Fox Rothschild Grows Revenue on Bigger Footprint

The firm advanced by one place in the Am Law 100 rankings after first gaining a foothold on the list in 2015.

April 30, 2019 at 05:59 PM

6 minute read

Fox Rothschild.

Fox Rothschild.

In a year of four mergers, including its largest combination yet, Fox Rothschild managed to grow revenue per lawyer and profits per equity partner, as it continued to spread its national footprint.

“We're able to do more in different places and clients perceive us as being able to do that,” firmwide managing partner Mark Morris said.

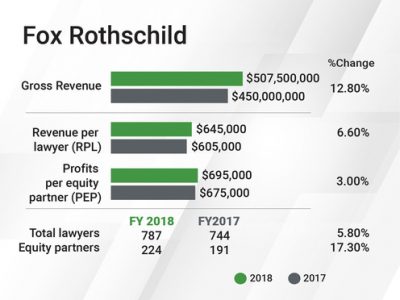

The Philadelphia-based Am Law 100 firm saw gross revenue increase by 12.8% from fiscal 2017 to fiscal 2018, to $507.5 million. RPL was up 6.6%, to $645,000, as the firm saw its total head count increase by 5.8%, to 787.

(Year-end figures for Fox Rothschild do not exactly match the firm's numbers reported in The American Lawyer, which are compiled before the firm's fiscal year ends March 31.)

The firm also managed to grow its profits, bringing in net income of $155.7 million, an increase of 20.8% since 2018. Profits per equity partner increased by 3%, to $695,000, even as the equity partnership swelled by 17.3%, to 224 partners.

Average compensation for all partners also increased by an equal percentage to total head count—5.8%—to $602,000.

Fox Rothschild moved up one spot in national rankings by revenue, coming in 74th in the 2019 Am Law 100 based on estimated gross revenue for 2018 as of two weeks before its fiscal year-end.

While the firm ultimately beat that estimate by $9.5 million, its Am Law 100 ranking would still be 74th based on gross revenue of $507.5 million. Ogletree, Deakins, Nash, Smoak & Stewart, at 73rd, had gross revenue of $509.8 million.

Despite double-digit revenue growth, Fox Rothschild's upward movement in the rankings was much slower than in recent years.

The firm jumped into the Am Law 100 in 2015, placing 95th that year after it grew revenue by 10% from 2013 to 2014. It grew revenue by another 10% the next year, jumping up another 10 spots in the rankings. It jumped up five more spots in the 2017 rankings, and another five in the 2018 Am Law 100.

Morris said rates increased by 3% to 4% in 2018, and the 6.6% RPL growth outpaced growth in expenses per lawyer.

“I think our operations are more streamlined, our hours increased both at the associate and partner level,” he said. “We actually just got more productive … that's the main reason why those statistics are as good as they are.”

Practices that showed growth included the cannabis law group, privacy and data security, construction and litigation, Morris said. “There really was no weakness” among practice groups firmwide, he added.

Some litigation wound up and major transactions closed, leading to fee recoveries, but none of those made an unusual impact on the firm's finances, he said.

In its four mergers throughout the year, Fox Rothschild added lawyers in Chicago, Delaware and Denver, where it already had offices, and established a new foothold in the Southeast by acquiring North Carolina-based Smith Moore Leatherwood. In all four cases, Morris said, “expectations were met” in terms of productivity.

He said other lateral hires as a whole were about 95 percent as productive as expected, meaning they “basically are doing what they said they were going to do.” In addition to its lawyer head count growth, Fox Rothschild also filled a key C-suite role at the end of its last fiscal year, hiring Holly Lentz Kleeman to fill the vacancy.

As the firm has grown, Morris said, Fox Rothschild has made an effort to decrease square footage per lawyer in its offices, ideally to 500 or 600 per lawyer. The firm also launched a data retention program, he said, which aims to cut data storage costs and eliminate unnecessary paper files.

“I think over time it will save us millions of dollars,” Morris said. “We run a pretty lean operation to begin with.”

At the same time, the firm has taken a closer look at its alternative fee arrangements, and hired an intake manager to make sure those arrangements are appropriate. Morris said work is being done on an alternative fee basis “more than ever before,” and realization has actually improved slightly in the midst of that trend.

Building Out Existing Offices

This year, Morris said, Fox Rothschild will be focused on the best ways to budget those matters and stick to the budget, and will likely implement a matter management training program for attorneys.

“We try to be responsive to what clients want,” he said. “They want to be your partner. They're not trying to take advantage of you.”

Morris said the firm is planning new space in Chicago and Dallas, and an expansion of its Pittsburgh office. No other mergers are imminent, he said, but the firm will continue to seek opportunities for beneficial combinations.

“The real upside for the firm is not just expanding geographically, but adding lawyers with productive practices in existing markets,” Morris said. “We don't have any plans at all to enter a specific market. That's not something we're looking to do.”

That said, he added, there are markets where the firm isn't present, and if the right opportunity were to arise, “we would look at it very carefully.”

With regard to growing the existing offices, Morris said the infrastructure investment doesn't change, making it much easier to get the next 30 lawyers than the first 30.

“The real juice in the lemon … is to continue to grow that way,” he said.

Read More

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Look to Gen Z for AI Skills, as 'Data Becomes the Oil of Legal'

De-Mystifying the Ethics of the Attorney Transition Process, Part 2

Pennsylvania Law Schools Are Seeing Double-Digit Boosts in 2025 Applications

5 minute readTrending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250