Suzi Ring

July 27, 2017 | Daily Business Review

Libor Funeral Set for 2021 as FCA Abandons Scandal-Tarred RateLibor, the nearly 50-year-old global borrowing benchmark that became a byword for corruption, is headed for the trash heap of history.

By Suzi Ring

8 minute read

March 08, 2017 | International Edition

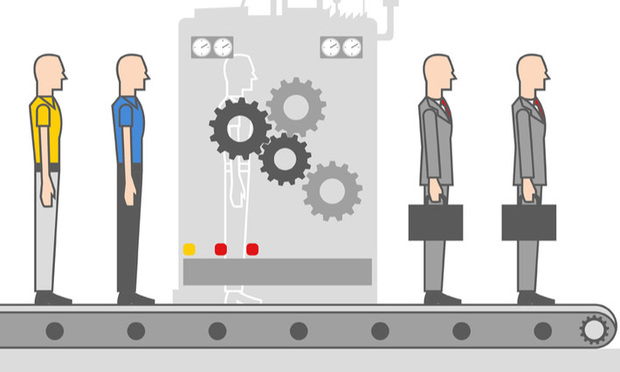

Rejecting the partner mould - associates give their views on career progressionLegal Week canvassed associates for their views on career progression and partnership

By Suzi Ring

11 minute read

December 18, 2012 | International Edition

A&O forms new association in Saudi ArabiaAllen & Overy (A&O) has re-established its presence on the ground in Saudi Arabia through an association with a new law firm launched by A&O Saudi-qualified lawyer Zeyad Khoshaim. The magic circle firm announced the exclusive association with Zeyad S. Khoshaim Law Firm today (18 December) after former associate firm Abdulaziz AlGasim last week entered into a cooperation agreement with Linklaters. A&O had already opted to end its relationship with Abdulaziz AlGasim, where three A&O partners were based, including Saudi and New York qualified Khoshaim.

By Suzi Ring

2 minute read

December 17, 2012 | International Edition

Lord Phillips takes press reform role; Matrix, 5RB counsel advise papersFormer Supreme Court president Lord Phillips of Worth Matravers has been asked to advise on the establishment of a new press regulator, amid much scrutiny over the impact of Lord Justice Leveson's recommendations for media reform. Phillips has been asked by Press Complaints Commission (PCC) chairman Lord Hunt to work alongside former Labour culture secretary Lord Smith and Simon Jenkins, the former editor of The Times, to help devise the new regulatory body.

By Suzi Ring

3 minute read

December 14, 2012 | International Edition

City banking partners welcome common bank supervisor but warn of regulatory burdenCity banking partners have welcomed plans to usher in centralised supervision of Europe's biggest banks announced yesterday (13 December) but warned that increased regulation could have a negative impact on liquidity. European finance ministers yesterday agreed to hand over nations' individual responsibility for bank regulation to the European Central Bank (ECB) in Frankfurt, which will supervise up to 200 of Europe's largest banks. It should pave the way for direct recapitalisation of struggling banks by the European Stability Mechanism rescue fund.

By Suzi Ring

3 minute read

December 12, 2012 | International Edition

Freshfields, Sullivan, Cahill Gordon advise on record $1.9bn HSBC fineFreshfields Bruckhaus Deringer has advised HSBC on its record $1.9bn (£1.2bn) fine in a settlement with the US Department of Justice for breaching US money laundering and sanctions laws. The magic circle firm advised the bank on the UK law aspects of the settlement with a team led by global financial services head Michael Raffan and London corporate finance head Barry O'Brien.

By Suzi Ring

2 minute read

December 11, 2012 | International Edition

US legal elite announce associate bonus payouts of up to $60,000A host of top-tier US firms have announced their end-of-year associate bonuses, with the majority following the lead of Cravath Swaine & Moore and hiking payments significantly across the board. Cravath has traditionally been the first Wall Street firm to announce its year-end bonuses, with the firm handing out a payout of between $10,000 (£6,200) and $60,000 (£37,000) to its junior lawyers this year.

By Suzi Ring

2 minute read

December 07, 2012 | International Edition

Freshfields high-yield partner quits for Weil in latest exit to US rivalFreshfields Bruckhaus Deringer high-yield partner Gil Strauss has resigned to join Weil Gotshal & Manges, marking the latest departure from the magic circle firm for a US rival. Strauss, whose practice focuses on US corporate finance and securities, will join Weil in London in the New Year to help build out the firm's European high-yield practice.

By Suzi Ring

3 minute read

December 06, 2012 | International Edition

Slaughters among firms advising on Autumn Statement lending initiativeSlaughter and May is advising the Treasury on the first set of investments made as part of the Government's Business Finance Partnership venture, announced yesterday (5 December) in Chancellor of the Exchequer George Osborne's Autumn Statement. The Government will invest £600m in the venture, which is intended to increase the supply of capital through non-bank lending channels, with fund managers Alcentra Limited, Haymarket Financial, M&G Investment Management and Pricoa Capital to raise a further £650m. An additional £100m is expected to be invested with a fifth fund manager.

By Suzi Ring

8 minute read

December 06, 2012 | International Edition

Slaughters leads for GSK on £650m India and Africa investmentSlaughter and May is advising global healthcare company GlaxoSmithKline (GSK) on a £650m move to increase its stake in its India and Nigeria subsidiaries. The magic circle firm is has put forward a team under corporate partners David Johnson, Simon Nicholls and Richard Smith to advise GSK.

By Suzi Ring

2 minute read

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future