Crossing the International Dateline: US-China Life Sciences Transactions

Despite the trade-related headwinds, the question for U.S. life sciences companies is not whether to engage with China—but how?

August 22, 2019 at 11:37 AM

7 minute read

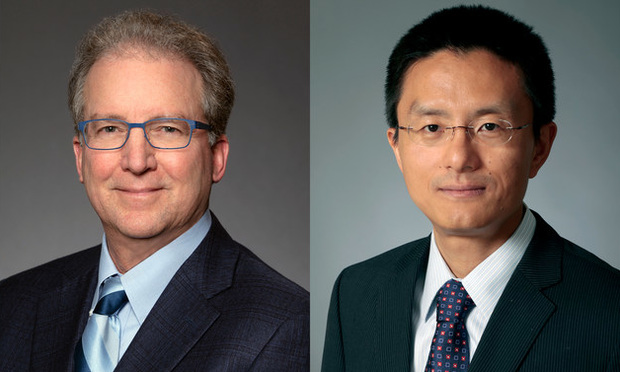

Tom Duley and Ruchun Ji of Sidley Austin

Tom Duley and Ruchun Ji of Sidley Austin

The headlines report almost daily news of trade tensions between the United States and China. In life sciences, however, China offers an unprecedented opportunity for U.S. biopharmaceutical and medical device companies:

- large commercial markets with expanding health insurance;

- regulations for product development and approval increasingly harmonized to international standards;

- an ecosystem of government-supported “incubators,” private venture capital and highly educated entrepreneurs building new companies on innovative science; and

- new public listing venues in Hong Kong and Shanghai for life sciences companies.

So, despite the trade-related headwinds, the question for U.S. life sciences companies is not whether to engage with China—but how?

Some key considerations follow.

CFIUS Restrictions: An Obstacle—Not Always a Barrier

CFIUS is the Committee for Foreign Investment in the United States. It is a U.S. federal interagency committee that reviews certain investments in the United States from a national security perspective. CFIUS jurisdiction was expanded by the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA), which, among other things, expanded the scope of transactions requiring CFIUS review to include investments in certain U.S. businesses that are involved in “critical technologies.”

The extent to which CFIUS will impact life sciences is a developing story, in part because experience will further define what “critical technologies” means with respect to biopharmaceuticals, diagnostics and medical devices. Just as the regulatory landscape is shifting, so too is life sciences technology evolving—for example, “big data,” artificial intelligence, and personalized health information are increasingly woven into everything from discovery of new drugs to diagnostic tools that identify which patients will benefit from a specific commercial drug product.

A detailed analysis of CFIUS and how it applies to life sciences technologies is beyond the scope of this article. We can, however, offer this suggestion: life sciences companies considering investments from Chinese investors should seek specialized advice at the outset to determine if the proposed deal is covered by CFIUS and, if so, how best to navigate this evolving regulatory regime, taking into consideration a variety of factors, including the specific investor, the technology and products at issue, the deal structure and the proposed investment terms. There are well-trodden paths and structures to satisfy the CFIUS compliance requirements but it is important that the parties work together collaboratively and early on.

Partnering U.S. Assets in China: Meshing Local and Global Development

In the current climate of trade tensions, it may come as a surprise to learn that China continues to harmonize its regulations pertaining to pharmaceutical development with those of the United States and E.U. China’s evolution in this regard is not new, but neither has it abated during the trade war. These Chinese regulatory reforms, together with increasing levels of expertise in all aspects of development and manufacturing, benefit U.S. life sciences companies in several ways, including:

- Time is money: A U.S.-developed drug or device that now can get to market in China sooner is more valuable to a Chinese partner. Recent reforms enable Chinese companies, in some circumstances, to rely on clinical trial data that has already been generated elsewhere in the world to support regulatory approval in China—with smaller (or no) local clinical trials in China.

- Quality is Key: Whether it is accuracy in generating and reporting clinical trial data for new drugs or manufacturing quality-controlled biopharmaceutical or medical devices, the right Chinese partner can adhere to international standards. For well over a decade, China has benefited from the return of its citizens after stints working for global multinational pharmaceutical and medical device companies. These returnees—so called “sea turtles”—have now established a robust ecosystem of high-quality companies in China.

- Navigating a Complex Commercial Landscape: Distributing, promoting and selling drugs and devices in China is a daunting undertaking. For example, each of the 31 provincial regions in mainland China operates its own provincial centralized drug procurement system (unlike U.S. states) through a competitive tender bidding process for procurement of drugs by public hospitals. Drug companies may only sell products to public hospitals in a provincial region after winning the tender there. Finding a Chinese company with commercial experience and resources is essential—and many such companies exist. In addition, however, a U.S. company should understand the key factors that will influence the price and breadth of distribution of its product in China, and negotiate contract terms that match its commercial expectations.

Looking to China for Innovation: An Abundance of Assets

Decades of investment and effort are transforming China—once known for its inexpensive research services—into a country that rivals the traditional life sciences innovation hubs of San Francisco and Boston. One Chinese life sciences incubator alone—bioBay in Suzhou—houses over four hundred young companies, and has already had several of its progeny become publicly traded, international companies.

With this abundance and potential, a U.S. company looking for assets has a lot to consider, including:

- Finding the Needle in the Haystack: Locating the right asset in a vast, competitive and unfamiliar country is a challenge. This requires time and effort; business development professionals with experience in China can add tremendous value.

- Due Diligence is Key: While true in any deal, China is often perceived—fairly or not—to present special risks. Diligence covers many fronts; but, for deals involving rights to a compound or device, it may be especially prudent for a U.S. company to obtain samples of the compound or device under a “material transfer agreement” to determine if you can replicate the data.

- Global versus “ex-China” Deals: Even a small Chinese company may want to retain rights to its product in Greater China—e., mainland China, the Special Administrative Regions of Hong Kong and Macau, and Taiwan. As with any such “territory-splitting” deal, the ability to work cooperatively and constructively with the other company is key. But it is also important to understand the development and regulatory pathways applicable to the product in China, and to establish an optimal allocation of responsibilities to mesh those activities in China with the rest of the world.

Conclusion

In life sciences, product development cycles are long—for a drug, a decade or more can separate discovery from regulatory approval to sell. In that context, taking the long view of opportunities in China makes sense. Even today, amidst trade tensions, great opportunity remains for U.S. life sciences companies willing to equip themselves with the right knowledge and resources.

Tom Duley is a partner in Sidley Austin’s San Francisco office. He has extensive experience representing life sciences companies in a wide range of cross-border technology and intellectual property transactions, including working with clients in both the United States and China.

Ruchun Ji is a partner in the firm’s Palo Alto office. He represents corporations, private equity sponsors and venture capital investors in the United States, China and other Asia countries in domestic and cross-border investments, divestitures and acquisitions, both inbound and outbound.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Pharmacies Accuse GoodRx of 'Inviting Price-Fixing' in Series of Antitrust Class Actions

4 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250