/2015. Nine similar lawsuits have been filed on behalf of children across the country, see” Surge of Climate Lawsuits Targets Human Rights, Damage from Fossil Fuels,” by Nicholas Kusnetz, Inside Climate News, Jan. 4, 2019.

The expanding types of lawsuits indicate that the breadth of risk that directors and officers face may be expanding as well.

Knowing What to Do

Every board needs a framework to help determine how climate change uniquely impacts the organization. Fortunately, certain large investors have taken the initiative to help public companies understand their own specific risks. State Street Global Advisors, for example, has identified three core risks that companies face: physical, regulatory and economic. Physical risk includes the risk of damage to facilities located in coastal areas, that may be subjected to more frequent or severe windstorms that in the past. Regulatory risk includes the risk of not being able to react fast enough to comply with regulations as they are imposed (especially when failure to comply could put the company out of business). Economic risk includes the risk of holding so-called “stranded assets” in the form of, say, coal reserves that need to remain in the ground because lack of demand causes their price to drop dramatically, see “Climate Change Risk Oversight Framework for Directors,” March 14, 2016, State Street Global Advisors.

Once the risks are identified and understood, an expanded corporate governance framework can enable directors and officers to make informed decisions regarding the risks associated with climate change.

State Street's specific guidance for directors regarding climate change is summarized below:

- Understand if the company adequately mitigates its climate change risks under multiple scenarios at regular intervals;

- Review climate change investments where technology could help the company gain a competitive advantage over its peers;

- Understand how changing regulatory standards impact company strategy;

- Ensure the board composition includes the proper climate change expertise, as well as access to experts as needed, especially for companies in high-risk sectors; and

- Be able to articulate the company's climate change strategy to investors.

Protecting Directors and Officers

Even when the board is doing the best job possible, directors and officers need to know that they are protected. The fear a director or officer may have of needing to defend a lawsuit can lead to suboptimal decision-making. Yet, the typical directors & officers' (D&O) insurance policy may not be enough to relieve those fears, as it may not contemplate all the risks associated with climate change. According to a Marsh report, “… climate change risks do not fit neatly within existing definitions and exclusions, leading to potential gaps in cover.” For example, there is some ambiguity (especially outside the United States) as to whether CO2, which occurs naturally in the Earth's atmosphere, is actually a pollutant, and therefore subject to the pollution exclusion found in some policies. Also, certain policies exclude coverage for fines and penalties levied by regulatory agencies, which could become a larger issue in the future. Further, due to the enormous exposure, it is possible that in the future insurance carriers will restrict or exclude coverage altogether for losses due to climate change.

In addition to these specific ambiguities relating to coverage for climate change, all of the usual concerns about D&O policies apply, and are potentially magnified, when considering any new or emerging large loss exposure. First, there is the concern about whether the policy provides severability, thereby allowing the policy to cover directors and officers who committed no wrongdoing. Then, there is the well-known D&O insurance limits issue. One section (or “side”) of the D&O policy covers the directors and officers, while another side covers the company (or “entity”). Yet, often, there is only a single set of insurance limits. If the company spends its insurance limits defending allegations brought against the entity, it may have nothing left when the time comes to cover the outside directors. These particular issues existed well before climate change litigation expanded; however, with the advent of intensified litigation, they will require further consideration.

Conclusion

Directors and officers need to be ever mindful of the changing landscape with regard to climate change litigation. Safeguards that worked in the past will inevitably be deemed insufficient in the future. In order to stay ahead of the curve, they should establish a pipeline that provides the board with the latest information, engage the services of experts when needed, and assess their risks using an established framework. At the same time, companies should ensure they can hire the best outside directors and retain the best company officers by offering indemnification protection as well as insurance that will enable the board to make unencumbered decisions on behalf of the shareholders.

Key Coleman is an advisory services director in Marcum LLP's Philadelphia office and a member of the firm's insurance industry group. Coleman provides business and financial analysis to the insurance and reinsurance industry. He focuses his practice on forensics, dispute analysis, damages and expert testimony for insurance companies, reinsurers and insurance attorneys.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Plaintiffs Seek Redo of First Trial Over Medical Device Plant's Emissions

4 minute read

'Serious Misconduct' From Monsanto Lawyer Prompts Mistrial in Chicago Roundup Case

3 minute read

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250