C Raymond Radigan

November 03, 2024 | New York Law Journal

The Least Restrictive Way to Limit Letters of Administration"In New York, although a practitioner might expect the Surrogate's Courts to act uniformly as part of the New York State Unified Court System, Surrogate's Courts in various counties may operate differently when assessing petitions. One example is with respect to restrictions placed on letters of administration. While under-restricting letters of administration may result in inadequate safeguards on the interests of non-consenting distributees, over-restricting letters could result in (i) a hindrance of a fiduciary's powers statutorily granted under EPTL §11–1.1, (ii) an unnecessary burden on the court's limited resources caused by additional applications to remove the restrictions, (iii) delayed administration of estates, and (iv) conflicts with the legislative intent as expressed in the Bennett commission."

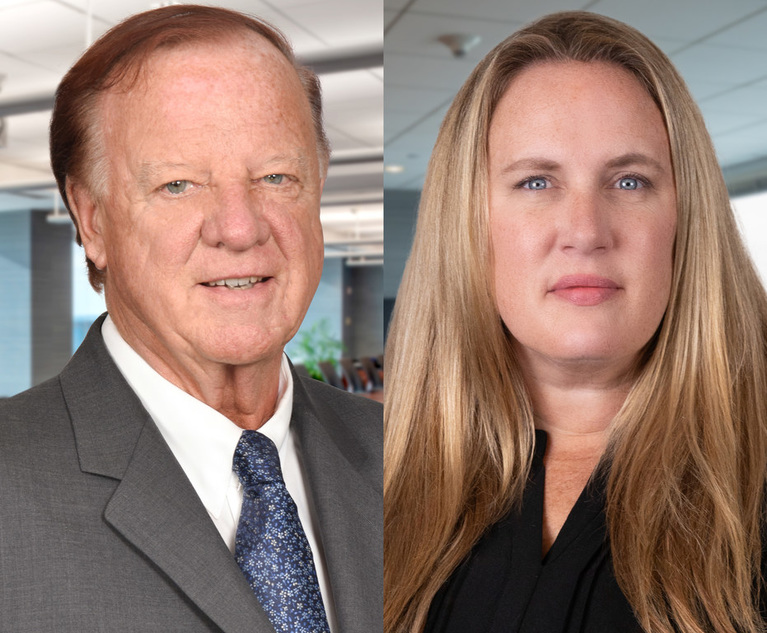

By Hon. C. Raymond Radigan (ret.), Tara E. Mahon, Esq., and Larry S. Wolfson

10 minute read

July 03, 2024 | New York Law Journal

Personal Liability of a Fiduciary for Claims Against an EstateA fiduciary of an estate must carefully balance his or her responsibilities to creditors of the decedent and to beneficiaries of the estate. A fiduciary "must act in good faith in the treatment of both" creditors and beneficiaries.

By C. Raymond Radigan and Tara E. Mahon

5 minute read

May 03, 2024 | New York Law Journal

Jury Trials in Surrogate's CourtEvery Surrogate's Court case is a special proceeding for which there is a presumption that no right to a jury trial exists. There is, however, a limited subset of a cases in which a Surrogate's Court proceeding may be tried to a jury.

By C. Raymond Radigan and Jessica M. Baquet

9 minute read

March 01, 2024 | New York Law Journal

Continuation of a Business of a DecedentA fiduciary does not have automatic authority under EPTL §11-1.1 to continue a business of a decedent, incur obligations and thus render the estate liable. However, courts have stated that a fiduciary has an inherent authority to temporarily continue a business for the limited exceptions of converting business assets to cash for the benefit of the estate.

By C. Raymond Radigan and Tara E. Mahon

8 minute read

November 03, 2023 | New York Law Journal

Surrogate's Court: Seeking Advice for Construction or DirectionMore often than not, it is the fiduciary that is looking for the court to tell them what to do or otherwise agree with what they want to do. In this article, C. Raymond Radigan and Margaret B. Rahner highlight the ambiguity in intent and uncertainty in the direction for the fiduciary to follow.

By C. Raymond Radigan and Margaret B. Rahner

6 minute read

September 10, 2023 | New York Law Journal

Why New York Attorneys Should Consider Inter Vivos Trusts in Estate PlanningSadly, over the years, there have been many developments that have adversely impacted upon the ability to achieve speedy probate. All courts have experienced a significant decline in court personnel. The pandemic contributed to even greater court delays, write contributors C. Raymond Radigan and David N. Milner.

By C. Raymond Radigan and David N. Milner

8 minute read

July 05, 2023 | New York Law Journal

Hostility as a Basis for Removal of a Fiduciary Without a HearingWhere a fiduciary's behavior clearly demonstrates entrenched hostility toward beneficiaries or a co-fiduciary, summary removal has been held appropriate.

By C. Raymond Radigan and Jessica M. Baquet

6 minute read

April 28, 2023 | New York Law Journal

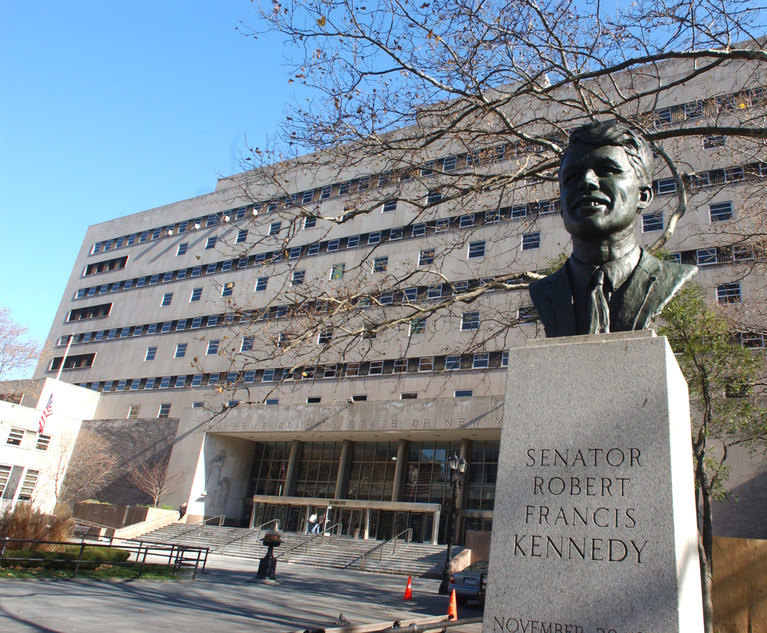

Arbitration and Mediation: Role of Surrogates in Settlement ConferencesIn Surrogate's Court practice, as a result of the pandemic and resulting delays, and an unprecedented shortage of court staff, both the courts…

By C. Raymond Radigan

5 minute read

March 03, 2023 | New York Law Journal

Right of Sepulcher: Some Recent Litigated MattersThere are few cases regarding proceedings brought against funeral directors for failure to properly dispose of one's remains. Where one dies intestate with no immediate family available or willing to provide for burial, then the public administrator or the county treasurer or fiscal officer may have the responsibility of providing the necessary services for the disposal of the decedent's remains.

By C. Raymond Radigan

8 minute read

November 04, 2022 | New York Law Journal

Accountings in Estate and Trust Proceedings, Part I: Informal AccountingsThis article, the first in a series, discusses settling fiduciary accounts informally rather than the fiduciary being compelled pursuant to SCPA §2205 or through the voluntary judicial settlement process as prescribed in the SCPA §2210.

By C. Raymond Radigan and Kera N. Reed

10 minute read

Trending Stories

- 1Decision of the Day: Judge Dismisses Defamation Suit by New York Philharmonic Oboist Accused of Sexual Misconduct

- 2California Court Denies Apple's Motion to Strike Allegations in Gender Bias Class Action

- 3US DOJ Threatens to Prosecute Local Officials Who Don't Aid Immigration Enforcement

- 4Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

- 5African Law Firm Investigated Over ‘AI-Generated’ Case References