Tech Firms Lose Out on Bid to Limit Forum in Securities Act Claims

Blue Apron, Stitch Fix and Roku lost out in a bid in the Delaware Court of Chancery to use forum-selection provisions in corporate charters to force shareholders to litigate securities fraud claims in federal court.

December 19, 2018 at 06:08 PM

4 minute read

The original version of this story was published on Delaware Business Court Insider

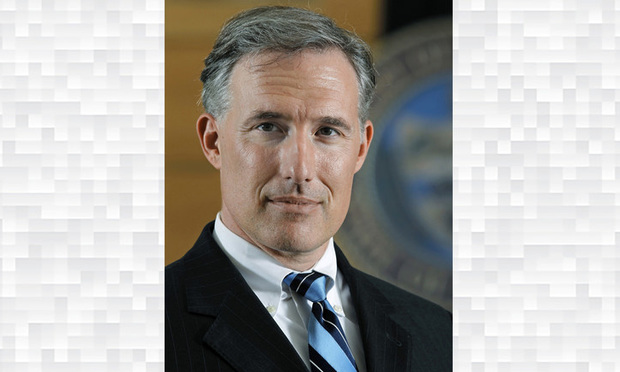

Vice Chancellor J. Travis Laster of the Chancery Court of the State of Delaware.

Vice Chancellor J. Travis Laster of the Chancery Court of the State of Delaware.

The Delaware Court of Chancery ruled Wednesday that companies cannot use forum-selection provisions in corporate charters to force shareholders to litigate securities fraud claims in federal court.

The decision, which nixed forum-selection bylaws for three technology firms—Blue Apron, Stitch Fix and Roku—was a win for plaintiffs, who will now have greater flexibility in deciding where to file lawsuits alleging fraud that occurred during companies' initial public offerings.

“Under existing Delaware authority, a Delaware corporation does not have the power to adopt in its charter or bylaws a forum-selection provision that governs external claims,” Vice Chancellor J. Travis Laster said. “The federal forum provisions purport to regulate the forum in which parties external to the corporation (purchasers of securities) can sue under a body of law external to the corporate contract (the 1933 Act). They cannot accomplish that feat, rendering the provisions ineffective

In a 54-page memorandum opinion, Laster said claims for misrepresentations or omissions made in initial public offerings filings are external to a corporation's governance and thus are not subject to Delaware precedent allowing the use of forum-selection provisions for claims related to companies' internal affairs.

In recent years, Laster said, corporations have adopted, in droves, clauses making federal courts the exclusive forum for claims arising under Section 11 of the federal Securities Act of 1933. According to his opinion, 746 publicly traded companies had forum-selection provisions in place at the end of 2014, compared to just 16 in 2010.

Plaintiff Matthew B. Sciabacucchi had challenged clauses in the charters of Blue Apron Holdings Inc., Stitch Fix Inc. and Roku Inc., which directed investors to bring claims only in certain federal courts—the preferred forum of corporate defendants.

Sciabacucchi and his Block & Leviton attorneys argued that the provisions were inconsistent with Delaware corporate law and that the state had a “compelling interest in keeping the federal government in its lane when it comes to the regulation of corporate governance.”

“If Delaware allows the federal forum provisions to stand, it will vitiate an express mandate of the Congress, a unanimous decision of the Supreme Court, and a longstanding policy of the SEC,” attorneys Jason M. Leviton and Joel A. Fleming said in a May 16 filing.

Their case was bolstered earlier this year when the U.S. Supreme Court rules in Cyan v. Beaver County Employees Retirement Fund that class actions filed under Section 11 could be filed either in state or federal court.

Attorneys for Blue Apron, Stitch Fix and Roku, however, argued that Cyan only dealt with a defendant's removal of a Securities Act claim to federal court and did not address whether companies and their shareholders could agree to file such claims only in federal courts. Existing Delaware and federal precedent, they said, authorized corporations to adopt the provisions.

But Laster ruled Wednesday that previous Delaware decisions permitting the use of binding forum-selection clauses related only to claims stemming from a companies' internal corporate governance. Securities claims for fraud involving the purchase shares, on the other hand, qualified as external matters because they don't arise out of the corporate contract.

“To the contrary, assuming the securities in question are shares, the claim arises from the investor's purchase of the shares. At the time the predicate act occurs, the purchaser is not yet a stockholder and lacks any relationship with the corporation that is grounded in corporate law,” Laster said

“The constitutive documents of a Delaware corporation cannot bind a plaintiff to a particular forum when the claim does not involve rights or relationships that were established by or under Delaware's corporate law. In this case, the federal forum provisions attempt to accomplish that feat. They are therefore ineffective and invalid,” he said.

Attorneys for both sides did not immediately return calls Wednesday seeking comment on the ruling.

Sciabacucchi was represented by Leviton and Fleming of Block & Leviton in Boston and Kurt M. Heyman and Melissa N. Donimirski of Heyman Enerio Gattuso & Hirzel in Wilmington.

Stitch Fix and Roku were represented by William B. Chandler III, Randy J. Holland, Bradley D. Sorrels and Lindsay Kwoka Faccenda of Wilson Sonsini Goodrich & Rosati's Delaware office and Boris Feldman and David J. Berge from the firm's Palo Alto office.

Blue Apron was represented by Michael G. Bongiorno and Timothy J. Perla from Wilmer Cutler Pickering Hale and Dorr New York and Boston offices and Catherine G. Dearlove, Sarah T. Andrade of Richards, Layton & Finger in Wilmington.

The case was captioned Sciabacucchi v. Salzberg.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Meta agrees to pay $25 million to settle lawsuit from Trump after Jan. 6 suspension

4 minute read

How We Won It: Latham Secures Back-to-Back ITC Patent Wins for California Companies

6 minute read

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250