Lawyers' Perspectives on Historic Cannabis Banking Vote

We reached out to attorneys in the cannabis space for their views on the U.S. House vote backing a landmark bill.

September 26, 2019 at 06:08 PM

4 minute read

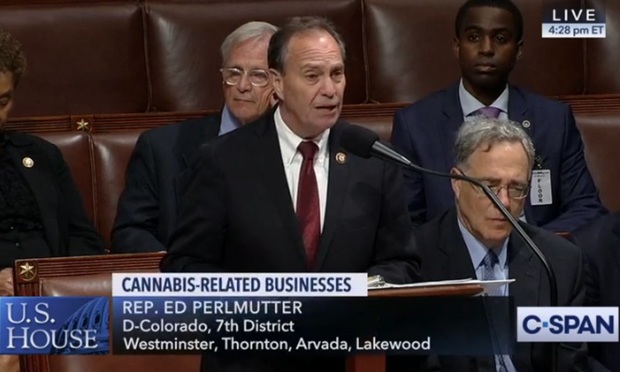

U.S. Rep. Ed Perlmutter, D-Colorado, speaking Wednesday in the US Congress. Credit: C-SPAN

U.S. Rep. Ed Perlmutter, D-Colorado, speaking Wednesday in the US Congress. Credit: C-SPAN

In a historic vote, the U.S. House of Representatives on Wednesday approved legislation to shield banks that serve state-licensed cannabis and hemp operators—as well as businesses and insurers that serve those industries—from federal regulators.

The Secure and Fair Enforcement Banking Act passed on a bipartisan 321-103 vote, marking the first time a stand-alone cannabis policy bill advanced from the House. That it passed so overwhelmingly with significant support from Republicans speaks volumes about the seismic shift in public opinion, and politics, surrounding marijuana.

"This bill is about public safety, accountability and protecting states' rights," the bill's author, Rep. Ed Perlmutter, D-Colorado, said.

We reached out to lawyers in the cannabis space for some of their early observations, and universally the legislation was hailed as "significant." Of course, there's no certainty the bill will ever become law, as it goes over to the Senate. Here are some early reactions from lawyers:

>> Jason Horst, Horst Legal Counsel: "It certainly is significant. Insurance protections were not originally included in the SAFE Banking Act, but were added in June. If it becomes law, I do think that you will see the dam break a great deal with regard to the number of insurers entering the cannabis insurance markets. The changes may not happen overnight in the way that they might with banking, though. Each new carrier will have to do its due diligence to understand how cannabis risks differ from other risks they insure. But, over time, competition in the markets will increase greatly, and prices and terms of available insurance should improve steadily."

>> Rachel Gillette, chairwoman of Greenspoon Marder's cannabis practice: "All-cash business operations are not only a safety issue, but they are a tremendous challenge, and the lack of available banking in a multibillion-dollar industry makes little sense. The lack of banking has only served to undermine states that have chosen the alternative path to end marijuana prohibition. Normalized banking relationships between licensed cannabis businesses and financial institutions adds the level of transparency states have needed in their regulatory efforts to quash the marijuana black market."

Manatt, Phelps & Phillips' office in Washington, D.C. (Photo by Diego Radzinschi/ALM)

Manatt, Phelps & Phillips' office in Washington, D.C. (Photo by Diego Radzinschi/ALM)>> Anita Boomstein, partner, Manatt, Phelps & Phillips: "Under the bill, banks still would need to have robust compliance procedures in place to ensure that their cannabis customers are, in fact, operating legally under the relevant state law. But assuming the bank can satisfy that hurdle, the bill would remove the threat of criminal liability, adverse supervisory action by its federal regulator, or seizure of funds from cannabis-related transactions, all of which have haunted banks up until now."

>> Jonathan Havens, partner, Saul Ewing Arnstein & Lehr: "The bill is significant for a few reasons. First, this is the first stand-alone cannabis reform bill that has reached the House floor. Second, this legislation would help address one of the cannabis industry's primary challenges: Finding financial institutions that will take them on as customers. Third, once implemented, the bill could pave the way for commercial lending and capital markets opportunities for plant-touching U.S. entities. Now, the bad news: Our take is that the SAFE Act will not become law this year. Senate Majority Leader Mitch McConnell, while a strong proponent of hemp, has not yet signaled a willingness to take up the marijuana—hemp's 'illicit cousin,' as McConnell calls it—reform measure in the Senate."

Read more:

Sign Up for the Higher law Weekly Cannabis Newsletter

Forget Reefer Madness: Pot Law Goes Mainstream

Manatt Touts New Cannabis Practice as Firms Vie to Ride Green Wave

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

'Biggest Influencer Scam of All Time'?: PayPal Accused of Poaching Commissions Via Its 'Honey' Browser Extension

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250