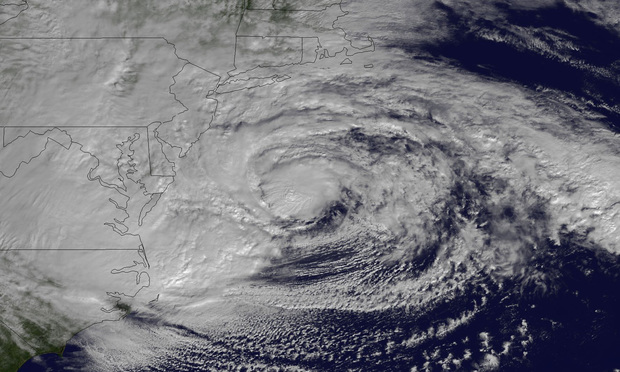

On Jan. 10, a Long Island engineering company, GEB HiRise Engineering (HiRise), and one of its former executives pleaded guilty to charges that they had falsified engineering reports that were used by flood insurance adjusters and federal officials to assess damage to homes caused by Hurricane Sandy. According to the indictment, HiRise, and executive Matthew Pappalardo, rewrote the engineering reports to minimize insurance payments to flood victims under the National Flood Insurance Program (NFIP) in the New York area after the hurricane. Dozens of flood claims may have been undervalued or denied under the program as a result of the fraud.

The case is an emphatic reminder for flood insurance policyholders—a group of about 5 million residential and commercial property owners—of the shortcomings of the NFIP, a federally backed insurance program administered by the Federal Emergency Management Agency (FEMA), which is set to expire on Sept. 30. The concerns of not just policyholders but also insurers and FEMA are currently being debated by members of Congress as they prepare to reauthorize the NFIP this fall. Major changes could be underway that would affect developers and property owners in areas at risk for flooding.

The National Flood Insurance Program

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

LexisNexis® and Bloomberg Law are third party online distributors of the broad collection of current and archived versions of ALM's legal news publications. LexisNexis® and Bloomberg Law customers are able to access and use ALM's content, including content from the National Law Journal, The American Lawyer, Legaltech News, The New York Law Journal, and Corporate Counsel, as well as other sources of legal information.

For questions call 1-877-256-2472 or contact us at [email protected]