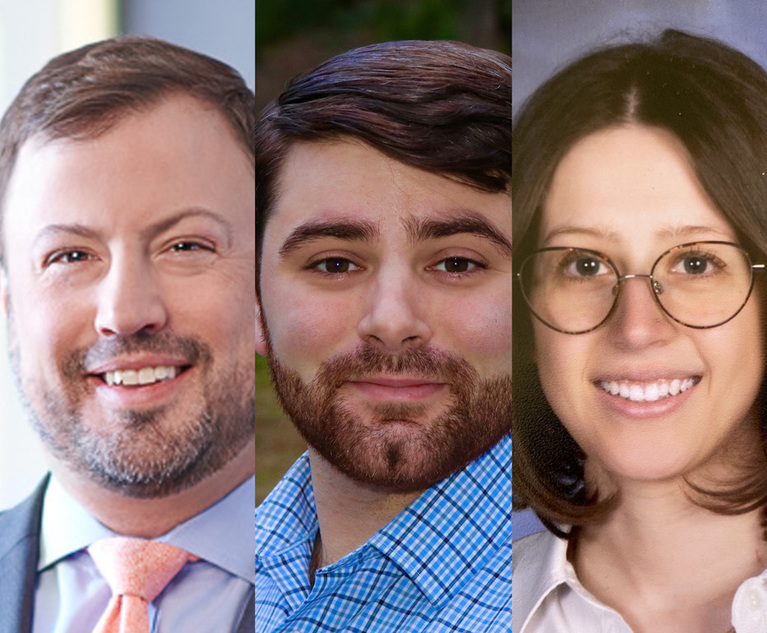

L-R: Nikolas S. Komyati, Patrick J. Medeo and Siena Carnevale of Bressler Amory & Ross

L-R: Nikolas S. Komyati, Patrick J. Medeo and Siena Carnevale of Bressler Amory & Ross The 'State' of Cannabis Banking—The Dormant Commerce Clause

As states continue promulgating more legislation to regulate the rapidly growing industry, which will doubtlessly include more banking regulation, financial institutions should be wary of a lurking dormant commerce clause challenge.

December 30, 2022 at 12:16 PM

7 minute read

With the cannabis industry growing rapidly and an increasing number of states legalizing the federally outlawed drug, out-of-state market participants are trying to strike down certain aspects of state laws and regulations as violative of the dormant commerce clause. To that end, financial institutions looking to rely on new state regulations, which explicitly allow them to provide banking services to legal cannabis businesses, should be wary of whether such laws will themselves be found unconstitutional.

Since September 2022, the New York Office of Cannabis Management has been embroiled in litigation, stalling awards of new recreational retail marijuana licenses in five state regions, based upon allegations that the state licensing scheme violates the dormant commerce clause by favoring state residents over out-of-state operators. Similar suits making nearly identical claims have been filed against the cities of Los Angeles and Sacramento, California by companies affiliated with the same individual. Jonathan Capriel, "Michigander Says Court Should Block NY Pot Retail Licenses," Law360 (Dec. 14, 2022 7:17 p.m.). The above cases come close on the heels of the recent decision by the U.S. Court of Appeals for the First Circuit finding that the Maine Medical Marijuana Act residency requirement violated the dormant commerce clause as facially protectionist in nature. See Northeast Patients Group v. United Cannabis Patients & Caregivers of Maine, 45 F.4th 542 (1st Cir. 2022). These are among a growing number of cases nationwide challenging state level cannabis regulations under the dormant commerce clause.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Lawyers' Phones Are Ringing: What Should Employers Do If ICE Raids Their Business?

6 minute read

3rd Circuit Strikes Down NLRB’s Monetary Remedies for Fired Starbucks Workers

Law Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250