Tech Deal Department of the Year Finalist: Skadden

"Where we distinguish ourselves is in handling deals that have never been done before, have never been done on that scale, or are likely to be under intense scrutiny, either by investors, regulators, employees, competitors, the media or all constituencies simultaneously," says Thomas Ivey, the Palo Alto corporate/M&A leader at Skadden.

November 03, 2019 at 01:00 PM

6 minute read

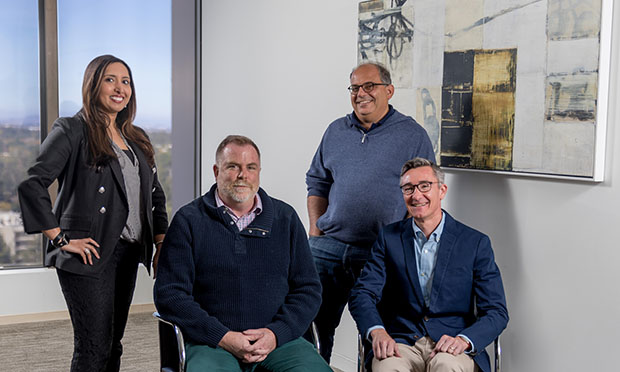

(L to R) Partners Sonia Nijjar, Michael Mies, Amr Razzak and Thomas Ivey; head of the Palo Alto M&A practice, Skadden Arps. Photo: Jason Doiy/ALM

(L to R) Partners Sonia Nijjar, Michael Mies, Amr Razzak and Thomas Ivey; head of the Palo Alto M&A practice, Skadden Arps. Photo: Jason Doiy/ALM

Skadden, Arps, Slate, Meagher & Flom Palo Alto partner Michael Mies represented PayPal in its $2.2 billion acquisition of Sweden-based payments provider iZettle AB. Palo Alto partner Amr Razzak teamed up with underson Dettmer Stough Villeneuve Franklin & Hachigian's Brooks Stough to represent San Francisco-based cryptocurrency company Ripple Labs in its strategic $50 million partnership with MoneyGram International to provide cross-border payment and foreign exchange settlement using digital assets. And Palo Alto partners Ken King and Sonia Nijjar represented private equity firm Silver Lake Partners in its purchase of 90% of ServiceMax from GE Digital.

That slate of deals landed Skadden a place a finalist for Tech Deal Department of the Year as part of The Recorder's California Leaders in Tech Law and Innovation Awards. The Recorder recently discussed with Thomas Ivey, Skadden's Palo Alto corporate/mergers and acquisitions leader, about why he believes the firm has the "most nimble, creative group of dealmakers anywhere."

What are the distinguishing characteristics of dealmakers that practice at Skadden?

Skadden is well established as one of the go-to law firms for sophisticated, transformational deals. So, our deep experience is, of course, one reason our clients come back to us, but there are other traits that allow us to stand out in a market with many excellent corporate attorneys.

Skadden lawyers are trained to thrive under intensely complex, time-sensitive circumstances. Where we distinguish ourselves is in handling deals that have never been done before, have never been done on that scale, or are likely to be under intense scrutiny, either by investors, regulators, employees, competitors, the media or all constituencies simultaneously. We also strive to staff teams with subject matter experts, applying deep industry know-how that serves to quickly hurdle obstacles inherent in any complex transaction.

We are known for being sticklers for detail. We budget realistically and transparently and work with our clients closely to make sure we are hitting the mark every day. We are an exceedingly diverse group in terms of gender, race, life experiences and other attributes, and this diversity adds greatly to our project analysis and success for our clients, resulting in what we believe to be the most nimble, creative group of dealmakers anywhere.

We are intense, but we are very human and, experience has shown, pretty easy to work with. We count our clients as our friends, and our associations have lasted decades.

When a client comes to Skadden for representation on a deal, what can they expect?

Skadden is unmatched in terms of the myriad services we provide for our clients, not just the world class M&A and capital markets teams people expect from Skadden, but also the regulatory and other related practices necessary to bring deals to the finish line in a highly efficient, cost-effective manner. We move quickly into action with support from our antitrust, CFIUS, Delaware team and related practices and geographies, all of which give our clients an edge. For example, in highly regulated industries such as fintech, we often draw on the resources of our deep bench of financial institutions regulatory and enforcement practice.

We are keenly aware that the companies we represent in Silicon Valley and around the world have their pick of the world's top attorneys. Complex transactions like the ones we tend to focus on require not just an ability to plot a course of action through a host of minefields, they also require something we think not all attorneys do well: carefully listening to our clients. Listening with great attention to our clients provides invaluable insights and can help us come to that "Eureka" moment that can drive a legal or business strategy.

Fees and efficiency are top of mind for our clients, so of course top of mind for us as well. Skadden may not be known for cut-rate fees, but our clients repeatedly tell us that our deep resources and our ability to do highly streamlined work set us apart and, ultimately, that they see the value that we bring to the table.

What are the biggest challenges facing your firm in representing tech companies in the current deal climate?

Right now, as a team that focuses on technology M&A, we are honestly seeing more opportunities than challenges. Not surprisingly, deals involving China have ground almost completely to a halt, with companies often considering some complex corporate gymnastics to avoid any kind of China antitrust review, including rethinking entire deal structures. The current political climate also is stirring understandable uncertainly.

However, from our vantage point, the trade wars, the risk of a hard Brexit and other such headline-grabbing occurrences do not seem to be impacting the volume of deal activity as much as one might expect. We see the tech deal pipeline as very robust, certainly more robust than one would expect given certain markers portending a potential economic downturn. We do not see tech companies waiting until after the 2020 election to contemplate or execute deals.

Cybersecurity is top of mind for our clients and for us. It's still rare for a data breach to spell the end of a deal, but it could delay the transaction or impact a target's value. Data breaches and cybersecurity remain a big issue for boards of directors, especially those being carried out by state actors.

Finally, companies focused on the gig economy are carefully eyeing new legislation that may impact their current business models. The influence of this certainly has been seen in the capital markets and likely will be considered in future M&A transactions.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

How I Made Office Managing Partner: 'Stay Focused on Building Strong Relationships,' Says Joseph Yaffe of Skadden

US Patent Innovators Can Look to International Trade Commission Enforcement for Protection, IP Lawyers Say

How the Deal Got Done: Sidley Austin and NWSL Angel City Football Club/Iger

How Uncertainty in College Athletics Compensation Could Drive Lawsuits in 2025

Trending Stories

- 1US DOJ Threatens to Prosecute Local Officials Who Don't Aid Immigration Enforcement

- 2Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

- 3African Law Firm Investigated Over ‘AI-Generated’ Case References

- 4Gen AI and Associate Legal Writing: Davis Wright Tremaine's New Training Model

- 5Departing Attorneys Sue Their Former Law Firm

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250