Charles M Tatelbaum

June 04, 2020 | Daily Business Review

Are Municipalities Jeopardizing Their Municipal Bonds By Failing to Take Needed Action to Avoid a Crisis?Based upon our professional experience, we fear that the failure of municipal entities, which includes cities, towns, counties, hospital districts, water districts, etc., to take immediate action in light of the consequences of the coronavirus pandemic will seriously jeopardize the ultimate payment of outstanding municipal bonds.

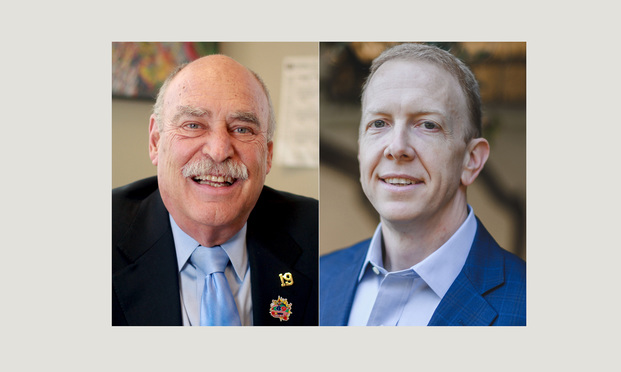

By Charles M. Tatelbaum and Shelby Faubion

7 minute read

February 20, 2020 | Daily Business Review

New Eleventh Circ. Ruling Applies a New Test to the TCPAThe cases concerned unwanted and unsolicited telephone calls received by the plaintiffs in their respective cases. The ruling creates a new opportunity for massive litigation to be filed against those who telemarket.

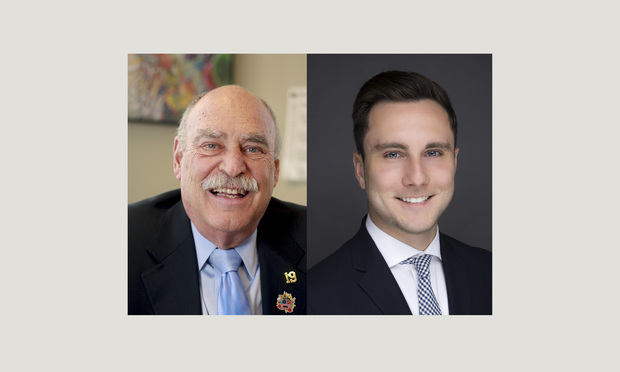

By Charles M. Tatelbaum and Thomas B. Sternberg

5 minute read

January 14, 2020 | Daily Business Review

Possibility of Applying Fraud-Specific Discovery Rule to FDCPA Suits Left OpenOn Dec. 10, 2019, the U.S. Supreme Court ruled 8-1 that the one-year filing deadline for Fair Debt Collection Practices Act (FDCPA) lawsuits is determined from when the alleged violation occurs, not when it is discovered.

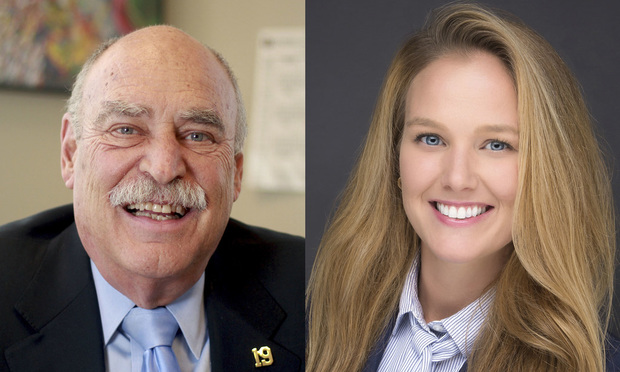

By Charles M. Tatelbaum and Brittany L. Hynes

5 minute read

October 25, 2019 | Daily Business Review

A Bankruptcy Lawyer's Perspective on Why a Recession Is ProbableAlthough the housing bubble was listed as the cause of the great recession a decade ago, it was only a significant contributing factor, with a number of others that "broke the camel's back."

By Charles M. Tatelbaum

5 minute read

July 15, 2019 | Daily Business Review

Creditors Beware — Bankruptcy Courts Now May Hold Creditors in ContemptThe U.S. Supreme Court ruled a bankruptcy court may hold a creditor in civil contempt for violating a discharge order if there is “no fair ground of doubt” as to whether the order barred the creditor's conduct.

By Charles M. Tatelbaum and Kadeem G. Ricketts

5 minute read

April 08, 2019 | Daily Business Review

Sellers Beware—Conventional Consignments Are a Thing of the PastThe March 11 opinion by the U.S. Court of Appeals for the Ninth Circuit in IPC (USA). v Kathryn A. Ellis, is a stark reminder to all businesses that sell goods on consignment that the combination of the Bankruptcy Code and the Uniform Commercial Code has virtually eliminated conventional and traditional consignments.

By Charles M. Tatelbaum and Christina Paradowski

5 minute read

January 29, 2019 | Daily Business Review

The Change in LIBOR—Prepare Now as It Will Affect You and Your BusinessThe London Interbank Offered Rate (LIBOR), sometimes called “the world's most important number,” is being completely phased out by 2021. Even with this much advance notice, every business and those professionals who advise businesses need to begin preparation now.

By Eli D. Gordon and Charles M. Tatelbaum

6 minute read

August 28, 2018 | Daily Business Review

Is Your Business a Debt Collector?—If So, Watch Out.On Aug. 7, the U.S. Court of Appeals for the Third Circuit issued an opinion in the case of Tepper v. Amos Financial (Case No. 17-2851) which has sent, and should send, shock waves to creditors and institutions that not only regularly purchase debt, but also those who can be classified as "debt collectors" under the Federal Fair Debt Collection Practices Act (FDCPA) 15. U.S.C. Section 1692.

By Charles M. Tatelbaum and Ian Lis

5 minute read

May 11, 2018 | Daily Business Review

Subprime Auto Lenders Folding—Is This a New Financial Indicator?The recent Bloomberg headline “Smaller Subprime Auto Lenders Are Starting to Fold,” and the accompanying article may seem astounding in today's bustling economy.

By Charles M. Tatelbaum

4 minute read

January 29, 2018 | Daily Business Review

Awake Ye Lenders to the Problems and Pitfalls of Collateral Insurance CoverageThe ravages of the recent hurricane season served as a wake-up call to many lenders and their professionals about problems and pitfalls when collateral is not appropriately and necessarily insured as well as when the lenders do not have the necessary rights concerning insurance recoveries.

By Charles M. Tatelbaum and Matthew Zifrony

6 minute read