Wolf Administration Announces Plan to Join Northeast Carbon Market

On Oct. 3, Gov. Tom Wolf issued Executive Order 2019-07 signifying his intention for Pennsylvania to join the Regional Greenhouse Gas Initiative (RGGI).

October 31, 2019 at 01:29 PM

8 minute read

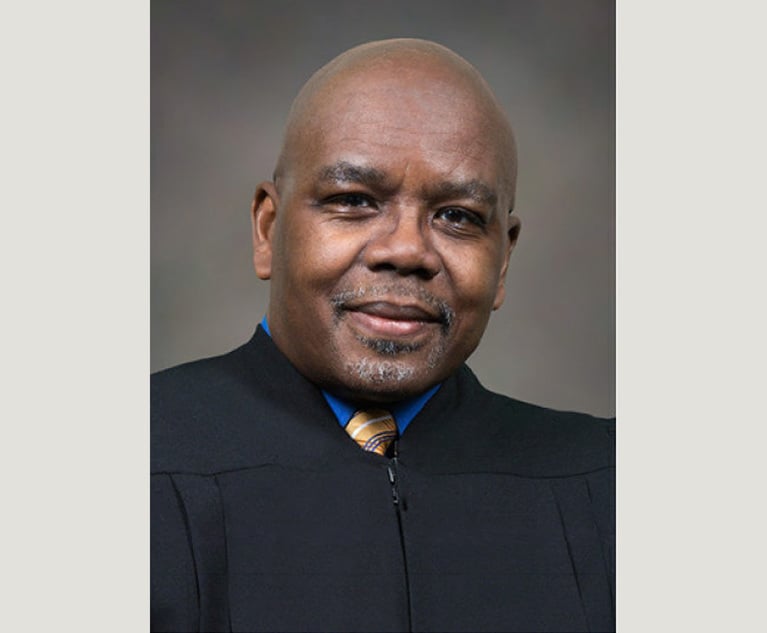

Kevin Garber and Hannah Baldwin of Babst Calland Clements & Zomnir

Kevin Garber and Hannah Baldwin of Babst Calland Clements & Zomnir

On Oct. 3, Gov. Tom Wolf issued Executive Order 2019-07 signifying his intention for Pennsylvania to join the Regional Greenhouse Gas Initiative (RGGI). The order instructs the Pennsylvania Department of Environmental Protection to "develop and present to the Pennsylvania Environmental Quality Board a proposed rulemaking package to abate, control or limit carbon dioxide emissions from fossil-fuel-fired electric power generators," by no later than July 31, 2020. The order directs the proposed rulemaking to be "sufficiently consistent with the Regional Greenhouse Gas Initiative (RGGI) model rule," such that allowances may be traded with holders of allowances from other RGGI states. Under the order, the DEP must also conduct a "robust public outreach process" ensuring the program results in reduced emissions, economic gains, and consumer savings, and must consult with PJM, the regional transmission organization that coordinates the movement of wholesale electricity within Pennsylvania and 12 other states, to promote the integration of the program.

What Is RGGI?

RGGI is the country's first regional, market-based cap and trade program designed to reduce carbon dioxide emissions from power plants. The program was created through a memorandum of understanding (MOU) signed by the governors of Connecticut, Delaware, Maine, New Hampshire, New Jersey, New York and Vermont on Dec. 20, 2005. The MOU committed the signatory states to propose a carbon dioxide budget trading program for legislative and regulatory approval, by setting the initial base annual emissions cap for each state and providing that each state's annual allocation would decline by 2.5% each year after 2015.

The MOU also provided for the creation of the regional organization, which has an executive board comprised of two members from each signatory state that serves as a forum for collective deliberation, emissions and allowance tracking, and technical support for determining offsets. The regional organization is funded, at least in part, through payments from each signatory state. The MOU also provides for periodic monitoring and review of the program facilitated by the regional organization.

RGGI currently has nine state members: Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island and Vermont. New Jersey, an original participant when the program started in 2005, withdrew from the program in 2011 but is in the process of rejoining. Virginia has also taken steps toward joining RGGI but the current state budget prohibits the state from joining the program this year.

Under RGGI, fossil-fuel-fired electric power generators with a capacity of 25 megawatts or greater (regulated sources) are required to hold allowances equal to their carbon dioxide emissions over a three-year compliance period. Each allowance is equal to one short ton of carbon dioxide. Regulated sources must purchase carbon dioxide allowances issued by a RGGI state in order to comply. Regulated sources may also use offsets, allowances awarded to certain acceptable environmental projects, to meet a maximum of 3.3% of its allowances.

The proceeds from the allowance auctions are allocated back to the participating states in proportion to the amount of carbon subject to regulation in each state.

Legal Authority to Join in Pennsylvania

To date, all RGGI states except New York have enacted both authorizing statutes and regulations to join and implement RGGI. In Pennsylvania, Wolf may have the authority to negotiate with the RGGI states and sign an amendment to the RGGI MOU, but like other RGGI states, a statute and regulation is likely required to bind the commonwealth to a cap and trade program.

RGGI would not be Pennsylvania's first cap and trade program. Like many states, Pennsylvania instituted a cap and trade program in the early 2000s in response to federal requirements under the Clean Air Act to regulate nitrogen oxides and sulfur dioxide. However, since RGGI was not created in response to a specific federal requirement, instituting a cap and trade program for carbon dioxide and participating in RGGI would likely require express legislative authorization.

RGGI Member Requirements

The MOU does not outline specific procedures for how new states can join RGGI. In the past, however, new signatory states have been added through amendment to the MOU. Section 8 of the MOU provides for general amendments, which must be in writing and have the collective agreement of the authorized representatives of the signatory states. The Second Amendment to the MOU added Maryland as a signatory state, set its initial base carbon dioxide emissions budget, and increased the regional emissions budget to include the new Maryland base budget.

The current RGGI participating states offer a "potential path forward" to RGGI participation in the new state participation in RGGI guidance document, available on RGGI's website. The guidance suggests that interested states start the process by initiating communication with current RGGI states. Initial discussions should include program compatibility, timing of new state participation, and stringency of the new state's proposed program. One critical aspect of these discussions is the development of the proposed carbon dioxide allowance budget for the incoming state. According to Maryland's RGGI coordinator, initial state allowance caps are determined by looking at historic emissions from power generators over 25 megawatts and using the integrated planning model (an model platform developed by the International Climate Foundation and used by both USEPA and FERC to evaluate utility air emissions and cost-benefits for regional transmission organizations) to analyze the projected impact of a state's entrance into RGGI on the price of allowances across all RGGI states. Pennsylvania's initial allowance would be the largest of any current RGGI participant, as Pennsylvania is the only major fossil fuel producing state to consider joining. In 2017 Pennsylvania's power sector emitted 76.8 million metric tons of carbon dioxide, compared to regional RGGI cap for all member states in the same year of 84.3 metric tons.

The guidance includes nine other steps, including the identification of legislation and executive action needed to authorize participation, establishing a carbon dioxide budget trading program and an auctioning procedure for carbon dioxide allowances using the RGGI model rule as a template, and completing the necessary state rulemaking process. Other steps include signing a contract with RGGI, Inc., a 501(c)(3) nonprofit corporation created to provide administrative and technical support to the development and implementation of each RGGI state's carbon dioxide budget trading program.

To become an official participating state under RGGI's bylaws, the RGGI board of directors will enter into a service contract with the participating state under which RGGI, Inc. will provide technical and scientific advisory services to the participating state. In Pennsylvania, the governor or DEP would likely sign the contract, with approval by the attorney general, depending on the authority granted in the implementing legislation.

Other Considerations

If Pennsylvania joins RGGI, one important question is how RGGI revenue generated by the carbon dioxide allowance auctions will be spent in the commonwealth. The MOU requires each signatory state to allocate 25% of its allowances to consumer benefit or strategic energy purpose, which includes measures promoting energy efficiency, directly mitigating electricity ratepayer impacts, promoting renewable or non-carbon emitting technologies or funding the administration of the program itself. Other than a provision in the 2017 model rule stating that the regional organization must be funded, at least in part, by the signatory states, nothing in the MOU or model rule specifically restricts how additional RGGI revenue can be spent.

There is also another cap and trade initiative pending in Pennsylvania resulting from a petition for rulemaking submitted by a group of non-profit organizations and individuals in November 2018. On April 16, the Pennsylvania Environmental Quality Board voted 14-5 in favor of directing the DEP to develop a report and recommendation on the cap and trade petition. The petition borrows heavy from the California cap and trade program and is far broader than RGGI cap and trade programs, covering multiple sectors of the economy, not just electricity generators. On June 18, the DEP reported to the EQB that it expects to present an outside consultant's evaluation of the cost and benefits of the petition in early 2020.

The impact of joining RGGI in Pennsylvania is unclear but is certain to affect pricing for residential and commercial consumers. The effect on future greenhouse gas emissions is also unclear because Pennsylvania emissions of greenhouse gases have already declined from 324 million metric tons in 2000 to 286 million metric tons in 2015.

Kevin Garber is a shareholder in the environmental services and energy and natural resources groups of Babst, Calland, Clements & Zomnir, practicing out of the firm's Pittsburgh and State College offices. Contact him at [email protected].

Hannah L. Baldwin is an associate in the environmental and energy and natural resources groups of the firm. She assists clients in a variety of industrial sectors with a broad range of environmental matters, including issues related to federal and state permitting and regulatory compliance. Contact her at [email protected].

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Plaintiffs Seek Redo of First Trial Over Medical Device Plant's Emissions

4 minute read

'Serious Misconduct' From Monsanto Lawyer Prompts Mistrial in Chicago Roundup Case

3 minute read

Trending Stories

- 1Settlement Allows Spouses of U.S. Citizens to Reopen Removal Proceedings

- 2CFPB Resolves Flurry of Enforcement Actions in Biden's Final Week

- 3Judge Orders SoCal Edison to Preserve Evidence Relating to Los Angeles Wildfires

- 4Legal Community Luminaries Honored at New York State Bar Association’s Annual Meeting

- 5The Week in Data Jan. 21: A Look at Legal Industry Trends by the Numbers

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250