Michael J Moore

December 16, 2022 | Daily Business Review

Goldman Sachs Set to Cut as Many as 4,000 WorkersGoldman Sachs' latest cuts appear to go beyond the firm's annual exercise of weeding out underperforming staff, which was the focus just months ago.

By Michael J. Moore

1 minute read

July 05, 2016 | Daily Report Online

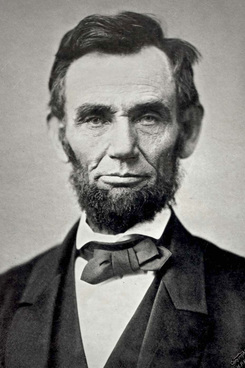

Blowing the Whistle on the 'Lincoln Law'With recent legislative efforts to expand whistleblower rights and protections, many businesses have been thrust into the unfamiliar territory accompanying whistleblower reports, complaints and lawsuits. Because knowledge is essential in handling claims of this nature, an understanding and familiarity of the False Claims Act is vital for all in-house counsel. This overview of the False Claims Act highlights important information concerning these types of cases for in-house counsel.

By Michael J. Moore

12 minute read

January 28, 2011 | Daily Report Online

Crisis panel: Banker pay helped hobble economyBy Hugh Son and Michael J. Moore

4 minute read

February 11, 2009 | Daily Report Online

JPMorgan cracks down on unused creditJPMorgan Chase Co., Citigroup Inc. and Bank of America Corp. are among lenders cutting back on $1.6 trillion of credit lines as they face increased demand for loans that threaten to drain capital. Banks used loan negotiations with retailers Rite Aid Corp. and Ethan Allen Interiors Inc., and with homebuilder Ryland Group Inc.

By Michael J. Moore and Pierre Paulden

7 minute read

June 30, 2010 | Daily Report Online

Hiring picks up at Wall Street firmsLeverage is back on Wall Street-and this time it's the bankers who have it.Firms are adding jobs for the first time in two years, rebuilding businesses cut during the financial crisis and offering guaranteed payouts to lure top bankers. In New York, 6,800 financial-industry positions were added from the end of February through May, the largest three-month increase since 2008, according to the New York State Department of Labor.

By Michael J. Moore

7 minute read

April 27, 2010 | Daily Report Online

Goldman e-mails spur push for new rulesWhite House officials and Democratic lawmakers seized on internal e-mails from Goldman Sachs Group Inc. to push for curbs including a ban on proprietary trading as they brace for a Senate showdown on Wall Street oversight. Democratic Sen. Christopher Dodd, chairman of the Senate Banking Committee, and Sen. Sherrod Brown, also a Democrat on the panel, said Sunday the e-mails help show why rules such as the Volcker rule are needed.

By Joshua Gallu and Michael J. Moore

7 minute read

June 09, 2011 | Daily Report Online

Shrinking valuations drive bank payroll cutsFinancial firms, shunned by investors to a degree seen only once in the last 20 years, are becoming a smaller part of the U.S. economy as they deal with a past that won't go away and a future of lower revenue and fewer jobs.Shares of financial companies have fallen for three straight months and now have their lowest ratio to the Standard Poor's 500 Index since 2009.

By Michael J. Moore

13 minute read

August 24, 2009 | Daily Report Online

Digest's failure is small mark on owner's recordBy Cristina Alesci and Michael J. Moore

8 minute read

May 18, 2010 | Daily Report Online

Investments were destined to failIn June 2006, a year before the subprime mortgage market collapsed, Morgan Stanley created a cluster of investments doomed to fail even if default rates stayed low-then bet against its concoction. Known as the Baldwin deals, the $167 million of synthetic collateralized debt obligations had an unusual feature, according to sales documents.

By Jody Shenn and Michael J. Moore

8 minute read

January 26, 2010 | Daily Report Online

Three top banks cut compensationGoldman Sachs Group Inc., Morgan Stanley and JPMorgan Chase Co.'s investment bank slashed their compensation in the fourth quarter, responding to political pressure that will probably persist as details of bonuses for their top executives emerge in coming weeks. The three Wall Street firms set aside $39.9 billion for pay in 2009, below the 2007 record of $44.

By Michael J. Moore

6 minute read

Trending Stories

- 1'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 211th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

- 3Supreme Court Takes Up Challenge to ACA Task Force

- 4'Tragedy of Unspeakable Proportions:' Could Edison, DWP, Face Lawsuits Over LA Wildfires?

- 5Meta Pulls Plug on DEI Programs

More from ALM

- Scan In Progress: Litigators Leverage AI to Screen Prospective Jurors 1 minute read

- Legal Speak at General Counsel Conference East 2024: Match Group's Katie Dugan & Herrick's Carol Goodman 1 minute read

- Legal Speak at General Counsel Conference East 2024: Eric Wall, Executive VP, Syllo 1 minute read