When it came through 2012′s financial performance, Pennsylvania’s largest law firms saw everything from small to double-digit rises in most of the key metrics.

Those nearly across-the-board increases might paint a stronger picture of 2012 than was actually the case, as the firms slogged through three tough quarters and reaped the benefits at the end of the year.

The demand for legal services in 2012 was still relatively flat, but that changed in the fourth quarter when clients looked to take advantage of a favorable tax scenario before the year’s end. Law firms saw a sharp uptick in transactional work in the fourth quarter, helping to propel their gross revenue, profits per equity partner (PPP) and revenue per lawyer (RPL) to perhaps higher-than-expected heights.

The end result sapped the inventory many firms would have started out with in the first quarter of 2013. But surveys have shown Pennsylvania’s firms are making up for that with increased hours compared to their national counterparts and by raising rates.

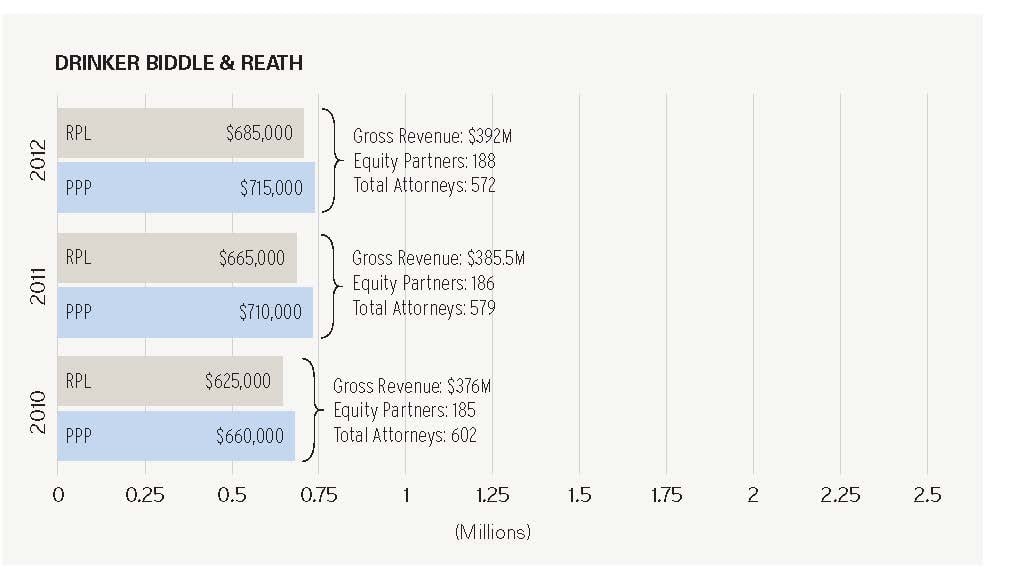

DRINKER BIDDLE & REATH

Philadelphia-based Drinker Biddle & Reath grew its revenue by about 1.7 percent and PPP by about 0.7 percent in 2012 in what executive partner Andrew C. Kassner called a “solid year” for the firm.

The firm’s revenue rose from $385.5 million in 2011 to $392 million in 2012.

The firm grew its equity partner tier by about 1.1 percent, from 186 partners in 2011 to 188 partners in 2012, and its net income by about 1.5 percent, from $132 million in 2011 to $134 million in 2012.

The combination of these increases led to a rise of about 0.7 percent in the firm’s PPP, from $710,000 in 2011 to $715,000 in 2012.

Meanwhile, what Drinker Biddle refers to as its “limited-equity” partnership tier dropped by about 24 percent, from 76 lawyers in 2011 to 58 lawyers in 2012, causing the firm’s limited-equity compensation to decrease by about 14 percent, from $28 million in 2011 to $24 million in 2012.

The firm’s average compensation for all partners went up by about 6 percent, from $610,000 in 2011 to $645,000 in 2012.

The firm’s total headcount dipped by 1.2 percent, from 579 attorneys in 2011 to 572 attorneys in 2012. Its RPL, meanwhile, rose by about 3 percent, from $665,000 in 2011 to $685,000 in 2012.

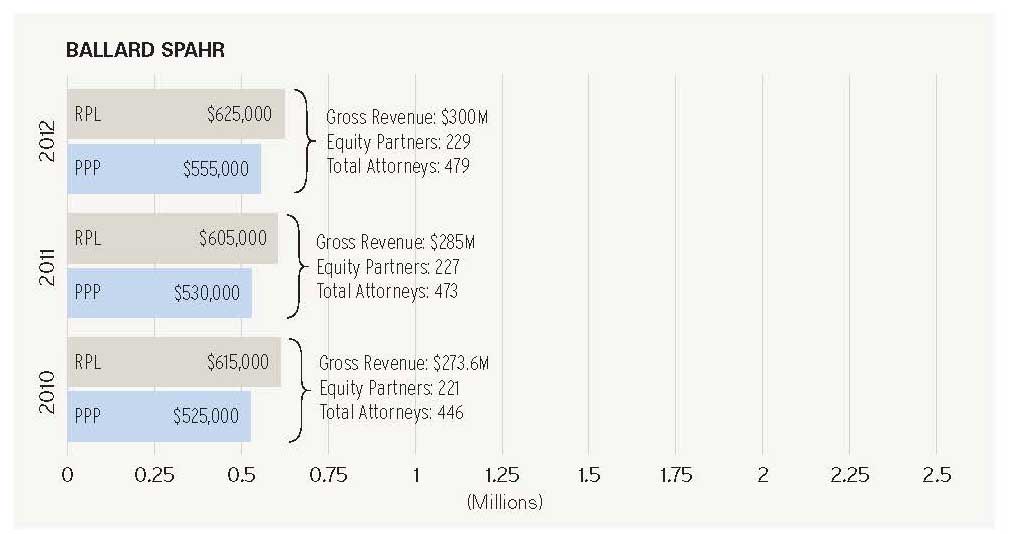

BALLARD SPAHR

Ballard Spahr grew gross revenue 5.3 percent and PPP by 4.7 percent in 2012 thanks to an increase in demand across all of its departments, firm Chairman Mark Stewart said.

The year was one focused on profitability and controlling costs, Stewart said. The end result was a 5.3 percent jump in gross revenue from $285 million in 2011 to $300 million in 2012. While productivity was relatively flat per lawyer, RPL grew 3.3 percent. Stewart said rates were increased selectively over 2012, with a net effect of about a 2 percent rise in rates.

The net result was a 1.3 percent increase in headcount from 473 attorneys to 479 in 2012. The firm’s sole partner tier grew less than 1 percent from 227 partners to 229 partners.

Partners brought home more on average in 2012. The firm’s PPP rose 4.7 percent from $530,000 in 2011 to $555,000 in 2012. Ballard Spahr was also able to increase its net income by 6.3 percent from $120 million to $127.5 million.

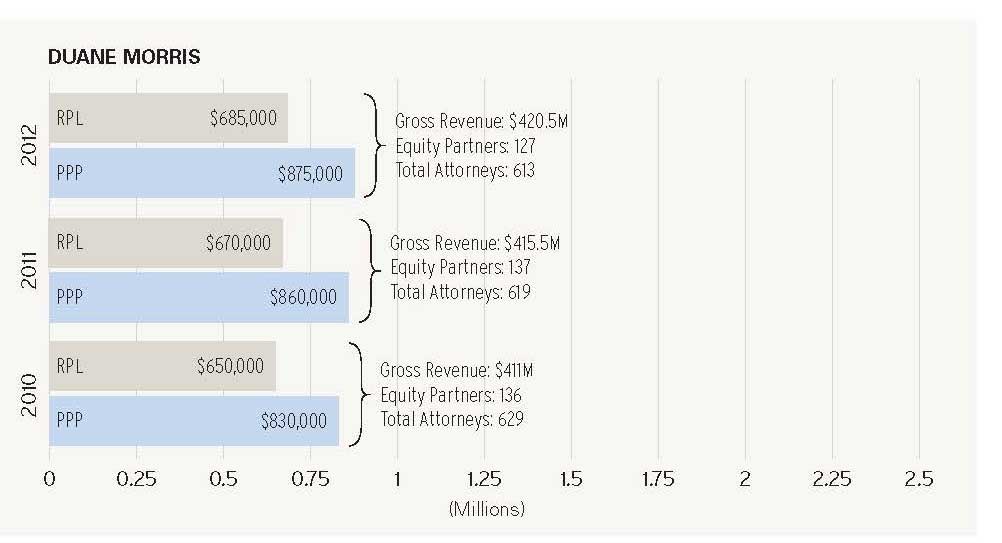

DUANE MORRIS

Philadelphia-based Duane Morris saw modest increases in its revenue and PPP in 2012, a fiscal year that Chairman John J. Soroko characterized as “almost an instant replay” of the prior fiscal year in terms of financial growth. The firm saw its 2012 gross revenue rise by about 1.2 percent, from $415.5 million in 2011 to $420.5 million in 2012. But while the firm grew its revenue last year, it saw a dip of about 5.5 percent in its net income, from $117.5 million in 2011 to $111 million in 2012.

Soroko explained that after being conservative with its expenses throughout 2012, the firm elected to get a headstart on its 2013 expenses toward the end of the year. Despite the drop in net income, the firm still saw an increase of about 1.7 percent in its PPP—from $860,000 in 2011 to $875,000 in 2012—thanks to a 7 percent reduction in its equity partner tier, from 137 partners to 127 partners.

Its overall headcount dipped by 1 percent, from 619 total attorneys in 2011 to 613 in 2012.

That, coupled with the firm’s revenue growth, led to about a 2.2 percent increase in RPL, from $670,000 in 2011 to $685,000 in 2012.

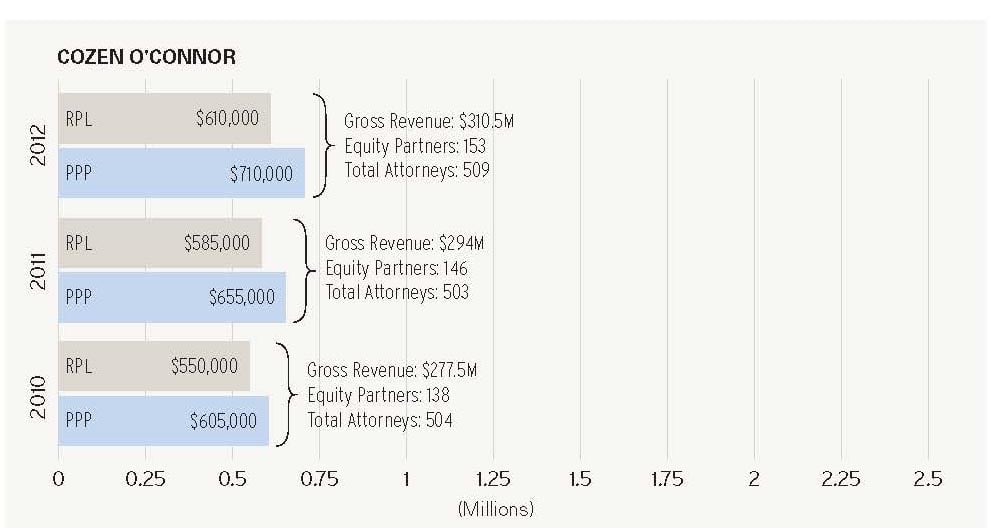

COZEN O’CONNOR

Cozen O’Connor’s gross revenue increased 5.6 percent from $294 million in 2011 to $310.5 million in 2012. The firm’s RPL rose 4.3 percent from $585,000 to $610,000 and its PPP increased 8.4 percent from $655,000 to $710,000. Average compensation for all partners rose 5.9 percent from $510,000 to $540,000.

The 5.6 percent annual revenue increase for Cozen O’Connor was aided in part by the firm’s 3 to 4 percent increase in rates and a 1.2 percent uptick in overall headcount that included more partners joining the firm than associates, Chief Executive Officer Michael Heller said.

While the firm’s overall headcount grew by just six attorneys to 509 lawyers in 2012, the number of partners increased 4.5 percent to 257. Of those partners, 153 were equity partners. That is a 4.8 percent increase from 2011. The firm’s nonequity partner tier rose 4 percent from 100 nonequity partners to 104. Cozen O’Connor was able to retain a larger portion of its revenue in 2012 in the form of net profits, bumping up its profit margin two percentage points to 35 percent. The firm’s net income rose 13 percent from $96 million in 2011 to $108.5 million in 2012.

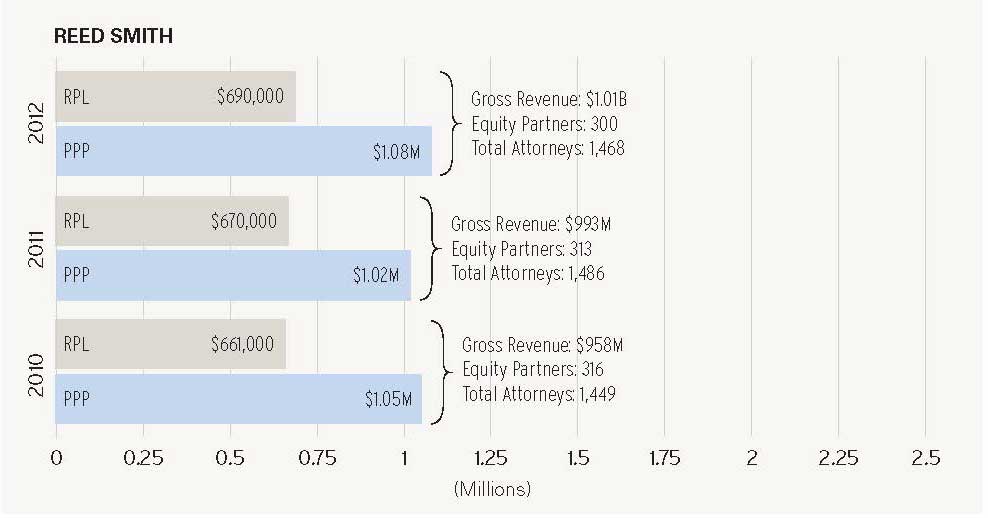

REED SMITH

Reed Smith saw increases in its key financial metrics between 2011 and 2012 that the firm attributed in large part to its cross-selling to its core industry groups.

The firm saw a 2 percent rise in gross revenue from $993 million in 2011 to $1.01 billion in 2012. That marks the first time Reed Smith has crossed over the billion-dollar mark when it comes to gross revenue.

The firm’s PPP increased 5.9 percent from $1.02 million to $1.08 million and its RPL rose 3 percent from $670,000 in 2011 to $690,000 in 2012. Average compensation for all partners rose 3 percent from $660,000 to $680,000.

Reed Smith increased its PPP by nearly 6 percent, in large part because of a decrease in equity partners coupled with a smaller increase in net income. The firm’s equity tier fell 4.2 percent from 313 to 300 equity partners. Net income increased $4 million to $324 million, a rise of 1.3 percent.

Reed Smith global managing partner Gregory B. Jordan said the firm continued to focus heavily on managing expenses, something he said was increasingly important given demand for legal services remained sluggish. Having the firm’s back-office operations in a cheaper building in Pittsburgh helped manage those expenses over the years, Jordan said.

Overall headcount in 2012 fell 1.2 percent from 1,486 attorneys in 2011 to 1,468 last year. While the equity partner tier dipped, the nonequity tier remained essentially flat, increasing by one lawyer to 393 attorneys.

Jordan said he expected headcount to rise about 6 to 7 percent in 2013 thanks to growth in Houston and Singapore, as well as the fact that the firm had two associate classes starting this year. The fall class from 2012 began this January and the 2013 fall class’ start date was moved up to this year rather than early 2014.

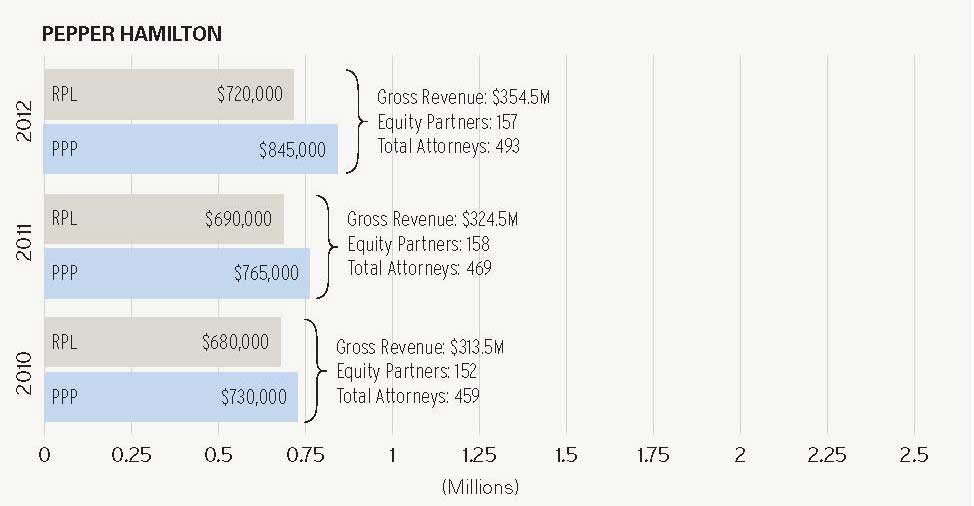

PEPPER HAMILTON

Pepper Hamilton’s revenue grew by 9.2 percent in 2012 on the strength of what its chief executive officer said was increased demand across nearly all of the firm’s practice groups.

The firm saw its revenue increase from about $324.5 million in 2011 to about $354.5 million in 2012.

Pepper Hamilton CEO Scott Green said client demand was “broad based” last year, even in those practices that had experienced slow periods in recent years.

The firm said corporate work accounted for about 30 percent of its total revenue in 2012, second only to litigation, which accounted for about 59 percent. Along with revenue, Pepper Hamilton’s PPP also saw a significant increase in 2012, growing by about 10.5 percent from the previous year.

The firm’s 2012 PPP was about $845,000, up from about $765,000 in 2011. Its equity partner tier remained essentially flat, decreasing by just one partner, from 158 in 2011 to 157 in 2012.

The firm’s nonequity partner tier increased by only two attorneys, from 60 to 62.

The firm’s overall number of lawyers grew by 5 percent, from 469 attorneys in 2011 to 493 in 2012. Its RPL increased by 4 percent, from about $690,000 in 2011 to about $720,000 in 2012. Among the most widely publicized moves of the busy 2012 lateral season for the firm was Pepper Hamilton’s acquisition of former FBI Director Louis Freeh’s 11-attorney law firm, Freeh Sporkin & Sullivan, and his consulting firm, Freeh Group International Solutions LLC, in August.

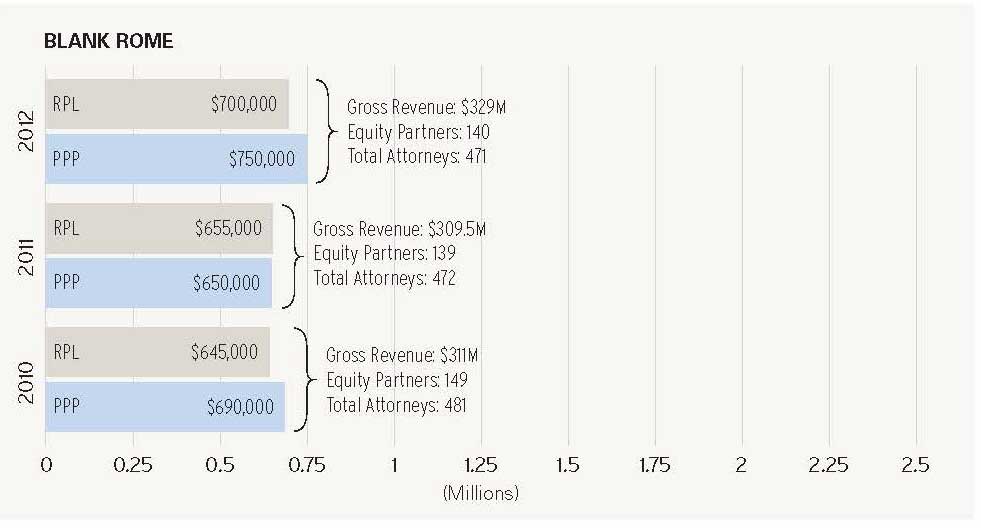

BLANK ROME

After seeing a dip in many key financial metrics between 2010 and 2011 driven by a number of investments, Blank Rome reaped the rewards in 2012 with significant jumps in billable hours, revenue and profits.

Blank Rome’s gross revenue grew 6.3 percent from $309.5 million in 2011 to $329 million in 2012. The firm’s RPL jumped nearly 7 percent from $655,000 to $700,000. On the profit side, PPP soared 15 percent from $650,000 to $750,000 and the average compensation for all partners rose 19 percent from $490,000 to $585,000.

Blank Rome Chairman Alan J. Hoffman noted the firm was able to increase revenue while keeping total attorney headcount essentially flat at 471 lawyers. He said the firm’s overall billable hours increased 4.7 percent and the average hours per attorney rose from 1,767 in 2011 to 1,804 in 2012.

Blank Rome’s equity partner tier increased by one lawyer to 140 equity partners and the nonequity partner tier decreased 11 percent from 121 nonequity partners to 108. While the firm actually carried some accounts payable over from 2011 into 2012, it was able to prepay $2 million worth of 2013′s expenses out of 2012 profits, Hoffman said.

Between 2010 and 2011, Blank Rome’s net income fell 12.1 percent. But between 2011 and 2012, that figure rose 16 percent from $90.5 million to $105 million. The firm’s profit margin rose from 29 percent in 2011 to 32 percent in 2012.

Regardless of where the firm’s revenue has been over the past few years, Blank Rome’s expenses have hovered between $186 million and $188 million since 2007. For 2013, the firm is budgeting for a second straight year of $188 million in expenses.

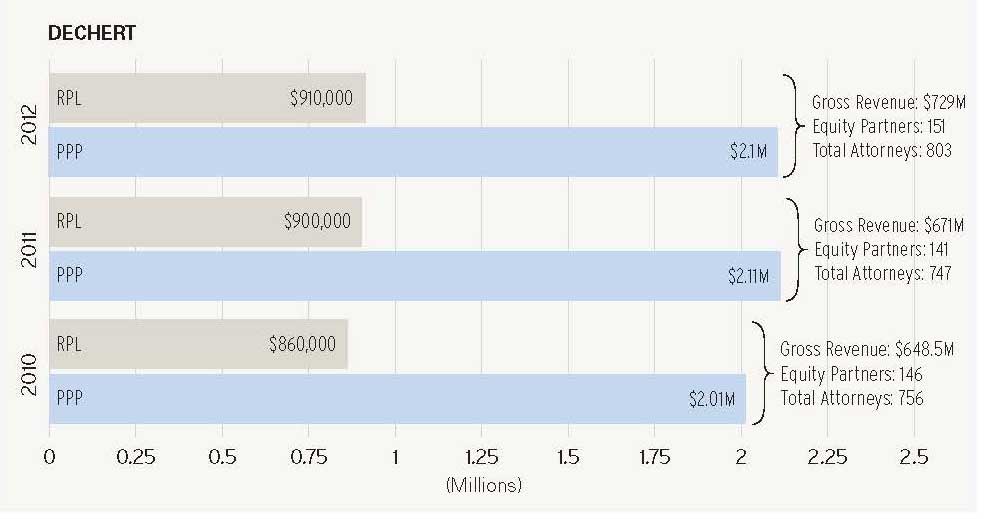

DECHERT

Dechert was able to increase its net profit in 2012 while growing partner ranks and footing the bill for significant international expansion thanks to an 8.6 percent increase in gross revenue last year, the firm said.

After four years of decline in gross revenue from 2007 through 2010, the metric has grown for the past two years. Dechert’s gross revenue of $671 million in 2011 rose to $729 million in 2012. The firm maintained the same 44 percent profit margin year over year while seeing its net profit rise 6.5 percent from $298 million to $317.5 million. Its PPP dipped less than 1 percent from $2.11 million to $2.1 million, but the firm increased the equity partner tier by 7 percent from 141 to 151 equity partners.

After expanding into five new markets—Almaty, Kazakhstan; Dubai; Chicago; Tbilisi, Georgia; and Frankfurt—and adding 29 lateral partners in 2012, the firm saw a 7.5 percent increase in attorney headcount.

The total number of lawyers rose from 747 lawyers in 2011 to 803 in 2012. The nonequity partner tier grew 7.6 percent from 105 to 113. Dechert’s RPL grew about 1 percent from $900,000 to $910,000.

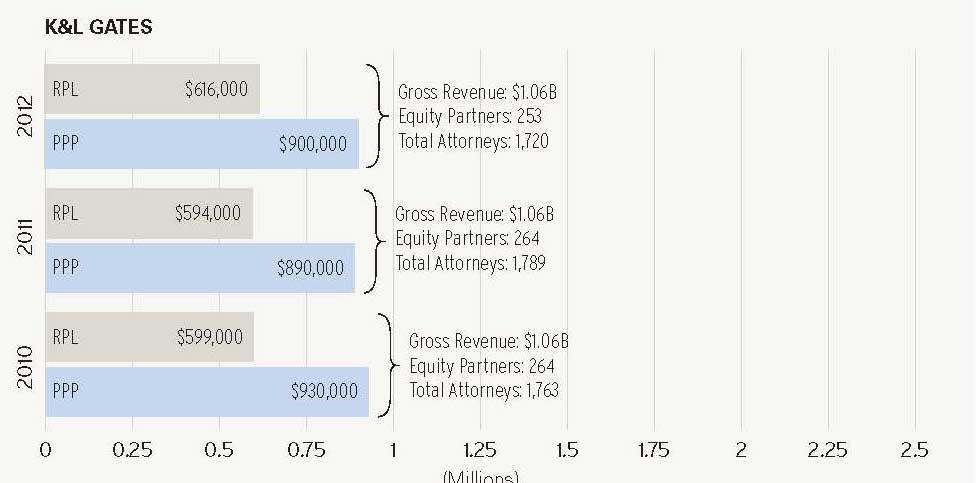

K&L GATES

K&L Gates was able to hold gross revenue flat between 2011 and 2012, thanks in large part to revenue gains in Europe and Asia while revenue fell in the United States.

The firm’s gross revenue in 2011 was $1.061 billion and came in at $1.06 billion in 2012. The largest bulk of that revenue— $924.9 million—came from U.S. operations in 2012. That was down 2.5 percent from the year before, which K&L Gates attributed to a 7 percent decrease in headcount in the Americas between 2011 and 2012.

K&L Gates’ RPL in 2011 was about $594,000. That figure rose 3.9 percent in 2012 to about $616,000.

K&L Gates offered data for its average profits per all equity partners, as well as more specific data for profits per “fully participating equity partner.”

The firm’s average profits for all equity partners rose 1.6 percent from about $627,000 in 2011 to $637,000 in 2012. In last year’s report for Legal affiliate The American Lawyer, K&L Gates’ per-partner profits were reflected as the profits for fully participating equity partners, which was about $890,000 in 2011. That figure rose about 1 percent in 2012 to about $900,000.

While average partner profits increased year over year, in part because of a reduction in equity partners, the firm’s overall net income did not increase.

The firm had an average of 1,789 lawyers in 2011. That figure dropped by 3.9 percent to 1,720 attorneys in 2012.

SAUL EWING

Following a 2011 fiscal year in which its revenue stayed nearly flat, Saul Ewing saw its 2012 revenue shoot up 7.8 percent despite only a modest increase in headcount.

Managing partner David S. Antzis attributed this financial growth spurt to a “strategic vision” focused on improving client service and increasing market share, which enabled the firm to snag some significant work from the jaws of its larger competition.

The firm’s revenue increased from $122.5 million in 2011 to $132 million in 2012.

Meanwhile, its overall headcount increased by only 3.2 percent, from 219 lawyers to 226, but its RPL increased by 4.5 percent, from $560,000 to $585,000.

In addition, the firm’s PPP went up 12 percent, from $500,000 to $560,000, while its equity partner tier decreased by only two lawyers, from 83 to 81. In terms of continued geographic expansion, Antzis said the firm is currently keeping an eye out for opportunities to open new locations in Ohio, Manhattan and Northern Virginia.

Antzis said he feels the firm is now strong enough to support significant growth in headcount as well, noting that the firm is currently looking for opportunities to acquire smaller shops. Antzis said he believes Saul Ewing could expand to 350 or 400 lawyers without needing to make significant infrastructure upgrades.

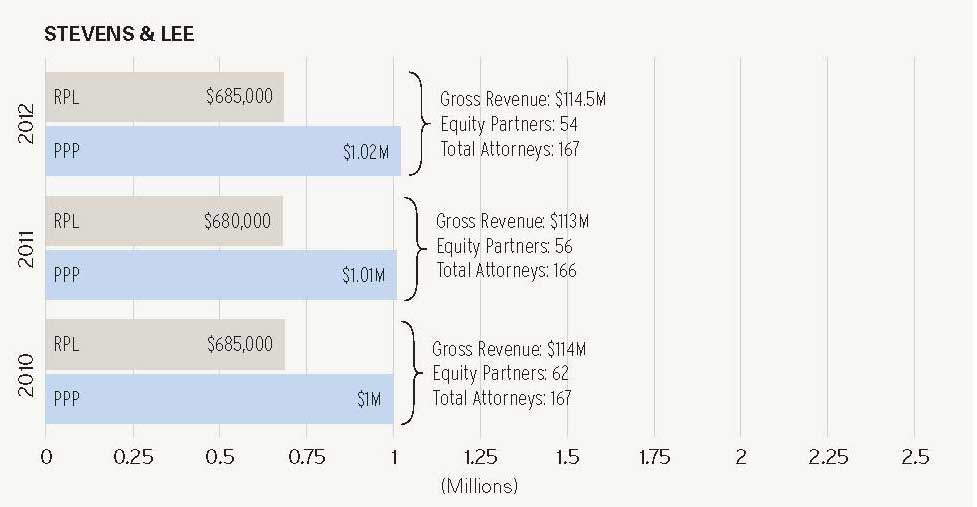

STEVENS & LEE

Small increases in gross revenue and PPP brought Stevens & Lee to all-time highs in those categories for 2012. The Reading, Pa.-based firm grew its gross revenue 1.3 percent from $113 million in 2011 to $114.5 million in 2012. Its RPL stayed about flat, moving from $680,000 to $685,000, and PPP rose 1 percent from $1.01 million to $1.02 million.

Stevens & Lee was able to boost PPP despite seeing a 2.6 percent drop in net income to $55.5 million because of the rise in gross revenue coupled with the decrease in equity partners from 56 in 2011 to 54 in 2012.

Stevens & Lee’s overall headcount increased by one lawyer to 167 attorneys across its 13 offices. The nonequity partner tier grew by one lawyer to 54 nonequity partners. The firm’s average compensation for all partners stayed the same year over year at $690,000.

The firm’s profit margin took a slight hit in 2012, dropping from 50 percent to 48 percent.

FOX ROTHSCHILD

Fox Rothschild grew its revenue by nearly 8 percent in its 2012-13 fiscal year as a result of a combination of strong practices and productive lateral hires, managing partner Mark L. Silow said.

The firm, whose fiscal year ended in March, saw its revenue grow from about $257 million in 2011 to $277 million in 2012, a 7.8 percent increase.

The firm’s overall headcount grew by 4 percent, from 471 lawyers in 2011 to 490 lawyers in 2012.

Its equity partner tier expanded by 2 percent, from 150 partners in 2011 to 153 partners in 2012, and its nonequity partner tier grew by 3.4 percent, from 58 partners in 2011 to 60 partners in 2012.

Even with across-the-board headcount growth and the expense that comes with opening three new locations, the firm’s RPL increased by about 3.7 percent, from $545,000 in 2011 to $565,000 in 2012, and its PPP increased by about 2.6 percent, from $585,000 in 2011 to $600,000 in 2012.

The latter was the result of a 5 percent increase in the firm’s net income, from $87.5 million in 2011 to $92 million in 2012.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]