Hogan Lovells lures heavy-hitting Weil tech transactions team in Silicon Valley

Four-partner Weil team once coveted by Freshfields set to join Hogan Lovells

March 29, 2017 at 04:30 AM

5 minute read

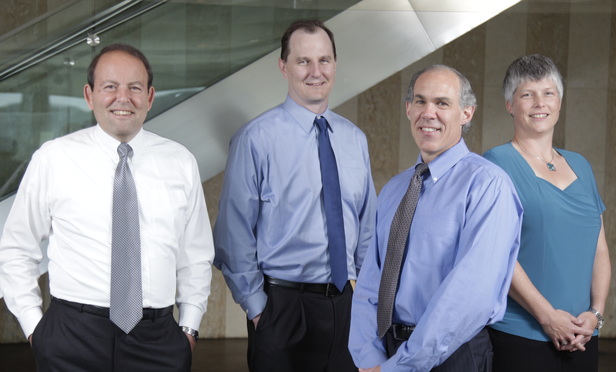

A four-partner Weil Gotshal & Manges Silicon Valley team led by heavyweight technology transactions partner Richard Climan is set to leave for Hogan Lovells, according to three sources familiar with the matter.

Other lawyers looking to leave Weil with Climan, who is in the final stages of withdrawing from the firm's partnership, include fellow partners John Brockland, Keith Flaum and Jane Ross. The group headed to Weil nearly five years ago from Dewey & LeBoeuf, the now defunct firm that they joined from Cooley in two separate moves three years earlier.

Hogan Lovells won a bidding war for Climan's team, according to one source briefed on its decision to depart Weil. The latter won a similar sweepstake for the close-knit group when it fled Dewey just weeks ahead of the firm's eventual bankruptcy filing.

It is understood that Freshfields Bruckhaus Deringer also courted the team in 2012, before its move to Weil.

Climan's group has not formally left Weil – as of late-day Tuesday all of their biography pages remained on the firm's website – but two sources said Hogan Lovells partners had started voting on Tuesday morning about whether to let Climan join their ranks.

At Weil, Climan and Flaum earned $3m-$4m (£2.4m-£3.2m) per year, according to another source knowledgeable of their compensation. Ross and Brockland, who had less seniority than their two colleagues, earned less. When the entire group moved from Cooley to Dewey in 2009, Climan received a multiyear annual guarantee of $3.5m (£2.8m), Flaum a deal for $3m (£2.4m) and Ross and Brockland about $1.5m (£1.2m) apiece, according to our previous reports.

Weil saw its profits per partner rise 22.6% in 2017 to $3.09m (£2.5m), according to The American Lawyer's reporting. Hogan Lovells saw its partner profits remain mostly flat last year at $1.25m (£1m).

Climan did not return a request for comment about his team's potential move to Hogan Lovells. In 2012, he said Weil's global reach was a major draw for his group, which focuses on cross-border deals involving major technology companies.

"We know their practices and know the reputation of Weil's practitioners and how good they are," Climan said at the time. "And we needed a firm that could accommodate very easily a high-end M&A practice. But we needed a firm that could do it globally."

Climan's group hit the ground running at Weil. Flaum led a team from the firm advising California-based Applied Materials in 2013 on its $9.3bn (£7.5bn) sale to Japan's Tokyo Electron, although that deal collapsed in early 2015. Flaum and Ross also took the lead for Facebook on its $19bn (£15.3bn) acquisition of WhatsApp in 2014, the biggest deal in a decade by the social networking behemoth.

Around that same time, Flaum and Climan advised Chinese computer giant Lenovo on its $2.9bn (£2.3bn) buy of Google's Motorola Mobility smartphone unit. Flaum and Climan also advised Oracle in 2014 on its $5.3bn (£4.3bn) acquisition of Micros Systems.

The American Lawyer noted in a 2014 profile about Weil the spate of deal activity by Climan and Flaum, who have worked with each other for more than two decades. But in more recent years, the pace of transactions from their team has slowed, despite an increase in technology market transactions. In 2015, a year in which The Recorder named Ross one of its Women Leaders in Tech Law, Climan assisted Weil corporate chair Michael Aiello in advising Intel on its $16.7bn (£13.4bn) buy of programmable chipmaker Altera.

A year ago this month, Climan and Flaum advised Bank of America in its role as financial adviser to Mitel Networks, on its $1.8bn (£1.4bn) acquisition of conferencing technology company Polycom. Earlier this month, the two once again advised Bank of America in its role as financial adviser to Hewlett Packard Enterprise on its $1.09bn (£877m) purchase of Nimble Storage.

"I think that real rainmakers rarely operate as lone wolves," Climan recently told The American Lawyer for an upcoming story about the secrets of top dealmakers. "Most established rainmakers that I know function as part of multitalented teams of lawyers [that] are able to provide attentive, around-the-clock services on the most sensitive issues."

Hogan Lovells, which declined to comment about Climan or his team, has been busy on the lateral hiring front so far this year. The firm has recently hired Brownstein Hyatt Farber Schreck real estate partner Lea Ann Fowler in Denver and Norton Rose Fulbright senior associate Matthew Leigh, who is joining as an asset finance partner in Singapore.

Earlier this month, the firm took on Greenberg Traurig private equity partner Adam Tope in New York, and last month it recruited Hilary Tompkins, a former solicitor at the US Department of the Interior, as an environmental partner in Washington DC.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

A&O Shearman, White & Case Advise on €1.2B Public Takeover of German Steel Giant Salzgitter

3 minute read

Slaughter and May and A&O Shearman Advise as Latest UK Company Goes American

3 minute read

Trio of Firms Act On Chinese Insurer Ping An's $1.7B Stake Acquisition In Healthcare Arm

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250