How Mastercard's general counsel improves his relationships with panel firms

The company had doubts about holding law firm summits, but the results have demonstrated their significant value.

September 18, 2018 at 12:00 AM

5 minute read

The original version of this story was published on The American Lawyer

As one of the signatories to last year's open letter from 25 general counsel, I am naturally interested in what makes the law firm-client relationship work better – and I've watched with interest the results of the GC Thought Leaders Experiment.

Throughout the summer, AdvanceLaw – an organisation helping us and 200 GCs identify top counsel – shared a number of findings from the experiment. One finding in particular jumped out at me. In an article about law firm panels, the authors point out that the quality of lawyers' work improves when clients convene law firm summits.

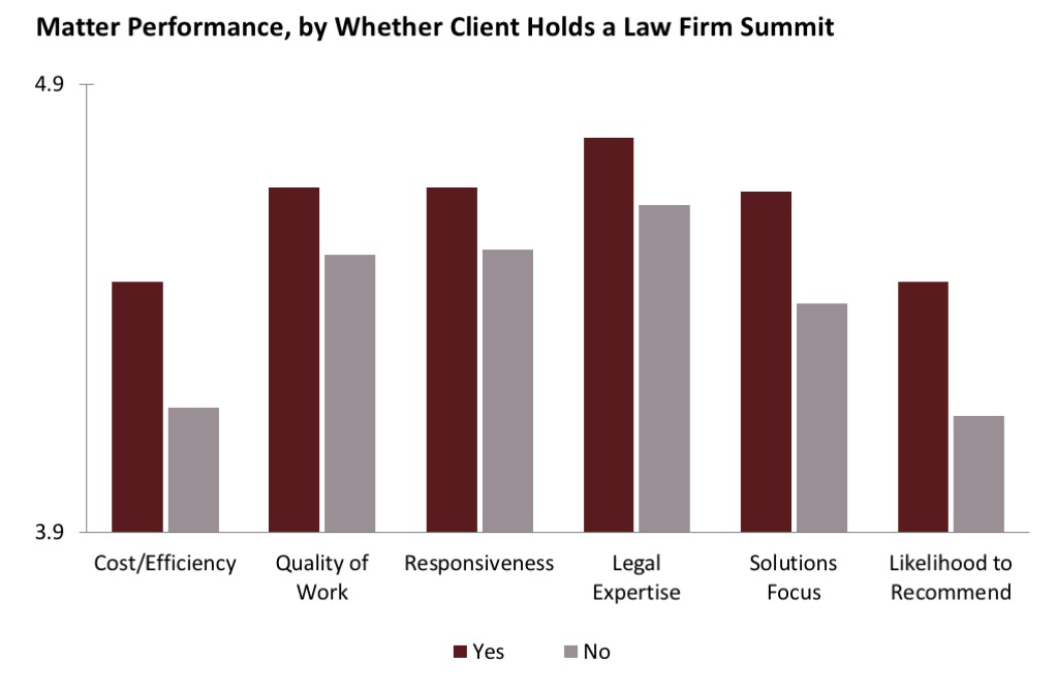

They defined a summit as a "one- or two-day meeting for key outside counsel from several firms to bond with inside lawyers, learn from business clients, discuss strategy and be recognised for strong performance". This chart from that article sums up the difference summits can make:

The data shows that clients hosting summits receive better performance from their law firms. I was interested to see this – and perhaps a bit relieved, as we have been investing in summits for some time now. Since 2016, Mastercard has brought together key players from our principal law firms for live panels, presentations and face-to-face conversations with our company's leadership. This annual event takes place here in our headquarters. The goal is for our law firms to get to know us better, so we host them in our own living room (and dining room).

So why do we do this? And how could this have such a strong impact on lawyers' performance?

There is good evidence that law firm panels often don't perform well, and I think it's because clients fail to build meaningful relationships with their firms. It is tempting to create a panel and expect it automatically to improve cost and quality. Even we at Mastercard may have been guilty of this in the past, but our thinking has evolved. We realised that in practice, like any powerful tool, a law firm panel can make things better or worse. It needs to be used intentionally.

And a law firm panel is, at bottom, a tool for managing human relationships. Face-to-face conversations build trust, establish priorities, create common vocabulary and allow everyone to figure out their true goals. This is hard to achieve over the phone.

While our summits have been a success, when the idea first came up we had our doubts. Would all the law firms come? Would they get along with one another, or even talk to each other? They are competitors, after all. And, oh yes, how much would it cost?

The firms all came. They paid their own expenses without question and the time wasn't billed. Most importantly, they talked to us and each other – a lot – about things that matter. Conversations covered developments in the payments industry, emerging legal questions, important technology questions and more. And they found ways to collaborate for Mastercard's benefit.

After some trial and error, here's what we do now: for one half-day, we bring together representatives from 30 of Mastercard's primary North American law firms. Most firms send three to five lawyers who work consistently for Mastercard. Attendees have a chance to meet and hear from executive leadership and other business leaders within Mastercard who are involved in key initiatives. For example, one year we featured the leaders of a key fintech initiative with significant regulatory implications. If something is strategically important to Mastercard and has a meaningful legal angle, we want all of our firms to know about it.

Our time together also lets us get across key messages to trusted lawyers who are critical to Mastercard's success. Each year we think hard about what themes to emphasise, be they legal or logistical. We have taken the opportunity to talk about staffing levels, consistency of relationship partners, critical forms of data tracking and other practices that we believe lead to better results for Mastercard. Most importantly, we have also set a consistent practice of discussing diversity with all of our law firms, because we firmly believe both clients and law firms must be leaders in making the legal profession more inclusive. Last year, we reviewed the American Bar Association Resolution 113 disclosures of our partner firms, to ensure everyone was aware of their own performance and our expectations.

In an industry as tech-enabled and highly regulated as consumer financial services, it's critical for law firms and clients to be on the same page. This is one of the reasons I continue to be excited about the GC Thought Leaders Experiment and AdvanceLaw's core mission: we need a legal market where client and law firm incentives are aligned and we are learning from one another.

For our part at Mastercard, we will continue to run law firm summits to ensure we get to know our trusted partners face to face, and keep everyone focused on Mastercard's major goals. This isn't easy – as another AdvanceLaw GC has said, law firm summits are "the most difficult, yet most rewarding" thing he does. But it's good for our business clients, it's good for our law firms, and it's great fun to spend some time together. I would certainly encourage other GCs to consider the practice.

Tim Murphy is the general counsel of Mastercard.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

McDermott Hits Paul Hastings In London Again As Macfarlanes Also Swoops For Talent

2 minute read

Re-Examining Values: Greenberg Traurig's Executive Chairman on the Lessons of the Pandemic

4 minute read

Diversity Commitments Feel Hollow When Firms Cosy Up to Oppressive Regimes

Trending Stories

- 1'A Death Sentence for TikTok'?: Litigators and Experts Weigh Impact of Potential Ban on Creators and Data Privacy

- 2Bribery Case Against Former Lt. Gov. Brian Benjamin Is Dropped

- 3‘Extremely Disturbing’: AI Firms Face Class Action by ‘Taskers’ Exposed to Traumatic Content

- 4State Appeals Court Revives BraunHagey Lawsuit Alleging $4.2M Unlawful Wire to China

- 5Invoking Trump, AG Bonta Reminds Lawyers of Duties to Noncitizens in Plea Dealing

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250