Class Cert Reversed in Uber Drivers' Suit Over Tip Sharing, Classification

The U.S. Court of Appeals for the Ninth Circuit reversed class certification in the case, ruling that the drivers can't sue the company because of an arbitration clause contained in their contracts.

September 25, 2018 at 04:10 PM

3 minute read

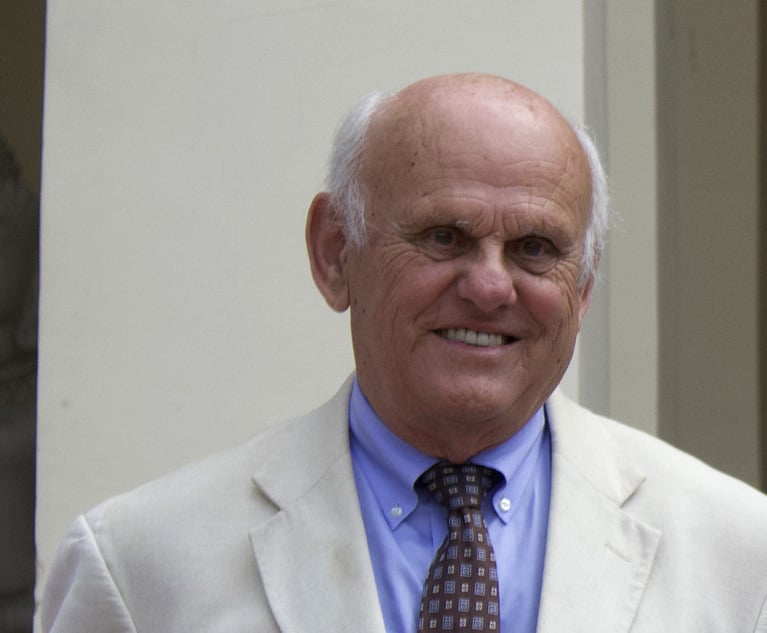

Ninth Circuit Judge Richard Clifton. Photo: Jason Doiy/ALM

Ninth Circuit Judge Richard Clifton. Photo: Jason Doiy/ALM

Uber Technologies Inc. has won a victory against some 160,000 drivers who could potentially have been class members in a suit over the company taking a cut of their tips and keeping them from working as full-time employees with benefits.

The U.S. Court of Appeals for the Ninth Circuit on Tuesday reversed class certification in the case, ruling that the drivers can't sue the company because of an arbitration clause contained in their contracts.

Circuit Judge Richard R. Clifton wrote for the panel, which included Judges Richard C. Tallman and Sandra S. Ikuta.

The judges rejected the argument that the lead plaintiffs in O'Connor v. Uber “constructively opted out of arbitration on behalf of the entire class.” Instead, the panel ruled that Uber's arbitration agreements can be enforced, and so overturned the class certification and related rulings by U.S. District Judge Edward M. Chen of the Northern District of California.

The circuit panel relied on the U.S. Supreme Court's ruling on arbitrability earlier this year in Epic Systems v. Lewis, which the parties addressed in supplemental briefs following the release of the decision in May 2018.

And the plaintiffs found no success citing a Georgia case.

“The sole authority offered by plaintiffs for this proposition is a Georgia Supreme Court decision, Bickerstaff v. SunTrust Bank, 788 S.E.2d 787 (Ga. 2016),” Clifton said. “The argument is unpersuasive for multiple reasons.”

The court said, “Nothing gave the O'Connor lead plaintiffs the authority to take that action on behalf of and binding other drivers. Nor did Bickerstaff hold that individuals in the lead plaintiffs' position had the authority to make such an election for others. Perhaps more importantly, plaintiffs provide no federal case law that has relied on Bickerstaff, nor could they. That decision rested exclusively on state law grounds and did not discuss the Federal Arbitration Act (FAA), 9 U.S.C. § 2.”

In the Bickerstaff case, the Georgia Supreme Court approved class certification for customers claiming Suntrust Bank manipulated their accounts to charge them excessive overdraft fees for small debits. The underlying lawsuit is still pending.

An Uber spokesperson offered a one-sentence email response: “We are pleased with the court's decision.”

Uber was represented by Theodore J. Boutrous Jr., Theane D. Evangelis, and Kevin J. Ring-Dowell of Gibson, Dunn & Crutcher in Los Angeles, and Joshua S. Lipshutz of Gibson Dunn's San Francisco office. Boutrous spoke for the company at oral arguments.

Shannon Liss-Riordan and Adelaide H. Pagano of Lichten & Liss-Riordan in Boston represented the plaintiffs. Liss-Riordan made the argument.

“We have, unfortunately, been long expecting this,” Liss-Riordan said by email Tuesday. “This panel of the Ninth Circuit had previously ruled against Uber drivers, and the U.S. Supreme Court's decision in Lewis v. Epic Systems earlier this year removed one of our remaining arguments for why Uber should not be able to use its arbitration clause to avoid certification of a class for its widespread labor violations. We are considering our options, including an en banc appeal to the entire Ninth Circuit.”

Liss-Riordan said she is also “urging all Uber drivers who want to pursue these misclassification claims to contact us immediately to sign up for individual arbitration,” which “thousands” so far have done.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Where Were the Lawyers?' Judge Blocks Trump's Birthright Citizenship Order

3 minute read

Netflix Music Guru Becomes First GC of Startup Helping Independent Artists Monetize Catalogs

2 minute read

K&L Gates Files String of Suits Against Electronics Manufacturer's Competitors, Brightness Misrepresentations

3 minute read

Holland & Knight Hires Former Davis Wright Tremaine Managing Partner in Seattle

3 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250