Proskauer's Revenue Crosses $1B Amid Growing Puerto Rico Workload

More firm lawyers than ever worked on Puerto Rico's reorganization, while Proskauer's London office revenue increased by 18.5%.

March 10, 2020 at 06:02 PM

4 minute read

The original version of this story was published on New York Law Journal

Steven Ellis with Proskauer Rose.

Steven Ellis with Proskauer Rose.

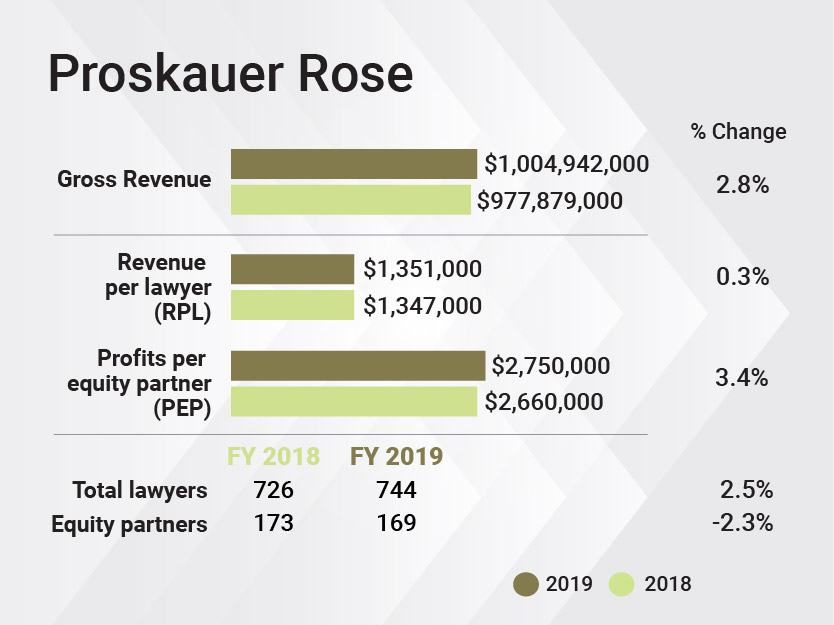

Proskauer Rose grew its revenue by 2.8%, past the $1 billion mark for the first time and upped its profits per equity partner by 3.4% to $2.75 million in 2019, helped along by increased leverage, a strong London office and a busy year in Puerto Rico's restructuring case.

Firm chairman Steven Ellis said Proskauer had "a good year across the board" in 2019 and that productivity was high. He said the firm focused on key industries, including sports, health care, asset management, hospitality, gaming and leisure, and more lawyers than ever—about 35% of the firm—worked on Puerto Rico's bankruptcy-esque proceeding, where it represents the island's Financial Oversight and Management Board.

The firm's London office delivered higher-than-average growth, increasing its revenue by 18.5% in 2019, from $68.7 million in 2018 to $81.4 million. Ellis said the firm "significantly expanded" its private investment funds practice there, and its private equity and mergers and acquisitions lawyers stayed busy as the growth in private credit business also led to more work. He said he anticipates the office will grow further in disputes in 2020.

"There were no aberrations," he said of the New York firm's 2019 finances. "It's just been solid."

As total head count rose by 2.5% to 744 lawyers, revenue per lawyer was mostly flat at $1.351 million.

Proskauer's compensation of all nonequity partners rose sharply, from about $57.7 million to $66.8 million, up about 15.8%, even as the firm's average number of nonequity partners was roughly flat at 68. Ellis said there was no change to the firm's "methodology or calculus" and chalked up the increase to the market for talented lawyers. Meanwhile, the firm's equity partnership tier contracted to 169 partners, a net loss of four lawyers, increasing the firm's leverage.

Ellis highlighted several high-profile matters last year, including its representation of Johnson & Johnson, which has worked with Proskauer's Bart Williams and others to fight a raft of lawsuits that claim its baby powder causes cancer, and Amgen, the biopharmaceutical company, in patent litigation with Genentech. He also noted the firm's work for Creative Artists Agency in its dispute with United Talent Agency.

For restructuring and related practices, the increasing Puerto Rico work has been something of a mixed bag. Ellis said he's proud of the work the firm has done on the case, which aims to get the territory's economy and finances back on track. But it has also been done at a "substantial discount" compared with the firm's other matters, in the words of the firm's engagement letter.

The firm's 150 private funds lawyers are "probably one of the largest and busiest teams in the market," Ellis said, closing 150 funds with $68 billion in committed capital last year and working on nearly as many secondary transactions.

Other corporate lawyers at the firm tapped the firm's "deep sector knowledge" of the sports and gaming industries in big deals such as The Stars Group's sports gambling partnership with Fox Sports, Ellis said.

While Ellis said there was no "major falloff" in any business, Law.com reported in March 2019 that about 20 lawyers from Proskauer's Los Angeles office left for Kirkland & Ellis last year. The group move was led by corporate and securities partner Michael Woronoff. Ellis said the group was "really centered around one client," declining to specify the client.

Overall last year, the firm tallied a total of 19 lateral partner departures, 13 lateral partner additions, plus retirements and promotions.

As far as 2020 is concerned, Ellis says the firm is ready for whatever shifts the business cycle may have in store, adding that the firm was "well-positioned" to advise clients on the challenges posed by the new coronavirus outbreak. He said he thought that Proskauer would see "substantial growth and success" in Boston, where the firm currently lists more than 120 lawyers.

The 2019 financial figures reported in this report are preliminary. ALM will report finalized data for the Am Law 200 in The American Lawyer's May and June issues.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG's Bid to Practice Law in U.S. on Indefinite Hold, as Arizona Justices Exercise Caution

Orrick Hires Longtime Weil Partner as New Head of Antitrust Litigation

Sidley Adds Ex-DOJ Criminal Division Deputy Leader, Paul Hastings Adds REIT Partner, in Latest DC Hiring

3 minute readLaw Firms Mentioned

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250