Fraud Trial of Former Autonomy CFO Kicks Off With Competing 'Cadillac' Metaphors

The federal criminal trial of former Autonomy CFO Sushovan Hussain will undoubtedly be heavy on accounting jargon and financial details as it unwinds over the next couple of months in District Judge Charles Breyer's courtroom.

February 26, 2018 at 05:01 PM

3 minute read

SAN FRANCISCO — The federal criminal trial of former Autonomy CFO Sushovan Hussain will undoubtedly be heavy on accounting jargon and financial details as it unwinds over the next couple of months in U.S. District Judge Charles Breyer's courtroom.

But at opening arguments Monday, lawyers on both sides of the case leaned on simple automotive metaphors to describe the ill-fated 2011 deal at the heart of the case where Hewlett-Packard acquired Autonomy for $11 billion.

During a methodical and low-key presentation for the government, Assistant U.S. Attorney Robert Leach said Hussain “dazzled” and “deceived” leaders at Hewlett-Packard into paying $11 billion, or what Leach called “a Cadillac offer for what was really a Pinto.” HP announced an $8.8 billion write-down of Autonomy's value in 2012, and claimed that more than $5 billion of that amount was due to accounting irregularities and misrepresentations by Autonomy.

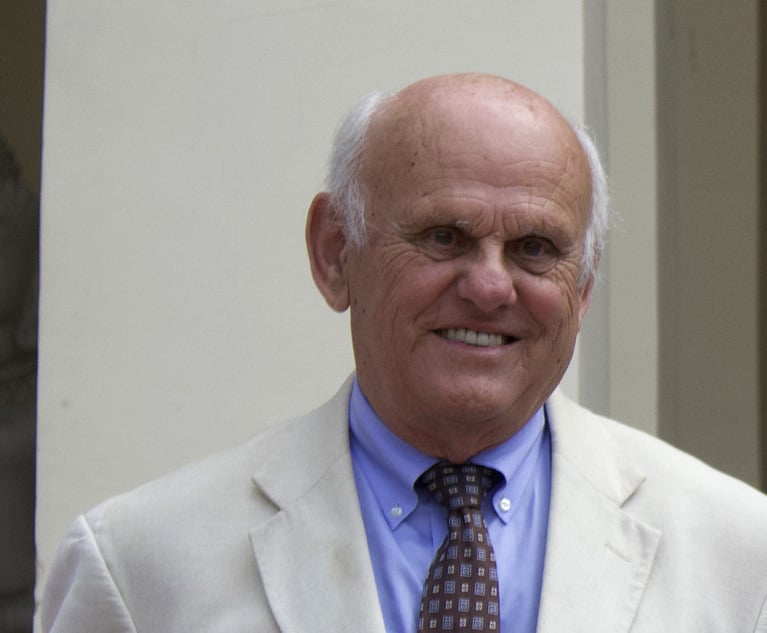

In response to the government's opening, Hussain's lead defense lawyer, John Keker of Keker, Van Nest & Peters, said it was HP that squandered Autonomy's value via mismanagement after the deal. “Autonomy the Cadillac had been turned into a Pinto by Hewlett-Packard,” said Keker, flipping Leach's metaphor on its head.

Hussain's fate will turn on whether jurors buy Keker's explanation of the two years leading up to the HP deal, or the prosecutors'.

During the government's opening, Leach said that “for Mr. Hussain revenue was everything.” Leach said Hussain pushed Autonomy's sales and finance teams to do everything they could to beat the consensus revenue projections expected in the market. That, according to the government, included back-dating sales contracts to make sure revenue was recognized in certain quarters and using deals with third-party resellers to make it appear that Autonomy's sales were more robust than they actually were.

Leach also claimed Hussain helped sell Autonomy as a high-margin “pure software” company even though 10 percent of its revenue came from low-margin hardware sales, often done at a loss to Autonomy just to book revenues.

“Ladies and gentlemen, this is a case about lying and cheating,” Leach told jurors. “Ultimately, [Hussain] misled HP and its shareholder, who were the ones left holding the bag while he walked away with millions.”

Keker, meanwhile, laid out a starkly different view of the case against his client. Hussain, he pointed out, was the only person charged criminally in a case where the “goliath” HP, which had $127 billion in annual revenue at the time of the Autonomy deal, claimed it was deceived by the smaller company.

“Hewlett Packard's attempt to turn a failed merger into a crime will not succeed,” Keker said.

Keker told jurors that many of the government's witnesses were offered immunity to testify, and that Christopher Egan, the former chief executive of Autonomy's U.S. subsidiary, entered into a deferred prosecution agreement. Keker said many of the government's witnesses from the Autonomy side of the merger initially said they did nothing wrong, but changed their tune under pressure from prosecutors.

Keker said it's up to jurors to decide “whether or not these immunized witnesses are trustworthy and whether they can be and should be believed.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Where Were the Lawyers?' Judge Blocks Trump's Birthright Citizenship Order

3 minute read

Netflix Music Guru Becomes First GC of Startup Helping Independent Artists Monetize Catalogs

2 minute read

K&L Gates Files String of Suits Against Electronics Manufacturer's Competitors, Brightness Misrepresentations

3 minute read

Holland & Knight Hires Former Davis Wright Tremaine Managing Partner in Seattle

3 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250