Adding R&W Insurance to the Toolkit for Tech Sector M&A

Competition to acquire privately-held startups continues to increase as cash-rich strategic acquirors from all sectors (including old-line industrial companies) and financial sponsors enshrine engagement in these transactions as a core part of their strategic plans.

April 08, 2020 at 01:55 PM

7 minute read

Ethan A. Klingsberg, Paul M. Tiger and Tomas T.J. Rua of Freshfields Bruckhaus Deringer

Ethan A. Klingsberg, Paul M. Tiger and Tomas T.J. Rua of Freshfields Bruckhaus Deringer

Competition to acquire privately-held startups continues to increase as cash-rich strategic acquirors from all sectors (including old-line industrial companies) and financial sponsors enshrine engagement in these transactions as a core part of their strategic plans.

With so-called "proprietary" deals declining in frequency, buy-side tech companies face pressure to distinguish themselves from competing bidders. Last year's release by Atlassian of a model term sheet for its acquisitions, trumpeting the company as a culturally friendly buyer, is emblematic of this pressure. In Atlassian's words, the term sheet is intentionally "more favorable to selling companies" and designed to make the "M&A process more efficient."

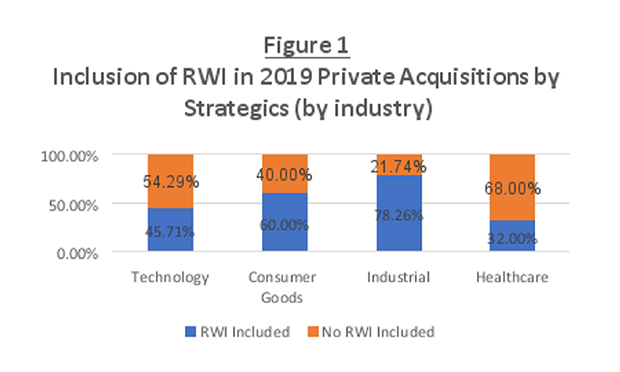

Notable among Atlassian's proposed terms is the substitution of a rep and warranty insurance (RWI) policy in place of the traditional post-closing structure in the Valley, a seller indemnity secured by an escrow funded with a portion of the purchase price. Although strategic acquirors have increasingly adopted RWI—traditionally the domain of price-constrained financial sponsors—to stand out in a competitive marketplace, tech has lagged other sectors in doing so (see Figure 1). Does the Atlassian term sheet point to RWI becoming a mainstay of tech M&A negotiations?

RWI 2019 (Photo: Courtesy Photo)

RWI 2019 (Photo: Courtesy Photo)Glass Half Full: The Upside of RWI

RWI was developed to "bridge the gap" in M&A negotiations over the scope of reps and related indemnification obligations by offering an alternative to post-closing seller indemnities while still covering buyers for breaches of sellers' reps. In addition to process benefits and competitive advantages for a bid, RWI may also offer the following advantages:

- Improved Coverage. Where seller indemnities are limited, RWI policies can expand coverage for rep breaches, potentially offering longer survival periods or higher recovery caps. For example, for an additional premium, RWI carriers sometimes offer incremental coverage limits for IP reps for $100-$500M deals. Such improved terms may be particularly useful in IP-heavy acquisitions, where rep breaches may take longer to detect and may result in substantial losses.

- Relationship Protection. Given the prevalence in tech of "acqui-hires," where targets are identified primarily for their management and engineering teams who also often happen to be selling stockholders, acquirors need to be able to preserve relationships with selling stockholders who will continue as employees. By relying on RWI, acquirors can avoid bad blood with employees by having recourse to a third-party insurer, rather than having to sue the employees.

- Easier Claim Collection. RWI provides an alternative to having indemnity claims against counterparties who may not be creditworthy (e.g., a fund that liquidates its holdings regularly or by a specified time horizon) or (may be numerous (e.g., private tech companies now often have in excess of 1,000 equity holders due to SEC rule changes and strong private markets), with the buyer instead pursuing a large creditworthy insurer, often interested in "doing right" by insureds in order to keep selling policies.

Glass Half Empty: The Downside of RWI

Despite RWI's growth, the product has drawbacks for strategic tech acquirors, including:

- Standard Exclusions. Certain subject-matter exclusions are standard, including losses relating to wage-and-hour claims, asbestos and PCBs, underfunded pensions, failures to meet projections, fines, accounting items that have some overlap with purchase price adjustments, and covenant breaches. If a target's risk exposures are particularly high in any of these areas, an acquiror should be cautious about buying RWI.

- Deal-Specific Exclusions. Depending on the transaction, RWI providers may add other deal-specific limitations.

- Due Diligence Red Flags. Acquirors are unlikely to receive coverage for areas of heightened risk identified during due diligence. While this may incentivize acquirors to limit the scope of diligence, RWI carriers are adept at detecting diligence gaps and will add policy exclusions accordingly. Furthermore, RWI policies adopt an "anti-sandbagging" approach, whereby rep breaches known by the insured's deal team as of a policy's binding are excluded from coverage. (However, "knowledge" is generally defined in a relatively pro-policyholder manner in RWI.)

- In-house diligence teams—particularly those focused on the technical nuances of a target's business—have incentives to "over-identify" issues out of concern that they may be held responsible post-closing. Outside counsel can help teams distinguish between customary risks and those issues worthy of special escalation or treatment.

- Specific IP Reps. Many RWI carriers require "knowledge" qualifiers in reps relating to third-party infringement of a target's IP. This can be jarring for cash-rich strategic acquirors accustomed to clean infringement reps.

- In asset and carve-out deals, some RWI carriers may be wary of IP sufficiency reps, particularly if they relate to the business "proposed to be conducted" (as opposed to "as currently conducted"). This hesitation may be overcome with a discussion of where the buyer sees the business headed or the scheduling of particular "future areas" to be covered by the rep.

- Cyber Breaches and Data Privacy. RWI carriers often take the view that particular tech businesses should have stand-alone insurance policies for cyber breaches and will not provide primary coverage. This position has been exacerbated by a trend toward increasingly stringent "there has been no breach" style cyber breach and data privacy reps.

- Reduced Seller Disclosure. In RWI-reliant transactions with no post-closing seller indemnities, tech companies sometimes view sellers as having less incentive to carefully draft disclosures. This perceived lack of "skin in the game" may be addressed by a business-level discussion to give the buyer assurance of the sellers' thoroughness or by having the sellers on the hook for a "baby" indemnity that covers the RWI deductible.

Other Considerations

Other considerations for strategic acquirors:

- Cost. While RWI policy premia in 2019 averaged only 2.5%-2.75% of coverage limits, RWI may still be cost-prohibitive for lower-value transactions, where carriers may require disproportionate minimum premia to cover their underwriting costs. Furthermore, RWI pricing may begin facing upward pressure, if carriers experience an increase in claims severity (particularly if the COVID-19 downturn creates remorseful buyers).

- Timing. Binding an RWI policy can take upwards of 10-14 days, with time required to engage brokers, evaluate quotes and permits carriers to conduct their own diligence.

- Process. It is critical that acquirors foster communication among internal teams (and outside counsel) to ensure that the RWI aligns with the underlying transaction agreement and diligence process and an experienced broker is engaged, who can help accelerate timing and negotiate favorable terms.

- Policy Terms. Initially, strategic acquirors may need to negotiate RWI policies more heavily than financial sponsors, who have historically received more favorable terms as repeat players in the market. Over multiple deals and by leveraging relationships with carriers. though, strategic acquirors should be well-positioned to develop better forms for themselves.

Conclusion

Though not appropriate for every transaction, RWI use is likely to increase to the extent a seller-favorable M&A market persists. In addition, RWI can be a useful tool to compete on terms other than price, particularly if acquirors become more reluctant after COVID-19 to pay large multiples for unproven or fledgling businesses. Tech companies would be wise to add a circumspect approach to RWI to their toolkit.

Ethan Klingsberg is a corporate and M&A partner at Freshfields Bruckhaus Deringer whose practice comprises of corporate, public company board of directors, M&A and SEC matters.

Paul Tiger is a corporate and M&A partner at the firm who advises on public and private M&A transactions and private equity investments. He also counsels companies and their boards on stockholder activism, corporate governance, and fiduciary duty considerations.

Tomas Rua is a corporate and M&A associate at the firm whose practice focuses on corporate and financial transactions, particularly mergers and acquisitions.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Apple Disputes 'Efforts to Manufacture' Imaging Sensor Claims Against iPhone 15 Technology

Lawsuit alleges racial and gender discrimination led to an Air Force contractor's death at California airfield

7 minute read

US Courts Announce Closures in Observance of Jimmy Carter National Mourning Day

2 minute read

'Appropriate Relief'?: Google Offers Remedy Concessions in DOJ Antitrust Fight

4 minute readLaw Firms Mentioned

Trending Stories

- 1'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 211th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

- 3Supreme Court Takes Up Challenge to ACA Task Force

- 4'Tragedy of Unspeakable Proportions:' Could Edison, DWP, Face Lawsuits Over LA Wildfires?

- 5Meta Pulls Plug on DEI Programs

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250