IRS Nominee Defended Trump's Refusal to Release His Tax Returns

Meet Beverly Hills tax attorney Charles Rettig, a name partner at Hochman, Salkin, Rettig, Toscher & Perez.

February 08, 2018 at 05:22 PM

6 minute read

IRS in Washington. Credit: Mike Scarcella / ALM

IRS in Washington. Credit: Mike Scarcella / ALM In February 2016, as Donald Trump came under increasing pressure to release his tax returns, a longtime tax lawyer in Beverly Hills came to the defense of the candidate's refusal to release any documents.

“Would any experienced tax lawyer representing Trump in an IRS audit advise him to publicly release his tax returns during the audit?” Charles Rettig, a name partner at Hochman, Salkin, Rettig, Toscher & Perez, wrote in a contributed piece at the Forbes site IRS Watch.

“Absolutely not.”

Rettig was named Thursday as the Trump administration's pick to run the IRS. If confirmed, he would be the first practicing tax attorney in at least 20 years to take the reins of the IRS. Recent commissioners had managerial experience but were not tax lawyers.

“Trump's tax professionals likely have their hands full responding to numerous informal and formal detailed inquiries by the IRS 'Wealth Squad' audit team assigned to his case,” Rettig wrote in his 2016 post. “Neither the IRS team nor Trump's tax team likely want the additional scrutiny brought on by a public disclosure during the examination.”

Trump, who often cited a pending audit, was the first president in modern times to decline to release any returns, or even partial returns. As Rettig pointed out in 2016, there was no legal impediment to Trump still releasing his returns. Indeed, the IRS said at the time there was no prohibition against an individual from releasing their own tax documents.

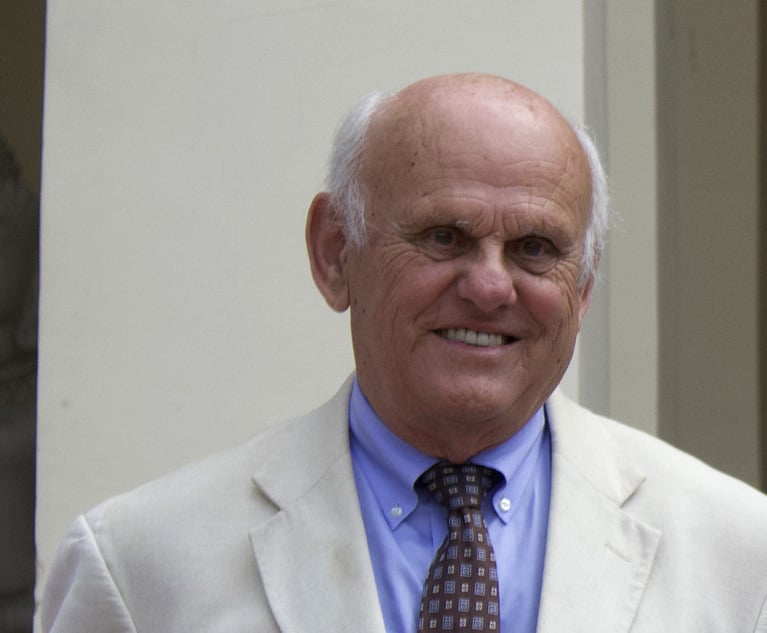

Charles Rettig. Credit: UCLA Extension

Charles Rettig. Credit: UCLA ExtensionRettig said in a statement: “If confirmed, I will do my utmost to improve taxpayer service and protect taxpayer's rights under the law, and to insure the fair, efficient and impartial but rigorous enforcement of our tax code.”

Hochman Salkin partner Steven Toscher called Rettig the “person who can protect taxpayers' rights, help improve taxpayer service, and help oversee the modernization of the ailing IRS information technology infrastructure.”

Rettig's name has floated for weeks as a possible pick. A team from the McDermott Will & Emery tax practice called Rettig “a friend and mentor to many of us in the tax controversy bar over the years.”

Rettig fills a vacancy created by the retirement of John Koskinen, who left the IRS in November 2017 after enduring months of congressional attacks from Republicans who accused his agency of political bias.

'Lives and breathes' Tax Law

Rettig has been a mainstay in the U.S. District Court for the Central District of California, representing individuals and companies in tax-related cases over the years. Rettig and his firm represent the estate of pop icon Michael Jackson in a dispute with the IRS over the value of his assets at the time of his 2009 death.

“Chuck's clients have ranged from the biggest celebrities, athletes and entertainers to Fortune 500 CEOs to very ordinary people who had tax issues and needed someone to champion their causes,” said Nathan Hochman, a Morgan, Lewis & Bockius partner in Los Angeles who was formerly head of the U.S. Department of Justice's Tax Division during the George W. Bush administration.

Hochman described Rettig as someone who “lives and breathes” tax law, negotiating “at the highest echelons” of the industry while still making tax law understandable to everyone. Rettig is well-positioned, Hochman said, to lead an agency that has been under political attack and will be responsible for implementing a new and controversial tax code.

“The position couldn't go to a better person at a key time,” Hochman said.

Federal campaign finance records show Rettig has given to the campaigns of both Republicans and Democrats, including Sen. Kamala Harris, D-California, in 2016, and Sen. Brian Schatz, D-Hawaii, in 2016. Rettig donated to Mitt Romney's failed 2012 presidential bid. In March 2017, Rettig donated $500 to the Trump Make America Great Again Committee.

Rettig long has served as chair of the UCLA Extension Tax Controversy Institute. Annual conferences feature discussions on compliance matters, tax appeals and trials.

“By attending the tax controversy institute, you'll find the benefits to yourself, your practice and your clients by bringing them into compliance before the government even knows they exist,” Rettig said in 2014 in a promotional video. “We can have an impact on the government, and the government representatives will have an impact on us, and together we move forward with improving the system of tax administration in the United States, which is a great thing.”

Last October, Rettig said the presentations “are current and ripped from the headlines—data breach and identity theft, bitcoin and crypto currencies, and the cannabis industry.”

State-legal marijuana businesses have bristled at IRS efforts to deny them tax write-offs that other companies enjoy because the federal government still considers their product an illegal drug. In the U.S. Supreme Court, the Justice Department's solicitor general this week urged the justices not to undermine the scope of IRS authority to collect certain audit information. Several marijuana dispensaries having pending cases against the IRS in Colorado federal district court.

Rettig is a former chairman of the 3,500-lawyer taxation section of the State Bar of California. He is also a past chair of the IRS advisory council, and he served on boards advising California's Board of Equalization and Franchise Tax Board. Rettig received his law degree from Pepperdine University and his master's in taxation from New York University School of Law.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Where Were the Lawyers?' Judge Blocks Trump's Birthright Citizenship Order

3 minute read

Netflix Music Guru Becomes First GC of Startup Helping Independent Artists Monetize Catalogs

2 minute read

K&L Gates Files String of Suits Against Electronics Manufacturer's Competitors, Brightness Misrepresentations

3 minute read

Holland & Knight Hires Former Davis Wright Tremaine Managing Partner in Seattle

3 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250