Ballard Spahr Held Revenue Flat Last Year as Partnership Contracted

Gross revenue grew just slightly and partner profits were flat, as the firm dealt with some overcapacity.

March 19, 2020 at 01:51 PM

5 minute read

Ballard Spahr offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

Ballard Spahr offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

Ballard Spahr chairman Mark Stewart said that even as 2019 was still getting underway, he expected the year to be flat after a significant jump in gross revenue in 2018. He was about right.

The Philadelphia-based Am Law 100 firm reported only modest revenue gains for 2019 amid challenges both expected and unexpected, and as it made adjustments to partner ranks that were complicated by its single-tier model.

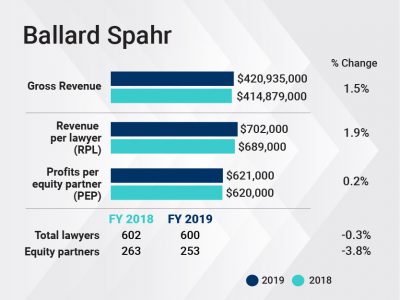

Ballard Spahr saw gross revenue increase by 1.5% in 2019, to $420.9 million. Revenue per lawyer was up slightly as well, increasing 1.9% to $702,000.

While the firm saw net income decline, it also decreased head count in its single-tier partnership by close to 4%. In the end, profits per equity partner were roughly flat, at $621,000, as net income decreased by 3.7%, to $156.9 million.

Some of that change in the profit margin was due to planned investments in technology, Stewart said, as part of a greater effort to improve responsiveness to client needs. But a second and bigger reason, he said, was the firm's decision to raise rates less than its peers did. He estimated Ballard Spahr's rate increases were 12% to 20% smaller than those of its competitors.

Those two reasons were planned for, he said. But a couple other factors also played a role. For one, collections were slower in the last part of the year. Meanwhile, the firm noticed—and worked to address—an overcapacity problem, Stewart said.

Those two reasons were planned for, he said. But a couple other factors also played a role. For one, collections were slower in the last part of the year. Meanwhile, the firm noticed—and worked to address—an overcapacity problem, Stewart said.

"We did have more partners, in particular, than we had work," he said. It wasn't in any specific practice or geographic region, but "there were pockets in each department" that were less productive.

He said the issue was not a result of the firm's late 2017 and early 2018 mergers with media law boutique Levine Sullivan Koch & Schulz and Midwest firm Lindquist & Vennum, respectively.

After the growth that resulted from those two combinations in 2018, the firm's total head count barely changed in 2019, decreasing by two lawyers to 600. But the equity tier shed a net 10 partners, making for a total of 253 for 2019.

Most lateral hiring that took place, Stewart said, was "to address a specific need," including additions to the firm's tax group. Though he noted the acquisition of Los Angeles media law boutique Leopold, Petrich & Smith was a move that added to an already strong practice.

The firm also looked for ways to confront partners who were not performing at the right level. Stewart acknowledged that having a single partnership tier makes that a little trickier.

"If we decide here that for one reason or another, someone is not performing as a partner, we only have the option of a nonpartner title. That obviously makes it more difficult," he said.

It also can complicate recruiting, he noted, because lawyers who are nonequity partners at one firm, and don't yet meet the requirements of equity partnership at Ballard, might not want to make a lateral move to a counsel position.

"We have a good track record of bringing in people who were nonequity partners [at their former firms] as counsel, and promoting them to partner later," Stewart said. Still, "That is an admittedly difficult sell."

Despite those two challenges, Stewart said the firm is committed to its partnership model. He said the greatest proponents of the structure as it exists now are women partners who came to Ballard Spahr from other firms with two tiers, where they were in the nonequity group.

Currently, 28% of Ballard Spahr's equity partners are women, and of the nine new partners in 2019, six were women. The firm's board is 40% women. Stewart said he has no exact numbers in mind, but he wants to continue increasing gender equality in the firm's top ranks.

In terms of other goals, at least for 2020, he admitted that the spread of the new coronavirus and resulting economic turmoil has changed his point of view. A month ago he would have been "extremely bullish" on the year, he said. But now "budgets are out the window."

Despite his optimism not so long ago, Stewart said, he had asked department chairs at the end of 2019 to plan what they would do in a recession. Having those plans in hand now will likely pay off, he said.

"If we get through this year and all of our people are safe and they're happy here and they feel that the firm has treated them fairly and taken care of them. … I can't think of anything else" to aim for, he said.

Read More

Ballard Spahr Sees Big Revenue Gain, Slight Profit Dip After Midwest Merger

Ballard Spahr Bolsters LA Office With Media Law Boutique

Ballard Spahr Takes Tax, Benefits Partner From Schnader in Phila.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Best Practices for Conducting Workplace Investigations: A Legal and HR Perspective

9 minute readLaw Firms Mentioned

Trending Stories

- 1We the People?

- 2New York-Based Skadden Team Joins White & Case Group in Mexico City for Citigroup Demerger

- 3No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 4Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 5Meet the New President of NY's Association of Trial Court Jurists

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250