In Pursuit of Merger, Pepper Hamilton Delivered Another Year of RPL Gains

The firm reversed a gross revenue slide and boosted profits per equity partner 13.6% as it prepared for a transformational merger with Troutman Sanders.

March 05, 2020 at 04:55 PM

5 minute read

Pepper Hamilton offices in Philadelphia. (Photo: Diego M. Radzinschi/ALM)

Pepper Hamilton offices in Philadelphia. (Photo: Diego M. Radzinschi/ALM)

By the time Pepper Hamilton was preparing for a merger with Troutman Sanders, the firm had already taken a serious look at its finances—both in terms of making itself an attractive merger partner and knowing what to look for in a potential combination.

"We did a lot of work," said Tom Gallagher, the chair of Pepper Hamilton's executive committee and soon-to-be vice chair of Troutman Pepper Hamilton Sanders when the merger becomes official next month. "Our preparation was so good that when we received calls, we were able to determine early on whether it was worth moving forward."

A major goal for the firm over the past several years has been improving revenue per lawyer, and it managed to do so for a third year in 2019.

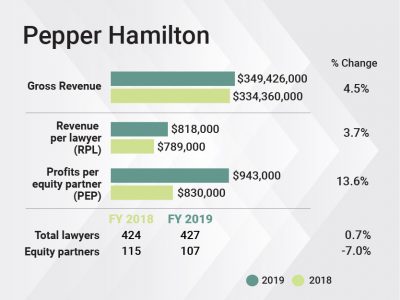

The Philadelphia-based firm saw gross revenue grow 4.5% in 2019, to $349.4 million, after three years of declines. Revenue per lawyer was up 3.7%, at $818,000.

The firm saw a significant jump in profits per equity partner, increasing by 13.6% to $943,000. It did so as net income grew 5.7%, to $100.9 million, with a smaller equity partner tier.

Pepper Hamilton managing partner Tom Cole, who will also be managing partner of the combined firm, said leadership manages to compensation for all partners more than to PEP. CAP was up 6.2%, at $707,000.

Pepper Hamilton managing partner Tom Cole, who will also be managing partner of the combined firm, said leadership manages to compensation for all partners more than to PEP. CAP was up 6.2%, at $707,000.

Pepper's head count was fairly steady year to year, growing by just three lawyers to 427. The total partnership grew by just one lawyer, to 194, but the balance of equity to nonequity partners changed. The equity partner tier shrank by 7%, or eight lawyers, to 107, while the nonequity group grew by nine lawyers, or 11.5%, to 87.

Cole pointed to health sciences and IP litigation as strong practices in 2019. He pointed to a number of transactions as well, in the corporate practices.

According to the firm, Pepper advised clients on more than 90 deals in 2019, with a combined value of more than $14 billion. Those included health sciences corporate work like JPMorgan Chase's acquisition of InstaMed, Xenon Pharmaceuticals' license agreement with Neurocrine Biosciences, Frazier Healthcare Partners' acquisition of Comprehensive Pharmacy Services, and Aro Biotherapeutics Co.'s licensing agreement with Ionis Pharmaceutical.

The firm also worked with GameStop Corp. as it sold its Spring Mobile business, and AMETEK's acquisitions of Pacific Design Technologies and Gatan.

On the litigation side, the firm represented United Egg Producers in an antitrust case, which notched a defense win in December. It also represented Michigan State University in a Title IX case, in which the school won a favorable opinion from the U.S. Court of Appeals for the Sixth Circuit in December. And it represented URS and AECOM in a trial over a $100 million claim, which ended in a defense verdict and a win for URS and AECOM in a $5 million counterclaim.

The IP practice experienced a significant addition early in the year, when it brought on two dozen lawyers from LeClairRyan in Rochester, New York. That hire marked Pepper's entrance into the Rochester market.

Thomas Gallagher, left, and Thomas Cole, right.

Thomas Gallagher, left, and Thomas Cole, right.Cole said that group brought its clients over, which may be unsurprising given that LeClairRyan closed its doors later in 2019, and the addition didn't cost much to Pepper Hamilton beyond taking over the Rochester lease and basic integration expenses.

"They had practiced together many years," Cole said of the lawyers who joined in Rochester. He would not say how much revenue their joining added to the firm, but he said their practice exceeded projected revenue for 2019.

But the bigger project in 2019 was readying the firm for the merger with Troutman Sanders, which it officially announced in January and which will go into effect April 1. When that happens, Gallagher said, some integration processes will remain, but the firm will come together with no changes to financial structure.

"The deal will be great for Pepper, and great for Philadelphia," Gallagher said.

Troutman Sanders also reported growth for 2019. The Atlanta-based firm saw gross revenue increase by 5.4% to $549.6 million, while profits per equity partner jumped 8.4% to $1.164 million. Troutman also trimmed a net of four equity partners to reduce its total to 178.

Read More

Troutman Sanders, Pepper Hamilton Vote to Seal Merger Deal

Troutman Posts Revenue and Profit Growth as Merger With Pepper Hamilton Nears

What's Behind a Wave of Healthier, Faster Law Firm Combinations?

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Visa Revocation and Removal: Can the New Administration Remove Foreign Nationals for Past Advocacy?

6 minute read

Feasting, Pledging, and Wagering, Philly Attorneys Prepare for Super Bowl

3 minute readLaw Firms Mentioned

Trending Stories

- 1States Accuse Trump of Thwarting Court's Funding Restoration Order

- 2Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 3Coral Gables Attorney Busted for Stalking Lawyer

- 4Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

- 5Securities Report Says That 2024 Settlements Passed a Total of $5.2B

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.