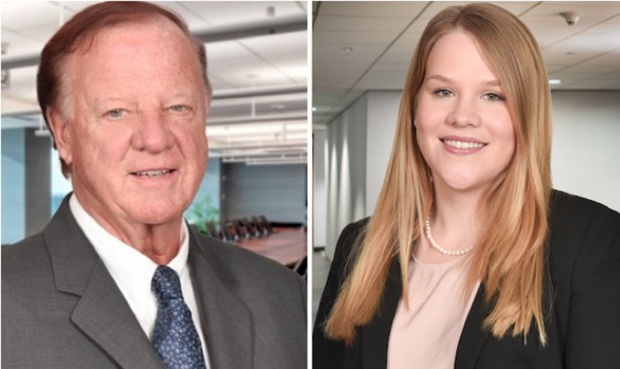

Raymond Radigan

November 04, 2022 | New York Law Journal

Accountings in Estate and Trust Proceedings, Part I: Informal AccountingsThis article, the first in a series, discusses settling fiduciary accounts informally rather than the fiduciary being compelled pursuant to SCPA §2205 or through the voluntary judicial settlement process as prescribed in the SCPA §2210.

By C. Raymond Radigan and Kera N. Reed

10 minute read

September 02, 2022 | New York Law Journal

Jurisdictional Considerations in Choosing Fora for Disputes Concerning Decedents' AssetsThis column is intended to illustrate a few examples of jurisdictional issues that involve disputes over a decedent's assets or affairs to demonstrate why a choice of forum is not always as obvious or simple as one might assume.

By C. Raymond Radigan and John G. Farinacci

9 minute read

July 01, 2022 | New York Law Journal

How Final Is a Decree Based Upon Virtual Representation?While we often see virtual representation provisions contained in wills and trust instruments, the absence of such a provision is not fatal to the application of the doctrine of virtual representation.

By C. Raymond Radigan and David N. Milner

9 minute read

April 29, 2022 | New York Law Journal

SCPA Article 17 Guardianships: How To Invest for a MinorWith court approval, a guardian can jointly control guardianship funds with a bank, credit union, or other financial institution. This type of investment agreement can significantly benefit the infant, while also providing the Surrogate with security in knowing that an established financial institution is a party to the agreement and subject to the Surrogate's oversite.

By Raymond Radigan and Kassandra Polanco

8 minute read

March 04, 2022 | New York Law Journal

Thoughts on Court Consolidation, RevisitedAs a follow-up to his previous article on court consolidation, Raymond Radigan continues the discussion by providing further insights for practitioners and others interested in Surrogate's Court practice.

By Raymond Radigan

5 minute read

December 30, 2021 | New York Law Journal

Accounting for Fiduciaries' ActionsAs with all other fiduciary duties, accounting is an integral part of being a fiduciary of an estate or trust, and must be handled with due care to protect both the fiduciary and the beneficiaries.

By C. Raymond Radigan and Lisa Fenech

6 minute read

October 29, 2021 | New York Law Journal

Asserting Affirmative Defenses to Objections in Accounting ProceedingsSuffice it to say that something as simple as raising affirmative defenses has complexities not found in Supreme Court practice. This is especially true in accounting proceedings, the procedural vehicle where parties often litigate a whole panoply of claims.

By C. Raymond Radigan and John G. Farinacci

9 minute read

September 10, 2021 | New York Law Journal

Is the Third Time the Charm? NYS Assembly Considers Amendment Increasing Individual Charitable Trustee Commission in 2021 Legislative SessionIn this Trusts and Estates law column, Raymond Radigan and Kassandra Polanco discuss proposed legislation that would increase the commission of an individual charitable trustee, and allow such commission to be derived from both the income and principal of a wholly charitable trust.

By Raymond Radigan and Kassandra Polanco

8 minute read

July 02, 2021 | New York Law Journal

Accessing Safe Deposit Boxes Owned by Allegedly Incapacitated PersonsThe Surrogate's Court Procedure Act provides a streamlined procedure for a nominated executor, distributee or otherwise interested person to obtain an order to open a safe deposit box to search for a will, insurance policy, or cemetery deed. In their Trusts and Estates Law column, Raymond Radigan and Lois Bladykas discuss the issues involved in accessing a safe deposit box when the owner of the box is still alive, but suffers from alleged incapacity.

By Raymond Radigan and Lois Bladykas

5 minute read

April 30, 2021 | New York Law Journal

Now, More Than Ever, New York Needs a Directed Trust StatuteWhile the creation of trusts may have significant tax savings, many clients remain concerned about giving up control to one trustee. Directed trusts have become increasingly popular with clients for precisely this reason. In this edition of their Trusts and Estates Law column, C. Raymond Radigan and Jennifer F. Hillman discuss this type of trust and analyze the current state of the law in New York pertaining to it.

By C. Raymond Radigan and Jennifer F. Hillman

8 minute read

Trending Stories

- 1Remembering Ted Olson

- 2Support Magistrates: Statutorily Significant

- 3Nelson Mullins, Greenberg Traurig, Jones Day Have Established Themselves As Biggest Outsiders in Atlanta Legal Market

- 4Immunity for Mental Health Care and Coverage for CBD: What's on the Pa. High Court's November Calendar

- 5Monday Newspaper

More from ALM

- Legal Speak: GCC East Comes to New York 1 minute read

- Legal Speak: A Convicted Felon is Coming to the White House. What Happens Now? 1 minute read

- Leveraging Partner Training To Recruit and Retain 1 minute read