If a business owns or leases a parking facility where employees park, then an employer may use any reasonable method to determine the cost of providing parking in that facility to the employees. (Photo: Shutterstock)

If a business owns or leases a parking facility where employees park, then an employer may use any reasonable method to determine the cost of providing parking in that facility to the employees. (Photo: Shutterstock)Paying for Employee Parking? Get Up to Date on the Latest IRS Guidelines.

Employers who provide parking to employees, take note: the expense has gone up.

April 09, 2019 at 10:34 AM

5 minute read

The original version of this story was published on Law.com

Employers who provide parking to employees, take note: the expense has gone up and, for tax-exempt employers, may now result in additional tax liability.

As previously noted, the Tax Cuts and Jobs Act brought surprising change in this area. For for-profit employers, the cost of providing parking to employees is no longer permitted as a deduction. For tax-exempt employers, the cost of providing parking to employees is now included in Unrelated Business Taxable Income (UBTI) calculations.

In December of last year, the IRS released new, interim guidance instructing employers exactly how to calculate this cost. Its Notice 2018-99 provides rather comprehensive guidance and addresses a number of smaller issues that had been left open under the Tax Cuts and Jobs Act. Its primary focus, though, is the process of calculating parking expenses.

If an employer pays a third party so that employees may park in that third party's parking facility, then the cost of providing employee parking is generally just the cost you pay to the third party—and that is the amount that is either non-deductible or treated as UBTI. The non-deductible/UBTI amount, however, is capped by the aggregated employee income exclusion limit for parking expenses (i.e., the monthly limit on each employee's ability to exclude qualified transportation fringe benefits, including parking, from gross income).

In 2019, this monthly income exclusion limit is $265 per employee. Any parking expenses paid by an employer that exceed this per-employee limit may still be deducted by the employer and will be disregarded when calculating UBTI.

If a business owns or leases a parking facility where employees park, then an employer may use any reasonable method to determine the cost of providing parking in that facility to the employees. The notice, however, sets forth a safe harbor method—composed of a series of steps—that has been deemed reasonable for calculating the expense.

|1. Calculate the expense for reserved employee spots

Determine whether any parking spots are reserved for employees (such as by gated entrances or reserved signs). If an employer has spots reserved for employees, determine what percentage of the total parking spots are reserved for employees. Multiply this percentage by the total parking expenses for that facility, and the resulting cost is an expense that may no longer be deducted (or, for tax-exempt employers, will count towards an increase in UBTI).

However, if an employer removes reserved employee spots by March 31, 2019, the spots can be counted as “unreserved” retroactively to January 1, 2018, to avoid this mandatory disallowance/increase in UBTI.

|2. Determine the primary use of the remaining parking spots

The next step is to measure how the remaining parking spots are typically used. If more than 50 percent of the spots' actual or estimated usage may be attributed to public use, then an employer can discontinue the analysis at this point because the company may continue to deduct the remaining total parking expenses (and for tax-exempt employers, this remaining total parking expense will not count towards an increase in UBTI).

If, however, an employer determines the primary use of the remaining parking spots in the parking facility is not public use, you must continue to the next step and determine what portion of your remaining parking expense is non-deductible (or will increase UBTI).

|3. If the primary use of the remaining spots is not public use, calculate the deduction allowance for reserved nonemployee spots

If the outcome of Step 2 is that the remaining parking spots in a parking facility are not primarily for public use, then first determine how many parking spots are reserved for nonemployees (including the general public, partners, sole proprietors, and 2 percent shareholders of S corporations). Calculate the percentage of these reserved spots in relation to the total number of remaining parking spots, and apply this percentage to the business's total remaining parking expenses. This portion of the total parking expenses may still be deducted and will not increase UBTI.

|4. If primary use of remaining spots is not public use, determine disallowed expenses

After taking into account the allowed expenses in Step 3, the last step is to determine the portion of the remaining total parking expenses attributable to employee parking. An employer may use any reasonable method to determine this portion.

|Special rules

The IRS guidance provides a host of additional rules not summarized here, such as what expenses must be counted in calculating the parking expense, when separate parking areas may be treated as a single parking facility, what constitutes public use, how to calculate usage, and examples of reasonable allocation of expenses for unreserved spaces.

Employers should consult with qualified advisors to ensure the parking expenses are properly handled and should take action quickly if they desire to avoid the mandatory non-deductibility/UBTI for reserved employee spaces.

Hannah Munn is an associate at Poyner Spruill LLP in the firm's Charlotte, North Carolina office. Her practice is focused in the areas of Employee Benefits and Executive Compensation, and she represents public, private, governmental and non-profit employers in designing and documenting retirement plans, welfare benefit plans, fringe benefit plans, and executive compensation plans.

|This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

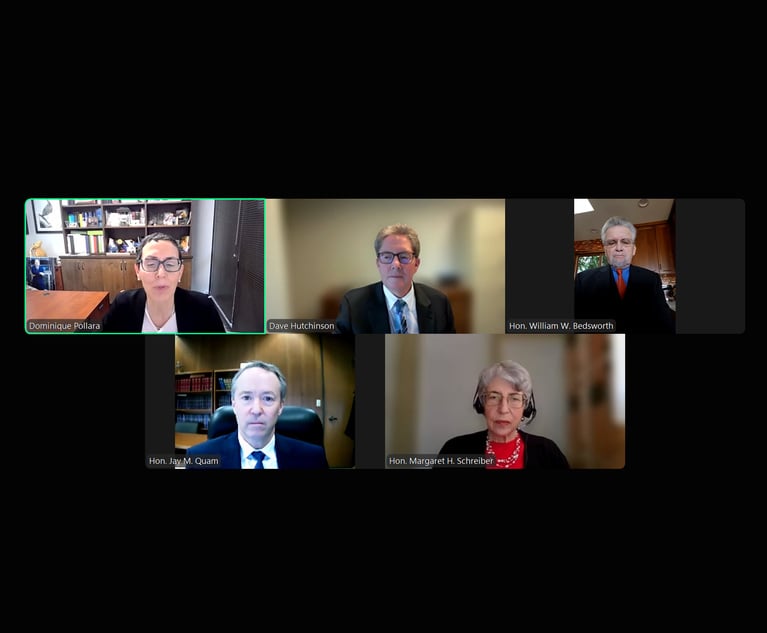

‘It's Your Funeral’: On Avoiding Damaging Your Client’s Case With Uncivil Behavior

Scammers Target Lawyers Across Country With Fake Court Notices

'The Most Peculiar Federal Court in the Country' Comes to Berkeley Law

Trending Stories

- 1Stevens & Lee Names New Delaware Shareholder

- 2U.S. Supreme Court Denies Trump Effort to Halt Sentencing

- 3From CLO to President: Kevin Boon Takes the Helm at Mysten Labs

- 4How Law Schools Fared on California's July 2024 Bar Exam

- 5'Discordant Dots': Why Phila. Zantac Judge Rejected Bid for His Recusal

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250