Fenwick & West Revenue Hits All-Time High Despite 2018 Defections

The Silicon Valley firm boosted its revenue by 14.6 percent to $429.69 million, while profits per equity partner grew by 20.2 percent to $1.82 million.

January 17, 2019 at 01:34 PM

4 minute read

Richard Dickson, chairman of Fenwick & West. Photo: Jason Doiy/ALM

Richard Dickson, chairman of Fenwick & West. Photo: Jason Doiy/ALM

Continuing its momentum from 2017, Fenwick & West has reported the firm's highest-ever financial growth in 2018, thanks to record-setting gross revenue.

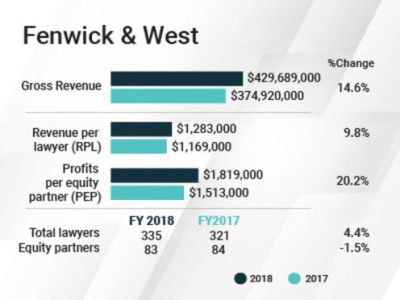

The Silicon Valley firm boosted its revenue by 14.6 percent to $429.69 million in 2018, while profits per partner grew by 20.2 percent to $1.82 million, according to preliminary ALM data. The results show a major acceleration from 2017, when the firm reported that revenue rose 3.7 percent and profits per equity partner (PEP) grew 1.5 percent.

“We are entering 2019 incredibly well-positioned for success,” said Fenwick chairman Richard Dickson, who has led the firm since since 2014. “We made more investments in 2018 than in any year prior, adding eight lateral partners, hiring associates, making substantial technology improvements, and growing our office space in New York, Seattle and San Francisco.”

Despite 11 partner departures over the course of the year, the size of Fenwick & West's equity partnership dropped by just one partner, to 83. Over a six-week stretch in August and September 2018, Fenwick & West lost five longtime partners, some of whom had practiced at the firm for over two decades.

According to data provided by the firm, the 11 partners who left in 2018 included three who retired, as well as litigation partner Virginia DeMarchi, who was selected for magistrate judgeship in San Jose, California. The other seven joined other law firms.

M&A lawyer R. Gregory Roussel, who counts Facebook among his clients, went to Latham & Watkins. Jeffrey Vetter, the former co-chair of the firm's corporate finance and securities group, fled to rival Gunderson Dettmer Stough Villeneuve Franklin & Hachigian. IPO specialist William Hughes left for Orrick, Herrington & Sutcliffe. IP partner Darren Donnelly joined Polsinelli, and compensation and benefits partner Blake Martell jumped to Cooley.

Despite the high-profile departures, Fenwick & West's firmwide head count increased by 4.4 percent from 2017 to 2018. Revenue per lawyer at the 335-lawyer firm jumped 9.8 percent, to $1.28 million. The firm's net income also rose by 18.5 percent to $219.6 million.

“We were very fortunate to experience demand growth in every major practice area in 2018—the best recipe for such extraordinary growth and one enabled by our sharp focus on technology and life sciences,” said Dickson, noting that the growth in the firm's M&A, corporate and tax practices were particularly strong.

“The strength and growth of our New York office, which has outpaced our expectations, has also been a driver of growth,” Dickson added.

Many of the firm's recent hires are based in its New York office, including a group of six intellectual property litigators from White & Case. The Silicon Valley firm has also moved its sole East Coast outpost into new space in the city's technology-friendly Flatiron District now that its New York presence has grown to nearly 40 lawyers.

“Our substantial investments in people, technology and growth over the past few years helped drive outstanding results in 2018, and given our high level of investment in 2018, should drive even greater success in 2019,” Dickson said.

Last year, Fenwick & West's corporate team handled GitHub, Inc.'s $7.5 billion acquisition by Microsoft Corp.—one of the largest venture-backed M&A exits in 2018—and handled Workday's $1.55 billion acquisition of Adaptive Insights, a cloud-based platform for modernizing business planning.

The firm also represented Cisco Systems, Inc. in its $2.35 billion acquisition of Duo Security; cryptocurrency exchange Coinbase in 8 acquisitions; Imperva in a $2.1 billion acquisition of the company by Thoma Bravo, LLC; and Cloudera, Inc. in its $5.2 billion merger with Hortonworks, Inc.

Fenwick lawyers also worked on IPOs for Smartsheet Inc., Sutro Biopharma Inc., and Upwork Global Inc.

“Public offering work is an everyday part of our practice. Our current partners led 18 public offerings last year raising over $4 billion,” Dickson said. “Indeed, we expect 2019 to be another strong year for public offerings and we have more than a dozen IPOs in the pipeline.”

Kicking off in 2019, Fenwick & West announced earlier in the month that it represented biopharmaceutical company Loxo Oncology in Eli Lilly and Co.'s $8 billion acquisition of the business.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Cleary Nabs Public Company Advisory Practice Head From Orrick in San Francisco

Morgan Lewis Shutters Shenzhen Office Less Than Two Years After Launch

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250