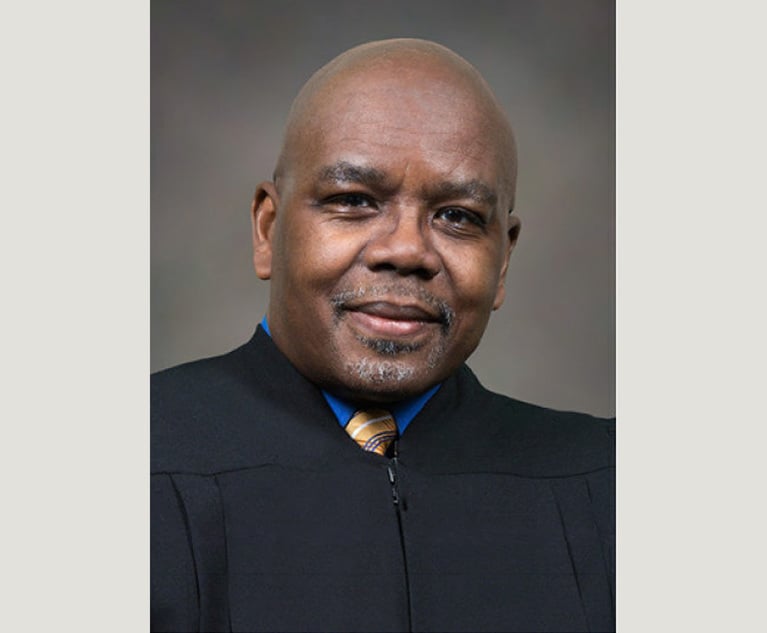

Michael Herz of Fox Rothschild.

Michael Herz of Fox Rothschild.Alternative to Bankruptcy for Cannabis Companies After COVID-19

The lack of access to bankruptcy is just one among several unique complications that cannabis enterprises face due to the federally illicit status of the product.

May 22, 2020 at 01:02 PM

9 minute read

In the wake of the COVID-19 pandemic, many prognosticators are forecasting a potentially substantial increase in bankruptcy filings across a myriad of industries. Under current law and policy, however, bankruptcy is likely not an option for companies within the steadily expanding cannabis industry. This is because cannabis products with a THC concentration exceeding 0.3% on a dry weight basis remain a Schedule I substance in the federal Controlled Substances Act (products with a THC concentration of 0.3% or below are classified as "hemp" and were removed from the Controlled Substances Act by the 2018 Farm Bill). Bankruptcy is also a creature of federal law, and thus allowing cannabis businesses to seek bankruptcy relief would put federal courts and bankruptcy trustees in the precarious position of having to administer assets that although legal within the particular state, remain illicit under federal law. This has created a unique obstacle for cannabis businesses that otherwise operate legally under state law and are experiencing financial distress.

The lack of access to bankruptcy is just one among several unique complications that cannabis enterprises face due to the federally illicit status of the product. Included among the obstacles are limited options for banking services and insurance. Cannabis businesses are further disadvantaged because they are not presently eligible for the Small Business Administration (SBA) loan programs that the federal government has established in response to the COVID-19 pandemic. A bill, titled the Emergency Cannabis Small Business Health and Safety Act, that would make cannabis businesses eligible for certain for certain SBA programs (including the Paycheck Protection Program, the Economic Industry Disaster Loans program, and the Economic Injury Disaster Loans Emergency Grants program), was recently proposed in the House of Representatives. The House of Representatives also previously passed the Secured Fair Enforcement Banking Act in September 2019, which would open banking and insurance options to cannabis companies.

Notwithstanding the attempts at helpful legislation, the lack of assistance options currently available to cannabis businesses may make them especially predisposed to financial hardship during these unsettled times. Although perhaps not as ideal as the robust federal bankruptcy scheme and protections provided therein, cannabis companies may still have viable options for addressing financial distress. Most notably, such options may include:

- Assignments for Benefit of Creditors (ABCs): ABCs are effectively an insolvency proceeding under state law that facilitates an orderly liquidation of a company's assets. Presently, 38 states and the District of Columbia have ABC statutes, and several other states have established ABC mechanisms under common law. In an ABC, the financially distressed entity will assign its assets to a trust administered by an "assignee" selected by the company. The assignee, similar to a trustee in bankruptcy, will liquidate the assets and provide a distribution to the company's creditors from the proceeds. Given that the company has divested all of its assets, unsecured creditor claims against the remaining corpus of the company will have no value, though creditors retain their rights to collect against third parties such as guarantors and co-obligors. Secured creditors will continue to have their rights in their collateral.

ABCs, however, are strictly a liquidation process, and thus cannot a help a business seeking to restructure and continue operations, though an ABC may provide a needed instrument for investors of a business to orderly dispose of the failing business and try again with a new venture. However, to the extent that investors may be obligated for the company's debts, the filing of the ABC may trigger creditors to pursue those obligations, and the investors, because of their ties to cannabis industry, may be unable to discharge those obligations in bankruptcy, if needed. Further, ABCs may also lack certain helpful elements of bankruptcy, such as the automatic stay prohibiting creditors from taking adverse action against a debtor upon a bankruptcy filing.

Additionally, given the nuanced and highly regulated nature of the cannabis industry, a cannabis business considering an ABC should select an assign with familiarity with the industry. Depending on the jurisdiction, it may be unclear statutorily if an assignee will have authority to dispose of the businesses' assets, most notably the marijuana inventory given the licensing requirements. If that is the case, the assignee may have to seek authorization from the presiding court to administer the company's assets under the premise that such authority is necessary in order for the assignee to fulfill his fiduciary obligations and provide a distribution to creditors. To the extent states have legalized cannabis and have sanctioned the development of the industry within their borders, there is a strong argument that there should be some mechanism to allow businesses in the industry to address financial hardship. Any authorization may still be limited based on the cannabis licensing requirements of the state. As noted above, there may be limitations on the scope under which the assignee can act under the company's license to sell cannabis inventory. There also may be limited options, if any, for transferring the company's license.

- Receiverships: A state court may appoint a receiver to oversee a company during troubled times. Unlike an assignee in an ABC who is focused on liquidating the company's assets, a receiver may continue to operate the company, perhaps to improve the company's condition, or to find a buyer of the company as a going concern, or to orderly wind-down operations. Receiverships, however, are often initiated by concerned creditors or shareholders, or born out of a dispute among partners of a business. Consequently, while a receivership may help bring stability or clarity to a company's situation, the incumbent management of the company may have limited control over the process.

Similar to an assignee in an ABC, there may also be a question regarding whether a receiver can operate and dispose of assets of a cannabis company. Three states (California, Oregon and Washington) have promulgated regulations under their applicable cannabis statutes to permit receivers to operate cannabis businesses and/or dispose of assets, and other states are considering similar schemes. Absent clear statutory or regulatory authority, receivers, like assignees, may seek court authorization as a necessary means to executing their duties.

- Workouts: A workout is an informal process through which a company (or individual) can negotiate with its creditors restructure debt repayment terms, including potentially the repayment amount. A company may also attempt a workout with several creditors in the form of a "composition agreement." Similar to bankruptcy or an ABC, a composition agreement provides creditors with pro-rata payments from a defined pot of funds as a way for the company to more holistically restructure its debts.

In light of the likely collection issues that creditors are facing stemming from the COVID-19 pandemic, and the unclear prospects for the future, creditors may be more amenable to discussing repayment terms. A successful workout can provide a company with a needed breathing spell to continue operations and weather a difficult storm.

Although the foregoing options are likely the path of least resistance for relief for distressed cannabis companies at present, there are some signs, particularly in the U.S, Court of Appeals fir the Ninth Circuit, that bankruptcy may be an option for entities with tangential ties to the cannabis industry. While courts in several jurisdictions have denied bankruptcy relief to entities and individuals that derive income indirectly from the cannabis industry, such as landlords and gardening equipment manufacturers, the Ninth Circuit Court allowed a landlord to confirm a Chapter 11 reorganization plan even enough it received rental income from a tenant that was a cannabis grower. See Garvin v. Cook Investments NW SPNWY, 922 F.3d 1031 (9th Cir. 2019). Since then, other courts within the Ninth Circuit have at least acknowledged the possibility that cannabis-related business may be eligible for bankruptcy relief, even if the court did not allow the bankruptcy to proceed in that particular instance. See In re Burton, 510 B.R. 533 (9th Cir. B.A.P. 2020) ("There mere presence of marijuana near a bankruptcy does not automatically prohibit a debtor from bankruptcy relief."); In re CWNevada, 602 B.R. 717, 746 (Bankr. D.Nev. 2019) ("There may be cases where Chapter 11 relief is appropriate for an individual or a non-individual entity directly engaged in a marijuana-related business."). As cannabis legalization continues to proliferate across the country, and with Congress exhibiting increasing initiative to potentially allow cannabis businesses to pursue the same opportunities available for other industries (e.g., banking, insurance, SBA loans), not to mention the possible uptick in bankruptcy filings that may result from the COVID-19 pandemic, courts may afford greater flexibility to debtors with indirect associations with the cannabis industry.

Lastly, to the extent a business deals in "hemp" products, including CBD products, which as noted are no longer Schedule I substances, such business should be eligible for bankruptcy protection. Two such cases were recently filed: Elemental Processing in the U.S. District Court for the Eastern District of Kentucky (case no. 20-50640-tnw) and United Cannabis Corp. in the U.S. District Court for the District of Colorado (case no. 20-12692-JGR). In the latter case, however, the bankruptcy court entered an order to show cause why the case should not be dismissed due to the marijuana ties. Given the rapidly evolving nature of the cannabis industry and general economic situation, it will be interesting to track whether there is an associated evolution in case law to make bankruptcy more accessible to the industry.

Michael R. Herz is counsel at Fox Rothschild who centers his practice on complex bankruptcy and insolvency matters. He can be reached at [email protected].

|This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Plaintiffs Seek Redo of First Trial Over Medical Device Plant's Emissions

4 minute read

'Serious Misconduct' From Monsanto Lawyer Prompts Mistrial in Chicago Roundup Case

3 minute read

Trending Stories

- 1Decision of the Day: Judge Reduces $287M Jury Verdict Against Harley-Davidson in Wrongful Death Suit

- 2Kirkland to Covington: 2024's International Chart Toppers and Award Winners

- 3Decision of the Day: Judge Denies Summary Judgment Motions in Suit by Runner Injured in Brooklyn Bridge Park

- 4KISS, Profit Motive and Foreign Currency Contracts

- 512 Days of … Web Analytics

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250