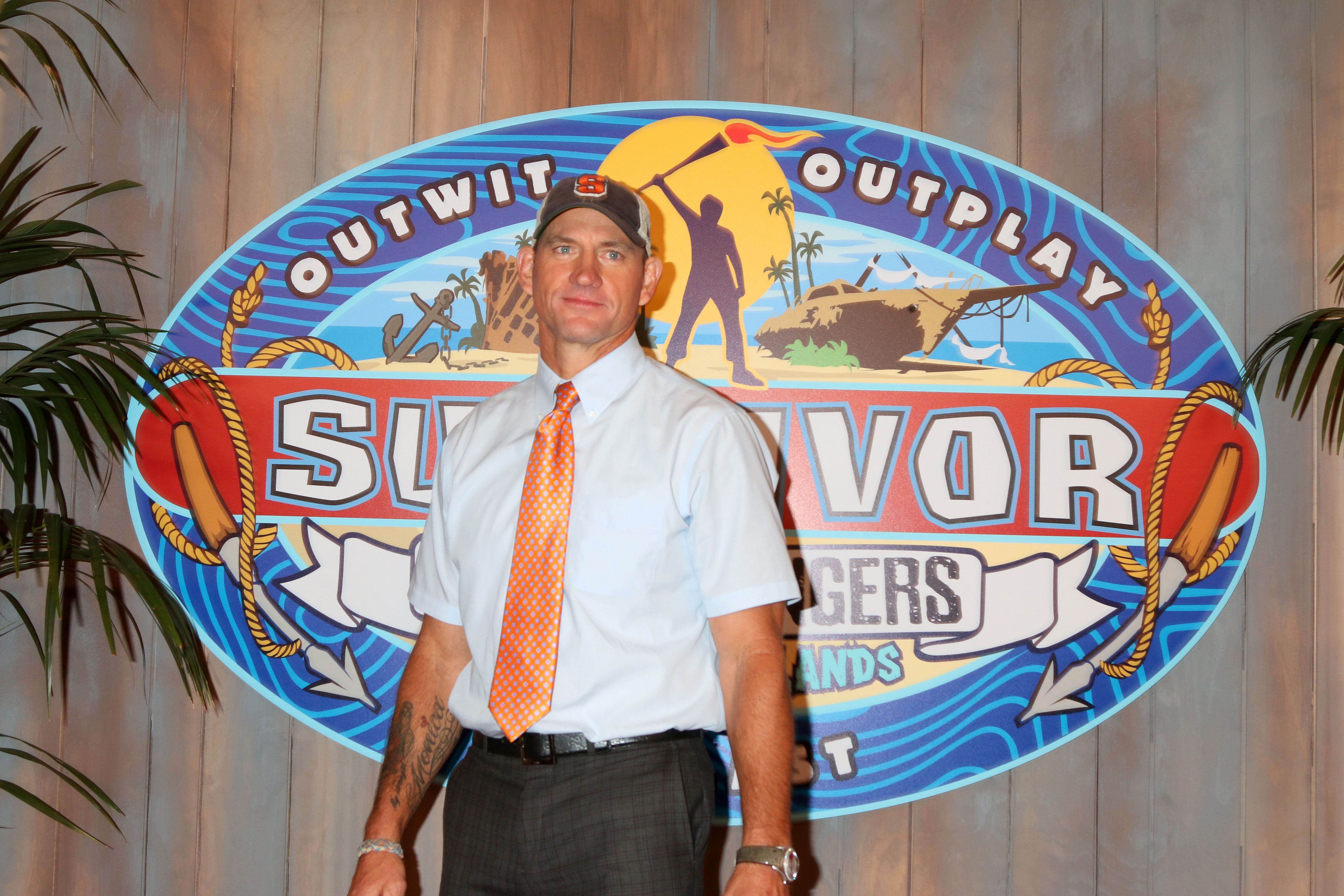

Ex-Pro Football Player Received Workers' Comp Benefits. After Appearing On Survivor, He May Have To Give Them Back.

The Ninth Circuit found that an insurer could proceed with its lawsuit to claw back its $175,000 workers comp payout to Brad Culpepper, a former member of the Chicago Bears.

May 03, 2018 at 11:40 AM

5 minute read

This story is reprinted with permission from FC&S Legal, the industry's only comprehensive digital resource designed for insurance coverage law professionals. Visit the website to subscribe.

An insurance company may proceed with its lawsuit seeking to recover workers' compensation benefits paid to a former professional football player, who thereafter appeared on the reality television show Survivor, the U.S. Court of Appeals for the Ninth Circuit has ruled.

The Case

In November 2010, Brad Culpepper, a former professional football player, filed a claim for workers' compensation benefits before the California Workers' Compensation Appeals Board (“WCAB”) in connection with injuries he allegedly suffered playing professional football. He was eligible for California workers' compensation benefits because, in 2000, he played six games in California while a member of the Chicago Bears football team.

Mr. Culpepper demanded $180,000 in workers' compensation.

Fairmont Premier Insurance Company, which was the workers' compensation provider for the Bears, settled with Mr. Culpepper for $175,000.

The settlement was approved by the WCAB in the form of an order approving a compromise and release (“OACR”).

Not long after the settlement, TIG Insurance Company, the successor by merger to Fairmont, came to believe that Mr. Culpepper's insurance claim was fraudulent. According to TIG, shortly after the settlement Mr. Culpepper became a contestant on the reality television show Survivor, a show that can be physically demanding on its contestants.

TIG also alleged that, during the pendency of Mr. Culpepper's workers' compensation claim, Mr. Culpepper engaged in activities such as running and kickboxing that were inconsistent with his claimed disability.

TIG alleged that Mr. Culpepper misled the medical examiners hired as part of the claim process to evaluate his condition.

On December 21, 2015, TIG, as relator, filed a qui tam action in California under Section 1871.7 of California's Insurance Fraud Prevention Act (“IFPA”).

Mr. Culpepper, now an attorney and co-founder of the Tampa-based personal injury law firm Culpepper Kurland, moved to dismiss. He argued that California Labor Code (“CLC”) Section 5901 divested the court of jurisdiction to hear the case.

The U.S. District Court for the Central District of California granted Mr. Culpepper's motion and dismissed the TIG suit. It concluded that the suit “arises out of” the OACR, that the OACR was a “final order” within the meaning of CLC Section 5901, and that TIG's suit had to be dismissed because TIG had not asked the WCAB to reconsider the OACR prior to filing suit.

TIG appealed to the Ninth Circuit.

California Law

CLC Section 5901 provides:

No cause of action arising out of any final order, decision or award made and filed by the appeals board or a workers' compensation judge shall accrue in any court to any person until and unless the appeals board on its own motion sets aside the final order, decision, or award and removes the proceeding to itself or if the person files a petition for reconsideration, and the reconsideration is granted or denied. Nothing herein contained shall prevent the enforcement of any final order, decision, or award, in the manner provided in this division.

IFPA Section 1871.7(b) subjects to liability:

Every person who violates any provision of this section or Section 549, 550, or 550 of the [California] Penal Code.

IFPA § 1871.7(e) states that:

Any interested persons, including an insurer, may bring a civil action for a violation of this section for the person and for the State of California. The action shall be brought in the name of the state.

The Ninth Circuit's Decision

The Ninth Circuit reversed.

In its decision, the circuit court explained that IFPA § 1871.7(b) authorizes a qui tam claim to be brought on behalf of the State of California for violations of, among other things, California Penal Code (“CPC”) Section 550, which prohibits “knowingly present[ing] or caus[ing] to be presented any false or fraudulent claim” for insurance.

The Ninth Circuit added that TIG alleged that Mr. Culpepper violated CPC Section 550 when he “presented” a fraudulent claim for insurance.

Therefore, the circuit court found, TIG's claim arose from Mr. Culpepper's allegedly fraudulent presentation of his claim for insurance benefits, not from the settlement of that claim or from the WCAB's approval of that settlement. TIG's suit did not “arise from the OACR” as the district court had determined, the Ninth Circuit ruled, and the district court had subject matter jurisdiction to hear it.

The Ninth Circuit concluded that the WCAB did not have exclusive jurisdiction over TIG's appeal because its action was on behalf of the State of California, not an action for benefits against an employer.

The case is California ex rel. TIG Ins. Co. v. Culpepper, No. 16-56639 (9th Cir. April 30, 2018).

Steven A. Meyerowitz, Esq., is the Director of FC&S Legal, the Editor-in-Chief of the Insurance Coverage Law Report, and the Founder and President of Meyerowitz Communications Inc. As FC&S Legal Director, Mr. Meyerowitz, a member of the team that conceptualized FC&S Legal, provides daily analysis and commentary on the most significant insurance coverage law decisions from courts across the country and news regarding legislative and regulatory developments. A graduate of Harvard Law School, Mr. Meyerowitz was an attorney at a prominent Wall Street law firm before founding Meyerowitz Communications Inc., a law firm marketing communications consulting company.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'A Death Sentence for TikTok'?: Litigators and Experts Weigh Impact of Potential Ban on Creators and Data Privacy

Shareholder Democracy? The Chatter Musk’s Tesla Pay Case Is Spurring Between Lawyers and Clients

6 minute read

Trending Stories

- 1Evidence Explained: Prevailing Attorney Outlines Successful Defense in Inmate Death Case

- 2The Week in Data Jan. 24: A Look at Legal Industry Trends by the Numbers

- 3The Use of Psychologists as Coaches/Trial Consultants

- 4Could This Be the Era of Client-Centricity?

- 5New York Mayor Adams Attacks Fed Prosecutor's Independence, Appeals to Trump

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250