Levi & Korsinsky Appointed to Lead Tesla Shareholder Suits Over Musk Tweets

U.S. District Judge Edward Chen cited the ability of Levi & Korsinsky's client, an individual investor who lost $3.5 million, to represent both stock purchasers and short sellers in the class.

November 28, 2018 at 06:35 PM

5 minute read

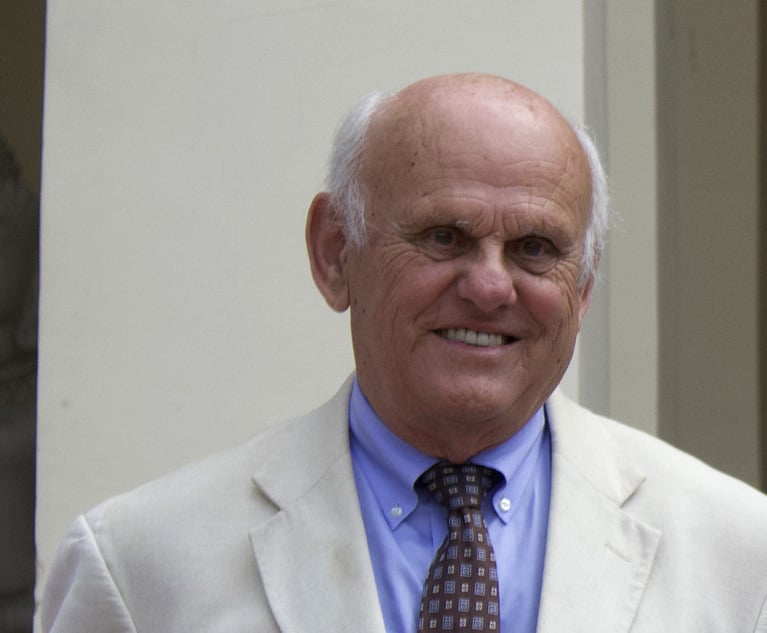

Elon Musk, co-founder and CEO of Tesla Inc., speaks during a news conference in Tokyo on Sept. 8, 2014. (Photo: Yuriko Nakao/Bloomberg)

Elon Musk, co-founder and CEO of Tesla Inc., speaks during a news conference in Tokyo on Sept. 8, 2014. (Photo: Yuriko Nakao/Bloomberg)

A federal judge has appointed Levi & Korsinsky to lead securities fraud class actions against Tesla Inc., citing ability of the firm's client, an individual investor who lost $3.5 million, to represent both stock purchasers and short sellers.

In his Tuesday order, U.S. District Judge Edward Chen of the Northern District of California rejected submissions by institutional investors and short seller Andrew Left to be lead plaintiffs in the consolidated lawsuits, which allege that Tesla CEO Elon Musk's Aug. 7 post on Twitter about taking the electric car company private sent its shares soaring—then, falling—amid questions about the accuracy of his claims. On Sept. 29, Musk agreed to step down as Tesla's chairman and pay $40 million to settle a U.S. Securities and Exchange Commission lawsuit.

In picking Levi & Korsinsky client Glen Littleton as lead plaintiff, Chen rejected three other applicants with larger investor losses but who lacked a mix of both long investors and short positions, both of which could end up being part of the class.

“Those who took long positions were injured when, e.g, they purchased Tesla securities after the alleged fraud (i.e., when the price of the securities was artificially inflated) and then sold after the truth began to be disclosed,” he wrote. “Those who took short positions were injured when, e.g., they covered their short positions by purchasing Tesla securities after the alleged fraud (again, when the price of the securities was artificially inflated).”

Levi & Korsinsky's Adam Apton, a Washington, D.C., partner, said in an emailed statement: “We are eager to proceed with the litigation now that the issue of lead plaintiff is resolved, and we look forward to obtaining maximum redress for Tesla shareholders who have suffered substantial damages as a result of the conduct alleged in this action. We are grateful that Judge Chen ruled in our client's favor and endorsed Levi & Korsinsky as lead counsel to litigate this important case.”

The firm beat out six other applicants for lead counsel. Ramzi Abadou, a San Francisco partner at Kahn Swick & Foti, representing a competing investor named Bridgestone Investment Corp., which claimed $3.8 million in losses, said: “We're looking at the order and reviewing our options.”

Kaplan Fox & Kilsheimer partner Laurence King, a San Francisco lawyer for two hedge funds that lost $15.8 million, the largest of anyone competing for leadership, did not respond to a request for comment.

Ashley Keller at Chicago's Keller Lenkner, representing a group of investors, including Left, who collectively claimed $4.4 million in losses, declined to comment.

The lawsuits focused on Musk's Twitter post saying that he was “considering taking Tesla private at $420. Funding secured.” The surprise announcement caused Tesla's stock to jump 11 percent. News reports later revealed that no such deal was in the works, and Tesla's stock plummeted for the next 10 days.

Chen consolidated nine lawsuits brought in the Northern District of California, home to Tesla's headquarters. Left, who publishes the online newsletter Citron Research, filed one of the lawsuits, alleging Musk intended to target short sellers with his Twitter post.

The fight over lead counsel involved heated exchanges about mudslinging and manipulating stock losses in a flurry of court papers. It even included a filing by Fenwick & West partner Jennifer Bretan, representing Tesla and Musk, over “unwarranted or excessive burdens” on the defendants or the court if multiple plaintiffs got appointed to represent both purchasers and sellers of shares.

In his lead counsel order, Chen had concerns that the hedge funds, Tempus International Fund and Opportunity Unique Fund Inc., both short sellers, had overstated their losses. Additionally, their founder, Brazilian billionaire Daniel Dantas, who has been tied to corruption scandals, “may well become the focus of the litigation to the detriment of the class.”

He made similar remarks about Left, one of the five investors who coalesced to submit a lead counsel submission. Chen also called them an “artificial group” whose members “are unrelated and were introduced to one another by their lawyers (even if at their request),” which courts have disfavored in securities class actions.

As to Bridgestone, Chen raised the prospect that the investor was overstating losses and noted that it held only long positions.

That left Chen focused on Littleton, whose losses were the largest of those remaining and, even though they were mostly in options, contained a mix of both long and short positions, the judge wrote.

In addition to Apton, Chen wrote that Levi & Korsinsky partner Nicholas Porritt and associate Adam McCall were anticipated to have “significant involvement” in the case.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Where Were the Lawyers?' Judge Blocks Trump's Birthright Citizenship Order

3 minute read

Netflix Music Guru Becomes First GC of Startup Helping Independent Artists Monetize Catalogs

2 minute read

K&L Gates Files String of Suits Against Electronics Manufacturer's Competitors, Brightness Misrepresentations

3 minute read

Holland & Knight Hires Former Davis Wright Tremaine Managing Partner in Seattle

3 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250