Timothy G Nelson

February 01, 2021 | New York Law Journal

The Law of Calendar Reform: We Got Rid of Year 2020, But Why Stop There?The calendar is more malleable than might be thought.

By Timothy G. Nelson

15 minute read

July 04, 2016 | National Law Journal

'RJR Nabisco' and the Future of ExtraterritorialityThe Supreme Court's ruling further limits the ability to seek redress for wrongs occurring abroad.

By Timothy G. Nelson, Lea Haber Kuck and Ashley Fernandez

10 minute read

July 29, 2015 | New York Law Journal

Mining Outer Space: Who Owns the Asteroids?Timothy G. Nelson writes: Over the last two years, U.S. business and policy makers have focused afresh on the commercial possibilities of asteroids—the solar system's minor planetary objects, some of which have large deposits of potentially valuable substances. In the last few years, some private operators have announced plans to mine them commercially, a concept that, until now, has been exclusively the realm of science fiction.

By Timothy G. Nelson

14 minute read

July 28, 2015 | New York Law Journal

Mining Outer Space: Who Owns the Asteroids?Timothy G. Nelson writes: Over the last two years, U.S. business and policy makers have focused afresh on the commercial possibilities of asteroids—the solar system's minor planetary objects, some of which have large deposits of potentially valuable substances. In the last few years, some private operators have announced plans to mine them commercially, a concept that, until now, has been exclusively the realm of science fiction.

By Timothy G. Nelson

14 minute read

February 24, 2015 | New York Law Journal

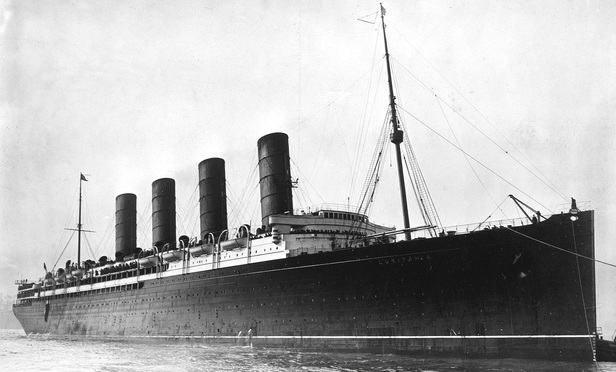

The Lusitania and the LawTimothy G. Nelson writes: While the role of "moral damages," particularly in business cases, is still debated, the influence of 'Lusitania' is undeniable. As in so many other facets of legal life, a case that initially prompted controversy in one area (laws of naval warfare) has spawned jurisprudence in an entirely different sphere.

By Timothy G. Nelson

6 minute read

February 23, 2015 | New York Law Journal

The Lusitania and the LawTimothy G. Nelson writes: While the role of "moral damages," particularly in business cases, is still debated, the influence of 'Lusitania' is undeniable. As in so many other facets of legal life, a case that initially prompted controversy in one area (laws of naval warfare) has spawned jurisprudence in an entirely different sphere.

By Timothy G. Nelson

6 minute read

April 12, 2010 | New York Law Journal

Render Unto Caesar No More?Timothy G. Nelson, a partner at Skadden, Arps, Slate, Meagher & Flom, and Julie Bédard, a counsel with the firm, write: The sovereign right to tax remains a core state prerogative. Where, however, a state has made commitments in investment treaties or tax stabilization agreements, investors may legitimately submit tax disputes arising under those instruments to international arbitration. We must still render unto Caesar what is Caesar's, but the emperor himself may now face scrutiny before a higher tribunal.

By Timothy G. Nelson and Julie Bédard

11 minute read

June 07, 2010 | The Legal Intelligencer

Explosion of International Trade Arbitration Felt in U.S. CourtsA largely unheralded feature of modern international business law is the emergence of thousands of bilateral investment treaties, or BITs, and fair-trading agreements, or FTAs, that give investors the right to pursue international arbitration if their investments are mistreated by the foreign host governments. Although investor-state arbitration is separate (indeed, often deliberately insulated) from litigation before national courts, the explosion of BIT and FTA arbitral jurisprudence during the past 15 years has been felt in the U.S. courts.

By Marco E Schnabl and Timothy G. Nelson

9 minute read

May 31, 2010 | National Law Journal

Investor-state arbitration and the U.S. courtsA largely unheralded feature of modern international business law is the emergence of thousands of bilateral investment treaties (BITs) and fair-trading agreements (FTAs) that give investors the right to pursue international arbitration if their investments are mistreated by the foreign host governments. Although investor-state arbitration is separate (indeed, often deliberately insulated) from litigation before national courts, the explosion of BIT and FTA arbitral jurisprudence during the past 15 years has been felt in the U.S. courts.

By Marco E. Schnabl and Timothy G. Nelson

9 minute read

April 13, 2009 | New York Law Journal

Relinquishing Jurisdiction Over Statutory ClaimsTimothy G. Nelson, a partner at Skadden, Arps, Slate, Meagher & Flom, and Julie Bédard, counsel at the firm, review a recent decision in which a federal district judge in Washington, D.C. held that a Canadian arbitral tribunal is competent to arbitrate a series of civil federal racketeering claims by a Colorado citizen against two European oil companies arising out of a Kazakhstan oil deal. The case is an important illustration of the willingness of U.S. courts, since the decision of the Supreme Court in Mitsubishi Motors Corp. v. Soler Chrysler-Plymouth Inc., to relinquish jurisdiction in favor of foreign arbitration, even when federal statutory claims are involved.

By Timothy G. Nelson and Julie Bédard

14 minute read

Trending Stories

- 1Court Rejects San Francisco's Challenge to Robotaxi Licenses

- 2'Be Prepared and Practice': Paul Hastings' Michelle Reed Breaks Down Firm's First SEC Cybersecurity Incident Disclosure Report

- 3Lina Khan Gives Up the Gavel After Contentious 4 Years as FTC Chair

- 4Allstate Is Using Cell Phone Data to Raise Prices, Attorney General Claims

- 5Epiq Announces AI Discovery Assistant, Initially Developed by Laer AI, With Help From Sullivan & Cromwell

More from ALM

- Scan In Progress: Litigators Leverage AI to Screen Prospective Jurors 1 minute read

- Legal Speak at General Counsel Conference East 2024: Match Group's Katie Dugan & Herrick's Carol Goodman 1 minute read

- Legal Speak at General Counsel Conference East 2024: Eric Wall, Executive VP, Syllo 1 minute read