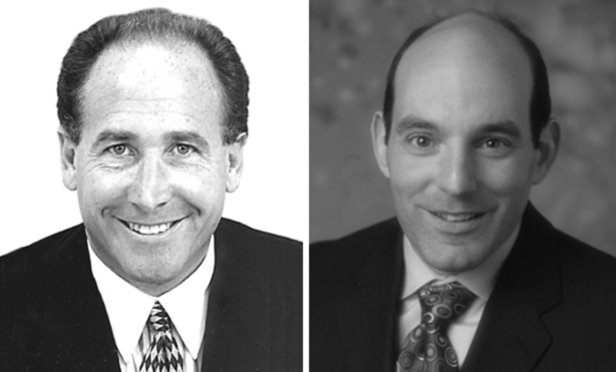

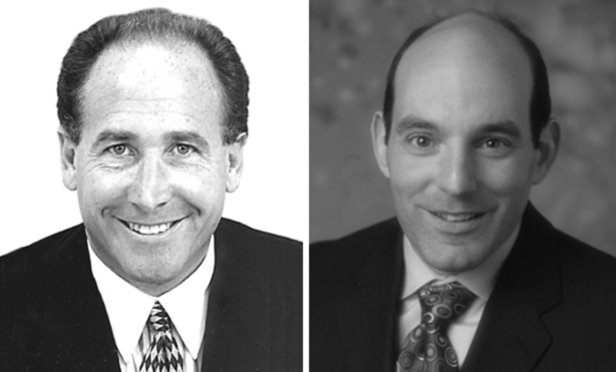

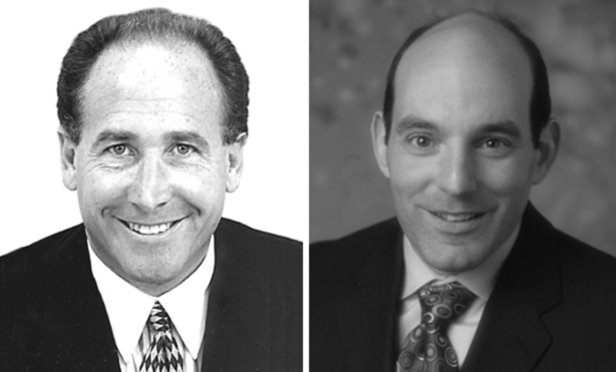

Jason R Goldstein

January 16, 2018 | New York Law Journal

Avoiding Pitfalls When Using Lists in Legal DocumentsIn their Financing column, Jeffrey B. Steiner and Jason R. Goldstein discuss the potential for unintended consequences resulting from the misuse of list-qualifying phrases such as "i.e." "e.g." and "including," and advise legal drafters to use caution before using them in legal documents.

By Jeffrey B. Steiner and Jason R. Goldstein

7 minute read

November 14, 2017 | New York Law Journal

Illegal Activity and Real Estate CollateralIn their Financing column, Jeffrey Steiner and Jason Goldstein caution real estate lenders to use caution now more than ever to avoid problems resulting from illegal activity occurring at collateral property.

By Jeffrey B. Steiner and Jason R. Goldstein

19 minute read

September 21, 2017 | New York Law Journal

LIBOR and the Future of Floating Rate Mortgage LoansIn their Financing column, Jeffrey B. Steiner and Jason R. Goldstein discuss the implications for real estate lenders in the wake of the anticipated phase-out of the much-used LIBOR index rate.

By Jeffrey B. Steiner and Jason R. Goldstein

12 minute read

July 18, 2017 | New York Law Journal

Material Modifications of Building LoansIn their Financing column, Jeffrey B. Steiner and Jason R. Goldstein remind practitioners to be cautious when representing lenders that modify building loans.

By Jeffrey B. Steiner and Jason R. Goldstein

8 minute read

May 16, 2017 | New York Law Journal

Enforcing Prepayment Premium ClausesIn their Financing column, Jeffrey B. Steiner and Jason R. Goldstein discuss how the prepayment of a loan in commercial real estate transactions may result in unanticipated economic consequences and write: Counsel representing lenders must take care when drafting provisions designed to protect their clients against the risks associated with prepayments by borrowers. For the broadest protection, such provisions should clearly and unambiguously call for the payment of a prepayment fee upon borrower's default and lender's acceleration of the loan, whether prepayment occurs before, after or during a foreclosure action.

By Jeffrey B. Steiner and Jason R. Goldstein

15 minute read

March 14, 2017 | New York Law Journal

Local Considerations in Jury Trial Waiver EnforcementIn their Financing column, Jeffrey B. Steiner and Jason R. Goldstein discuss the inclusion of pre-dispute jury waiver provisions in loan documents as a means to circumvent a trial by jury in commercial cases. They use a recent California case, 'Rincon v. CP III Rincon Towers,' to highlight the issue.

By Jeffrey B. Steiner and Jason R. Goldstein

12 minute read

January 17, 2017 | New York Law Journal

Condominium Loans and Lien PriorityIn their Financing column, Jeffrey B. Steiner and Jason R. Goldstein address some unique aspects of condominium structures which require closer examination on a case-by-case basis.

By Jeffrey B. Steiner and Jason R. Goldstein

13 minute read

November 15, 2016 | New York Law Journal

Pitfalls of Relying on General IndemnitiesIn their Financing column, Jeffery B. Steiner and Jason R. Goldstein write: Lenders cannot rely exclusively on generic catch-all indemnification provisions to recover all of their loan expenses from their borrowers. To the extent that lenders expect to enter into hedging transactions when extending credit, the loan documents should delineate the circumstances when the borrower will be liable for losses arising from unwinding any such transactions, including upon an early prepayment.

By Jeffery B. Steiner and Jason R. Goldstein

13 minute read

September 20, 2016 | New York Law Journal

The Importance of Reviewing Term Sheet ContingenciesIn their Financing column, Jeffrey B. Steiner and Jason R. Goldstein discuss term sheets contingencies and write: Term sheet disputes can be frustrating but they are a natural result of a fast-paced negotiation that seeks to distill a couple hundred pages of loan documents down to a ten-page letter agreement. A well-written term sheet will protect a lender from being obligated to lend on terms that, following diligence or complete loan document negotiation, turn out to be unacceptable to the lender.

By Jeffrey B. Steiner and Jason R. Goldstein

15 minute read

July 20, 2016 | New York Law Journal

Guarantees: When Is a Contest 'Material'?In their Financing column, Jeffrey B. Steiner and Jason R. Goldstein discuss guarantee agreements and advise: "In order to ensure that a lender's rights to exercise its default remedies are protected, guaranty agreements should always be negotiated with care to ensure that the guarantor will be held sufficiently liable for any losses incurred by the lender."

By Jeffrey B. Steiner and Jason R. Goldstein

19 minute read

Trending Stories

- 1Restoring Trust in the Courts Starts in New York

- 2'Pull Back the Curtain': Ex-NFL Players Seek Discovery in Lawsuit Over League's Disability Plan

- 3Tensions Run High at Final Hearing Before Manhattan Congestion Pricing Takes Effect

- 4Improper Removal to Fed. Court Leads to $100K Bill for Blue Cross Blue Shield

- 5Michael Halpern, Beloved Key West Attorney, Dies at 72

More from ALM

- Scan In Progress: Litigators Leverage AI to Screen Prospective Jurors 1 minute read

- Legal Speak at General Counsel Conference East 2024: Match Group's Katie Dugan & Herrick's Carol Goodman 1 minute read

- Legal Speak at General Counsel Conference East 2024: Eric Wall, Executive VP, Syllo 1 minute read