Dechert Grows Revenue by 11%, PEP by 10% in 'Exceptional' Year

While the firm saw strong performance across the board, CEO Henry Nassau singled out the real estate, finance and products liability practices as key drivers.

February 07, 2020 at 04:35 PM

4 minute read

The original version of this story was published on The American Lawyer

Dechert CEO Henry Nassau. (Courtesy photo)

Dechert CEO Henry Nassau. (Courtesy photo)

A year after Dechert first climbed past the $1 billion mark, the firm posted double-digit gains in revenue in 2019.

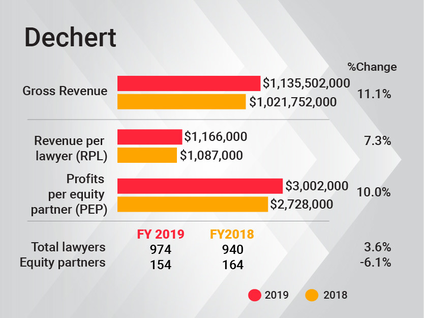

Gross revenue grew by 11.1%, to $1.14 billion in 2019, up from $1.02 billion in 2018. Revenue per lawyer increased by 7.3%, to $1.2 million.

Profits grew at a slightly slower clip, which Dechert CEO Henry Nassau attributed to paying a very significant amount of expense repayments not due until this year in late 2019. Net income increased by 3.3%, to $462.4 million in 2019, compared with $447.7 million in 2018.

"We've had seven years of steady, very stable growth, and 2019 was an exceptional year, both on revenue and the increase in profitability," Nassau said.

While the firm saw strong performance across the board, Nassau singled out real estate, finance and products liability for terrific years.

Dechert realized a full year of performance from the 21-lawyer products liability team that it added in the middle of 2018 from Quinn Emanuel Urquhart & Sullivan, led by Sheila Birnbaum, and the firm notched court wins for Pfizer in the Lipitor and Zoloft disputes. It's also representing Purdue Pharma in some 1,300 opioid matters, and defending Saint-Gobain in one of the United States' largest MDLs.

Representing Citi, the firm had a hand in the financing behind Blackstone's acquisition of a major industrial warehouse portfolio from Singapore-based GLP, the world's biggest private real estate deal ever.

Representing Citi, the firm had a hand in the financing behind Blackstone's acquisition of a major industrial warehouse portfolio from Singapore-based GLP, the world's biggest private real estate deal ever.

Profits per equity partner also climbed 10% in 2019 to $3 million, up from $2.7 million the previous year. That figure was aided by a 6% dip in the number of equity partners, while the nonequity cohort grew by 25 lawyers, or over 20%.

Nassau attributed these numbers in part to natural attrition and retirement, but he also hinted that some partners had been deequitized.

"We pride ourselves on our financial discipline and rigor," he said. "To be an equity partner here requires significant effort and success."

The firm had a strong year in London, home of its third largest office, which Nassau attributed primarily to growth in litigation. He called Dechert's funds practice, which has a global presence beyond London, its most stable "year-in, year-out," and said the London corporate practice hasn't suffered, even with former London chairman Camille Abousleiman giving up his leadership role and partnership to join the Lebanese government at the start of 2019.

Dechert increased its rates over 3% in 2019, and Nassau expects to see similar rate growth in 2020, commensurate with the rest of the market.

Nassau said the firm has also invested significantly in initiatives aimed at preserving and improving the firm's culture—examples include inclusive leadership training and expanded parental leave. The latter went into effect in the U.S. in late 2018 and is now being rolled out in London.

"One of the things we spend a lot of time focused on is making sure that Dechert is considered a special place to be a lawyer," he said. "We want our associates and partners to feel that they're part of a special institution where quality means something."

Looking forward, he expects the firm to continue to be active in pursuing growth through lateral hires.

And even acknowledging significant challenges to the Big Law operating model, Nassau said that 2020 is off to a strong start, with significant large loans being deployed to real estate and continuing optimal conditions for midmarket private equity work.

"Our core practice areas of real estate, finance and product liability continue to be doing well and our large offices—New York, Philadelphia and London—continue to be busy in all practice groups," he said.

The 2019 financial figures reported in this story are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

Read More

How Drama Is Helping Dechert Shrink Its Gender Gap

Litigation Leaders: Dechert's Hector Gonzalez on Multiculturalism, Lateral Hires and Keeping It Simple

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'The World Didn't End This Morning': Phila. Firm Leaders Respond to Election Results

4 minute read

Settlement With Kleinbard in Diversity Contracting Tiff Allows Pa. Lawyer to Avoid Sanctions

3 minute readLaw Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250