Cozen O'Connor Sees Profits Jump as Investments Pay Off

The firm has seen strong revenue growth for several years in a row, but this year revenue per lawyer was also up significantly.

February 25, 2020 at 12:04 PM

4 minute read

(Courtesy photo)

(Courtesy photo)

Guided by a disciplined practice strategy and buoyed by increased client demand, Cozen O'Connor grew revenue per lawyer and profits per equity partner significantly in 2019.

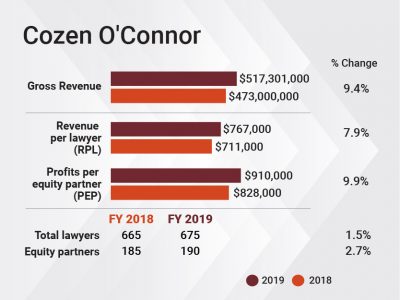

The Philadelphia-based Am Law 100 firm grew revenue 9.4% in 2019, surpassing the half-billion-dollar mark to reach $517.3 million. At the same time, lawyer head count grew only modestly, driving a 7.9% increase in revenue per lawyer, to $767,000.

Likewise, the firm saw its profits jump, with net income of $173.2 million, an increase of 13.3% from 2018. Profits per equity partner grew by 9.9%, to $910,000, and the firm's profit margin grew by one percentage point, to 33%.

"We continued our unblemished record of one better year after another," CEO Michael Heller said.

The firm's head count grew by just 1.5% on a full-time equivalent basis, to 675 lawyers, while the equity partner tier grew 2.7%, to 190. That included nine people who were promoted to equity partner, two of whom are women and one of whom is of a minority race.

The firm's head count grew by just 1.5% on a full-time equivalent basis, to 675 lawyers, while the equity partner tier grew 2.7%, to 190. That included nine people who were promoted to equity partner, two of whom are women and one of whom is of a minority race.

Asked how the firm managed to grow partner profits with a larger equity tier, Heller said no cost cutting was involved.

"We will always look to manage conservatively, but we don't look to enhance profits by cutting expenses. We look to enhance our profits by increasing our revenue, even if that means increasing our expenses, like marketing and business development," he said.

The firm did increase rates by more than 3%. Heller also noted that some investments in technology made in 2018 have been paying off "as planned." And, he said, both aggregate hours and hours per lawyer increased.

"It looks like we bucked a trend over the past year by increasing our hours per lawyer," Heller said. A recent survey by Citi Private Bank found that demand growth was less than head count growth industrywide in 2019.

While Cozen O'Connor's head count growth was small compared to recent years, Heller credited some organic growth and some acquisitions for the improvement in revenue, including a large group of labor and employment lawyers in California from woman-owned firm Miller Law Group. The firm also added lobbyists around the country, including several in Chicago, and a construction litigation group in Washington, D.C., in the fall.

"You will see us continue to look to increase the size of the firm through lateral groups, and some larger groups as well," perhaps up to 100 lawyers, Heller said, though he noted there are no current merger discussions ongoing that would lead to a transaction in the near future. Cozen O'Connor has no interest in doing "what some would call a merger of equals," he added.

He said the firm often gets phone calls from law firms with between 50 and 250 lawyers that are interested in pursuing a combination. "Our success is no longer the best-kept secret out there," Heller said.

He said the most successful practice areas in 2019 were corporate, real estate, commercial litigation and subrogation. He also noted activity in niche practices, including construction litigation, the firm's state attorneys general group, and its lobbying arm, Cozen O'Connor Public Strategies. The firm has continued to focus its strategy of growing on its specialty practices, he said, also including life insurance and annuities and institutional response.

Heller noted significant work across the firm's practices that contributed to revenue growth. Cozen O'Connor represented cannabis company Acreage Holdings in its $3.4 billion sale to Canopy Growth, announced in April. And it successfully argued before the Supreme Court in Manhattan Community Access v. Halleck, which was decided in June. And the firm represented Wells Fargo in a $575 million resolution with all 50 states and Washington, D.C., though that settlement was actually announced in the final days of 2018.

Looking ahead to the rest of 2020, Heller said, "When we look at our pipeline, we are cautiously optimistic that it will be another strong year."

As for future growth, Heller said Cozen O'Connor is looking to grow its commercial practices around the country. The firm is "always looking to build in the mid-Atlantic region," and constantly evaluates opportunities in the Midwest, Southeast and on the West Coast, he added.

Read More:

Pa. Firms Beat Industry on Revenue, Profit Growth: Citi Survey

Cozen O'Connor Sees Revenue Outpace Profit Growth in Investment Year

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Patent Pending ... and Pending ... and Pending? Brace Yourself for Longer Waits

3 minute read

How Some Elite Law Firms Are Growing Equity Partner Ranks Faster Than Others

4 minute readLaw Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250