On Aug. 8, President Donald Trump signed several presidential memoranda, including a memorandum, which allows employees earning less than $104,000 to defer certain payroll tax obligations beginning on Sept. 1 through Dec. 31. The purpose of this deferral was to “put money directly in the pockets of American workers and generate additional incentives for work and employment, right when the money is needed most.” However, the only thing Trump has managed to do is create another headache for employers and a mirage for employees.

The COVID-19 pandemic was declared a federal disaster by Trump on March 13. Under Section 7508A of the Internal Revenue Code, the Secretary of the Treasury has the authority to defer the payment of tax if a taxpayer is affected by a presidentially declared disaster. This is the same authority the Secretary invoked to push back the 2019 income tax filing and payment deadline from April 15 to July 15 earlier this year. Notably, this authority does not permit the Secretary to forgive the payroll tax obligations deferred by Trump’s memorandum. Only a Congressional act can accomplish this.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]

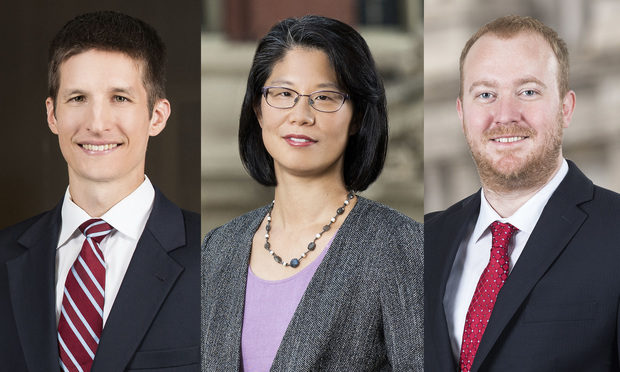

(l-r) Ivo Becica, Pauline Markey, and Charlie Shute, of Obermayer Rebmann Maxwell & Hippel.

(l-r) Ivo Becica, Pauline Markey, and Charlie Shute, of Obermayer Rebmann Maxwell & Hippel.