Terence E Smolev

January 17, 2020 | New York Law Journal

Tax Scams and the General PopulationThe IRS each year puts together a list of the most dangerous scams and calls the list the "Dirty Dozen." Some that may catch the reader or a client are discussed here.

By Terence E. Smolev

7 minute read

September 06, 2019 | New York Law Journal

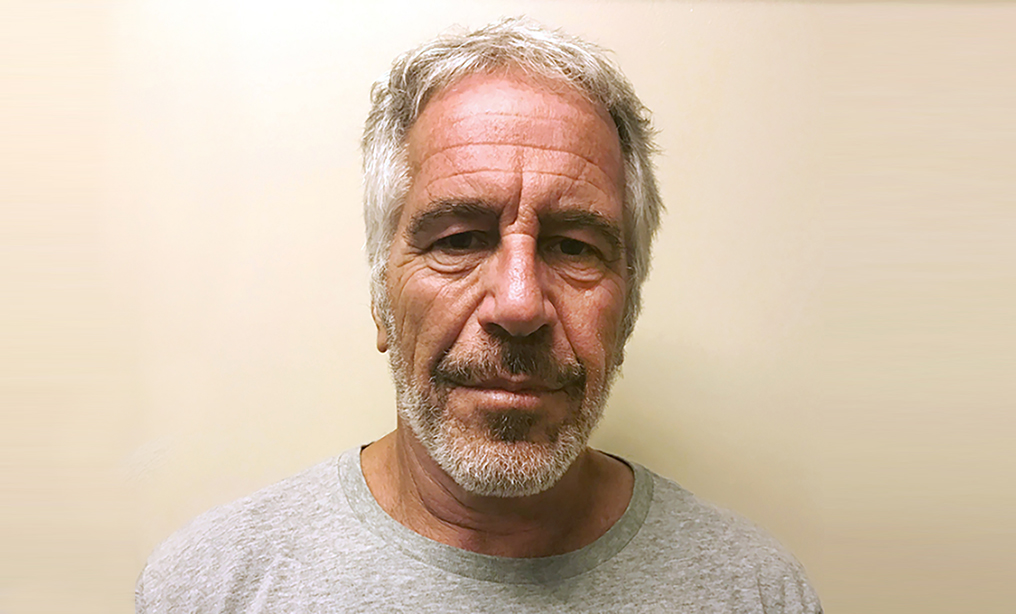

Estate Administration and Domicile Issues Raised by Epstein's SuicideWhile this case presents interesting issues about the above facts, the issues concerning estate attorneys may be of even more interest.

By Terence E. Smolev

6 minute read

March 27, 2019 | New York Law Journal

Actor Wesley Snipes' Offer in Compromise Got Sniped by the IRSThere is no question that the Internal Revenue Service has liberalized its collection policies and procedures. Specifically, the agency has established a “Fresh Start” initiative to permit qualified taxpayers a means to pay less taxes through the Offer in Compromise program. The authors discuss this program in the context of a case involving actor Wesley Snipes.

By Terence E. Smolev and Christina Jonathan

9 minute read

January 12, 2018 | New York Law Journal

The Inevitable: Death and TaxesChristina Jonathan and Terence E. Smolev write: There is an old English saying, usually attributed to Benjamin Franklin, that "nothing in our lives is certain except death and taxes." Many wealthy individuals, politicians and corporations attempt to dodge one of these life certainties. However, if in attempting to avoid one of these certainties, violations are committed, the consequences are severe and will not be pardoned, not even in death.

By Christina Jonathan and Terence E. Smolev

8 minute read

September 12, 2017 | New York Law Journal

Dead Hand Control and Estate Tax ConsiderationsChristina Jonathan and Terence E. Smolev discuss the concept of dead hand control, using as an example the will of Pulitzer and Tony Award winning author and playwright Edward Albee, whose will was recently admitted to probate in the Suffolk County Surrogate's Court and which directed his executors to destroy some of his works.

By Christina Jonathan and Terence E. Smolev

7 minute read

December 28, 2016 | New York Law Journal

Criminal Considerations for FiduciariesTerence E. Smolev and Christina Jonathan of Berkman Henoch Peterson Peddy & Fenchel write: Fiduciaries—both individual and corporate—run the risk of being charged with numerous crimes. Some crimes are intentionally committed, while some arise unintentionally but nevertheless create criminal liability. This article provides insight into some of the criminal charges fiduciaries may face.

By By Terence E. Smolev and Christina Jonathan

14 minute read

February 09, 2016 | The Legal Intelligencer

Protecting Pets With Estate PlanningWhile you were shopping for the holidays this year, you may have noticed more and more people walking the busy aisles cradling their puppies instead of babies. The trend is also seemingly popular in banks, which have replaced lollipops for dog treats in some branches.

By Terence E. Smolev and Christina Jonathan

8 minute read

January 19, 2016 | New York Law Journal

Protecting Pets With Estate PlanningTerence E. Smolev and Christina Jonathan of the Law Office of Terence E. Smolev, P.C. write: It is no doubt that pets have become an integral part of many families. This new family dynamic has led to changes in New York's estate laws over the years to ensure that pets are cared for upon their owners' demise.

By Terence E. Smolev and Christina Jonathan

8 minute read

January 19, 2016 | New York Law Journal

Protecting Pets With Estate PlanningTerence E. Smolev and Christina Jonathan of the Law Office of Terence E. Smolev, P.C. write: It is no doubt that pets have become an integral part of many families. This new family dynamic has led to changes in New York's estate laws over the years to ensure that pets are cared for upon their owners' demise.

By Terence E. Smolev and Christina Jonathan

8 minute read

August 31, 2015 | New York Law Journal

Birth After DeathTerence E. Smolev and Christina Jonathan of Terence E. Smolev, P.C. write: Life has become more complicated in recent years as advances have been made with respect to artificial insemination, and storing eggs and sperm for future use. Eggs can be fertilized by a sperm years after the eggs and the sperm were stored by. This certainly complicates estate planning and administration.

By Terence E. Smolev and Christina Jonathan

10 minute read

Trending Stories

- 1How This Dark Horse Firm Became a Major Player in China

- 2Bar Commission Drops Case Against Paxton—But He Wants More

- 3Pardons and Acceptance: Take It or Leave It?

- 4Gibbons Reps Asylum Seekers in $6M Suit Over 2018 ‘Inhumane’ Immigration Policy

- 5DC Judge Chutkan Allows Jenner's $8M Unpaid Legal Fees Lawsuit to Proceed Against Sierra Leone