Most Innovative Emerging Company Legal Department of the Year: Coinbase

Recognizing a need in the cryptocurrency industry, the Coinbase legal team developed a tool to assess the risk that any particular asset may be a security subject to further regulatory scrutiny.

October 23, 2019 at 08:00 AM

4 minute read

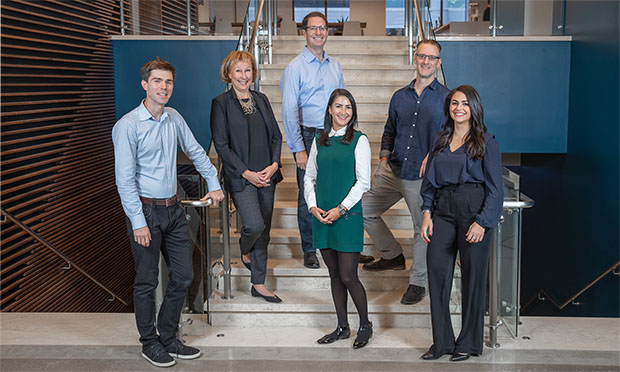

(L to R) Juan Suarez, VP Legal; Maribeth Bushey, Disputes & Regulatory Counsel; Brian Brooks, Chief Legal Officer;

(L to R) Juan Suarez, VP Legal; Maribeth Bushey, Disputes & Regulatory Counsel; Brian Brooks, Chief Legal Officer;

Tara Shine, Commercial Counsel; Michael Cianfrani, Litigation Program Manager and Brittany Cuthbert, Commercial Counsel. Photo: Jason Doiy/ALM

Recognizing a need in the cryptocurrency industry, the legal team at San Francisco-based digital currency exchange Coinbase developed a securities rating scorecard to assess the risk that any particular digital asset may be a security subject to certain regulatory scrutiny. The Coinbase team has shared its scorecard with state and federal regulators and promoted it as a self-help tool to help the industry keep an eye on securities law compliance.

That work and spirit of collaboration landed Coinbase as the Most Innovative Emerging Company Legal Department of the Year as part of The Recorder's the California Leaders in Tech Law and Innovation Awards. The Recorder asked Brian Brooks, the chief legal officer at Coinbase, about the challenges he and his colleagues have faced in the past year.

The Recorder: What are the distinguishing characteristics of Coinbase's in-house legal department and the lawyers and staff that make it up?

Brian Brooks: The Coinbase legal team is made up of a diverse set of talented lawyers and legal professionals, who deliver excellent legal services in a hyper-growth environment to an organization with the mission of building an open financial system for the world. The legal team includes lawyers with backgrounds that range from traditional finance and regulated industries like energy and fintech, to today's top tech companies as well as the best law firms in the country.

Every day, we embody the Coinbase values: efficient execution, positive energy, continuous learning and clear communication. These characteristics are needed to provide the level of legal services the organization requires in the rapidly changing cryptocurrency ecosystem.

What was the biggest challenge your in-house team faced in the past year and how did you overcome it?

The rate of product development increased significantly in the past year, and so we had to do some fundamental thinking about the design of our organization and whether we were structured to provide the level of service the clients need. The result was a reorganization that separated the regulatory functions from the product functions and thus allows us to (a) advocate with our regulators more effectively and (b) better serve our in-house clients.

Coinbase has gone from a narrower set of product offerings in a limited geographical area, to a global group of companies offering multi-faceted crypto-related financial services. Our employee count more than tripled in less than a year. This rapid growth and expansion required the legal team to produce scalable legal solutions to help the business build the foundation of the crypto-economy and continue to move at light speed.

Reorganizing our legal team product and regulatory functions enabled us to provide the highest level of client service while simultaneously prioritizing and strengthening our regulatory relationships.

Besides that challenge, what was your legal department's most significant accomplishment of the past year and why?

Regulatory uncertainty was undermining nearly every product decision facing the company. The legal team developed a repeatable and objective process for evaluating listing potential of new assets with our Digital Asset Launch Group. We worked with independent outside counsel to refine this process, blind-testing and repeating until objectivity and consistency were established.

The legal team communicated directly with regulators to keep them informed about the process for assisting the company with listing decisions. The ultimate result is the Crypto Rating Council, a consortium of cryptocurrency companies that is navigating the uncharted waters of the cryptocurrency ecosystem.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Kraken’s Chief Legal Officer Exits, Eyes Role in Trump Administration

3 minute read

Collectible Maker Funko Wins Motion to Dismiss Securities Class Action

How Tony West Used Transparency to Reform Uber's Toxic Culture

Trending Stories

- 1'Lookback Window' Law for Child Abuse Cases Constitutional, State High Court Finds

- 2Troutman Pepper Says Ex-Associate Who Alleged Racial Discrimination Lost Job Because of Failure to Improve

- 3Texas Bankruptcy Judge Withdraws Ethics Complaint Against Jackson Walker

- 4Apply Now: Superior Court Judge Sought for Mountain Judicial Circuit Bench

- 5Harrisburg Jury Hands Up $1.5M Verdict to Teen Struck by Underinsured Driver

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250