Pillsbury Hits Record High Revenue as Partner Profits Soar

Pillsbury Winthrop Shaw Pittman grew revenue by 9.6 percent, while profits per equity partner jumped 17.6 percent.

January 25, 2019 at 02:26 PM

4 minute read

Photo: Diego M. Radzinschi/ALM.

Photo: Diego M. Radzinschi/ALM.

Pillsbury Winthrop Shaw Pittman saw revenue spike to an all-time high in 2018, an outcome chairman David Dekker attributed in large part to strong performance in technology and financial services.

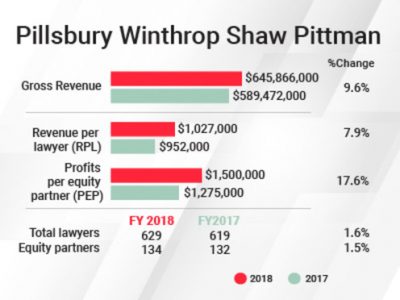

The firm saw its gross revenue hit $645.9 million last year, an increase of 9.6 percent from the $589.5 million it brought in the year before. Revenue per lawyer climbed 7.9 percent, to $1.03 million.

Profits per equity partner (PEP) also grew by 17.6 percent, reaching $1.5 million. Net income increased by 19.5 percent to $201.1 million.

“We were fortunate to see particularly strong client demand in each of our four areas of industry focus, but it was particularly strong in the technology area and in financial services,” said Dekker, who has been Pillsbury's chairman since 2017. “In both of those industry segments we experienced greater than 10 percent growth in demand for our services.”

“We were fortunate to see particularly strong client demand in each of our four areas of industry focus, but it was particularly strong in the technology area and in financial services,” said Dekker, who has been Pillsbury's chairman since 2017. “In both of those industry segments we experienced greater than 10 percent growth in demand for our services.”

Dekker said Pillsbury benefited from a strong economy in 2018 and also credited the firm's lateral hiring over the past three years for its financial growth. The firm said it brought on 13 new partners in 2018, in California, Texas and New York.

Pillsbury increased its total head count by 10 lawyers, or 1.6 percent, to 629 in 2018. The size of its equity partnership grew by two, to 134, while the nonequity partner tier shrank by six, to 161.

The firm also opened an office in Taipei, Taiwan, in 2018, Dekker noted.

Intellectual property litigators Christopher Kao and David Tsai, who are among fewer than 50 registered foreign lawyers in Taiwan, joined Pillsbury from Vinson & Elkins in May. When the firm opened its Taipei office in August, Kao and Tsai said they planned to spend at least one week per month in the new office. Partners from other offices will also use the new location to meet with Taiwanese clients, they said.

Meanwhile, Pillsbury made some readjustments in the Middle East, closing its offices in Abu Dhabi and Dubai, United Arab Emirates, last year. Asked about those closings, Dekker said the firm decided it could service clients in Middle East matters from its London, New York and Washington, D.C., offices.

In addition to its expansion in Taiwan, Pillsbury also recruited a litigation team in New York that focuses on China-related disputes. The six-lawyer group was led by Geoffrey Sant, formerly a partner in Dorsey & Whitney's trial department.

Pillsbury also focused on growing its state and local tax and leveraged finance practices, which included adding a group of 13-lawyer team from Eversheds Sutherland and a pair of leveraged finance partners, Michael Michetti and Joel Simon, from Schulte Roth & Zabel in New York.

The firm had a hand in a couple of deals that made headlines last year. It represented JUUL Labs, Inc., in Altria Group, Inc.'s $12.8 billion investment in the U.S. e-vapor company and advised Brookfield Business Partners on the regulatory and policy aspects of its acquisition of Westinghouse Electric Company LLC for $4.6 billion.

Pillsbury lawyers are also representing New York University in an ongoing lawsuit against its insurer, Factory Mutual Insurance Co., for coverage of losses stemming from Superstorm Sandy. According to the firm, the case involves more than $1 billion in claims.

In 2019, Dekker said his firm will continue to focus on its core areas including technology, financial service, energy and real estate and construction industries.

Read More

Pillsbury Winthrop Expands Asian Presence With Taipei Office

Pillsbury Snags 13-Lawyer Tax Team From Eversheds Sutherland

Pillsbury Adds New Leveraged Finance Leader From Schulte Roth

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Morgan Lewis Shutters Shenzhen Office Less Than Two Years After Launch

Invoking Trump, AG Bonta Reminds Lawyers of Duties to Noncitizens in Plea Dealing

4 minute read

‘Extremely Disturbing’: AI Firms Face Class Action by ‘Taskers’ Exposed to Traumatic Content

5 minute read

State Appeals Court Revives BraunHagey Lawsuit Alleging $4.2M Unlawful Wire to China

3 minute readTrending Stories

- 1Newsmakers: Former Pioneer Natural Resources Counsel Joins Bracewell’s Dallas Office

- 2Quiet Retirement Meets Resounding Win: Quinn Emanuel Name Partner Kathleen Sullivan's Vimeo Victory

- 3Avoiding the Great Gen AI Wrecking Ball: Ignore AI’s Transformative Power at Your Own Risk

- 4A Lesson on the Value of Good Neighbors Amid the Tragedy of the LA Fires

- 5Change Is Coming in the Trump Era. For Big Law, Change Is Already Here

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250